NetFlix 2007 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2007 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

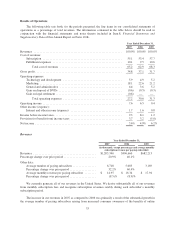

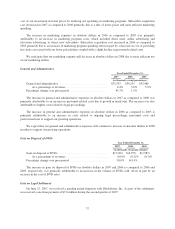

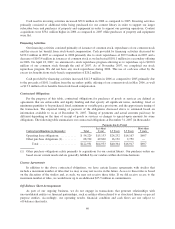

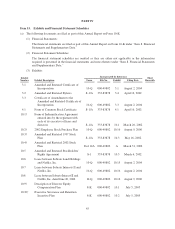

our common stock through the end of 2008. We completed this stock repurchase program in February 2008. The

following table highlights selected measures of our liquidity and capital resources as of December 31, 2007, 2006

and 2005:

Year Ended December 31,

2007 2006 2005

(in thousands)

Cash and cash equivalents . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 177,439 $ 400,430 $ 212,256

Short-term investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 207,703 — —

$ 385,142 $ 400,430 $ 212,256

Net cash provided by operating activities . . . . . . . . . . . . . . . . $ 291,823 $ 247,862 $ 157,507

Net cash used in investing activities . . . . . . . . . . . . . . . . . . . . $(450,813) $(185,869) $(133,248)

Net cash (used in) provided by financing activities . . . . . . . . . $ (64,001) $ 126,181 $ 13,314

Operating Activities

Our operating activities consisted primarily of net income of $67.0 million, increased by non-cash

adjustments of $194.8 million and net changes in operating assets and liabilities of $30.0 million during 2007.

The majority of the non-cash adjustments came from the amortization of the content library of $203.4 million

which increased by $62.3 million over the prior period as we continue to purchase additional titles, including

Internet-delivered content in 2007, in order to support our larger subscriber base. Cash provided by operating

activities increased $44.0 million in 2007 as compared to 2006. This was primarily due to an increase in net

income of $17.9 million, increased non-cash adjustments of $31.2 million and a decrease in net changes in

operating assets and liabilities of $5.1 million.

Our operating activities consisted primarily of net income of $49.1 million, increased by non-cash

adjustments of $163.7 million and net changes in operating assets and liabilities of $35.1 million during 2006.

The majority of the non-cash adjustments came from the amortization of the content library of $141.2 million,

which increased $44.3 million over the prior period as we continue to purchase additional titles in order to

support our larger subscriber base. Cash provided by operating activities increased $90.4 million in 2006 as

compared to 2005 due to higher net income of $7.1 million, non-cash adjustments of $80.8 million and net

changes in assets and liabilities of $2.5 million.

Investing Activities

Our investing activities consisted primarily of purchases and sales of available-for-sale securities,

acquisitions of content library, including Internet-delivered content in 2007, and purchases of property and

equipment. Cash used in investing activities increased $264.9 million in 2007 as compared to 2006. During the

first quarter of 2007, we started an investment portfolio which is comprised of short-term investments consisting

of corporate debt securities, government and agency securities and asset and mortgage-backed securities. The

majority of the portfolio is invested in “AAA” rated residential and commercial mortgage-backed securities. The

mortgage bonds owned represent the senior tranches of the capital structure and provide credit enhancement

through over-collateralization and their subordinated characteristics.

We continue to purchase additional titles, including Internet-delivered content in 2007, for our content

library in order to support our larger subscriber base. Content acquisitions were $53.9 million higher in 2007 as

compared to 2006. Purchases of property and equipment consisted of expenditures related to Company

expansion, primarily to our headquarters in Los Gatos, California. In March 2006, we exercised our option to

lease a building adjacent to our headquarters in Los Gatos, California. The building will comprise approximately

80,000 square feet of office space and have an initial term of 5 years. The building is expected to be completed in

the first quarter of 2008. Additionally, purchases of property and equipment consisted of automation equipment

for our various shipping centers in order to achieve increased operational efficiencies.

39