NetFlix 2007 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2007 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

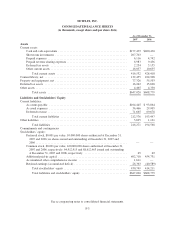

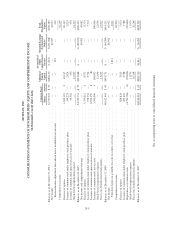

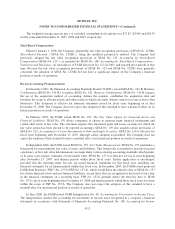

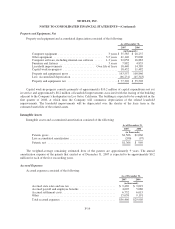

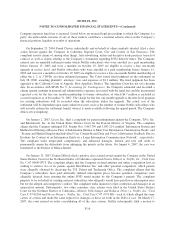

NETFLIX, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

Year Ended December 31,

2007 2006 2005

Cash flows from operating activities:

Netincome ................................................... $ 66,952 $ 49,082 $ 42,027

Adjustments to reconcile net income to net cash provided by operating

activities:

Depreciation of property and equipment . . . . . . . . . . . . . . . . . . . . . . . . 21,394 15,903 9,134

Amortization of content library . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 203,415 141,160 96,883

Amortization of intangible assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 153 73 985

Amortization of discounts and premiums on investments . . . . . . . . . . . 24 — —

Stock-based compensation expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11,976 12,696 14,327

Excess tax benefits from stock-based compensation . . . . . . . . . . . . . . . (26,248) (13,217) —

Loss (gain) on disposal of property and equipment . . . . . . . . . . . . . . . . 142 (23) —

Gain on sale of short-term investments . . . . . . . . . . . . . . . . . . . . . . . . . (687) — —

Gain on disposal of DVDs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (14,637) (9,089) (3,588)

Non-cashinterestexpense ................................... — — 11

Deferredtaxes ............................................ (661) 16,150 (34,905)

Changes in operating assets and liabilities:

Prepaid expenses and other current assets . . . . . . . . . . . . . . . . . . . (4,303) (7,064) (4,884)

Accountspayable ...................................... (1,217) 3,208 8,246

Accruedexpenses...................................... 32,809 17,559 12,432

Deferredrevenue ...................................... 1,987 21,145 16,597

Otherliabilities........................................ 724 279 242

Net cash provided by operating activities . . . . . . . . . . . . . . . 291,823 247,862 157,507

Cash flows from investing activities:

Purchases of short-term investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (405,340) — —

Proceeds from sale of short-term investments . . . . . . . . . . . . . . . . . . . . . . . . 200,832 — —

Purchases of property and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (44,256) (27,333) (27,653)

Acquisition of intangible asset . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (550) (585) (481)

Acquisitions of content library . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (223,436) (169,528) (111,446)

Proceeds from sale of DVDs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21,640 12,886 5,781

Proceeds from disposal of property and equipment . . . . . . . . . . . . . . . . . . . . 15 23 —

Otherassets .................................................. 282 (1,332) 551

Net cash used in investing activities . . . . . . . . . . . . . . . . . . . (450,813) (185,869) (133,248)

Cash flows from financing activities:

Proceeds from issuance of common stock . . . . . . . . . . . . . . . . . . . . . . . . . . . 9,611 112,964 13,393

Excess tax benefits from stock-based compensation . . . . . . . . . . . . . . . . . . . 26,248 13,217 —

Repurchases of common stock . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (99,860) — —

Principal payments on notes payable and capital lease obligations . . . . . . . . — — (79)

Net cash (used in) provided by financing activities . . . . . . . . (64,001) 126,181 13,314

Effect of exchange rate changes on cash and cash equivalents . . . . . . . . . . . — — 222

Net (decrease) increase in cash and cash equivalents . . . . . . . . . . . . . . . . . . (222,991) 188,174 37,795

Cash and cash equivalents, beginning of year . . . . . . . . . . . . . . . . . . . . . . . . 400,430 212,256 174,461

Cash and cash equivalents, end of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 177,439 $ 400,430 $ 212,256

Supplemental disclosure:

Cashpaidforinterest ........................................... — — 170

Incometaxespaid.............................................. (15,775) (2,324) (977)

See accompanying notes to consolidated financial statements.

F-6