NetFlix 2007 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2007 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Overview

Our Business

We are the largest online movie rental subscription service in the United States, providing approximately

7.5 million subscribers access to approximately 90,000 DVD titles plus a library of more than 6,000 choices that can

be watched instantly on their PCs. We offer nine subscription plans, starting at $4.99 a month. There are no due

dates, no late fees and no shipping fees. Subscribers select titles at our Web site aided by our proprietary

recommendation service, receive them on DVD by U.S. mail and return them to us at their convenience using our

prepaid mailers. After a DVD has been returned, we mail the next available DVD in a subscriber’s queue. We also

offer certain titles through our instant-watching feature. The terms and conditions by which subscribers utilize our

service and a more detailed description of how our service works can be found at www.netflix.com/TermsOfUse.

Our core strategy is to grow a large DVD subscription business and to expand into Internet-based delivery

of content as that market develops. We believe that the DVD format, along with its high definition successor

formats, including Blu-ray, will continue to be the main vehicle for watching content in the home for the

foreseeable future and that by growing a large DVD subscription business, we will be well positioned to

transition our subscribers and our business to Internet-based delivery of content if it becomes the preferred

consumer medium for accessing content.

Key Business Metrics

Management periodically reviews certain key business metrics within the context of our articulated

performance goals in order to evaluate the effectiveness of our operational strategies, allocate resources and

maximize the financial performance of our business. The key business metrics include the following:

•Churn: Churn is a monthly measure defined as customer cancellations in the quarter divided by the

sum of beginning subscribers and gross subscriber additions, then divided by three months. Management

reviews this metric to evaluate whether we are retaining our existing subscribers in accordance with our

business plans.

•Subscriber Acquisition Cost: Subscriber acquisition cost is defined as total marketing expense divided

by total gross subscriber additions. Management reviews this metric to evaluate how effective our

marketing programs are in acquiring new subscribers on an economical basis in the context of estimated

subscriber lifetime value.

•Gross Margin: Management reviews gross margin to monitor variable costs and operating efficiency.

Management believes it is useful to monitor these metrics together and not individually as it does not make

business decisions based upon any single metric. Please see “Results of Operations” below for further discussion

on these key business metrics.

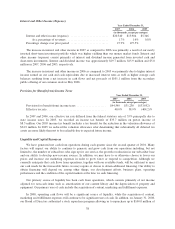

Performance Highlights

The following represents our 2007 performance highlights:

2007 2006 2005

Revenues .......................................... $1,205,340 $996,660 $682,213

Netincome ........................................ 66,952 49,082 42,027

Net income per share—diluted . . . . . . . . . . . . . . . . . . . . . . . . . $ 0.97 $ 0.71 $ 0.64

Total subscribers at end of period . . . . . . . . . . . . . . . . . . . . . . . 7,479 6,316 4,179

Churn(annualized) .................................. 4.3% 4.1% 4.5%

Subscriber acquisition cost . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 40.88 $ 42.96 $ 38.77

Grossmargin ....................................... 34.8% 37.1% 31.7%

28