NetFlix 2007 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2007 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.disclosure and transition of uncertain tax positions. The interpretation was effective for fiscal years beginning

after December 15, 2006. The adoption of this standard did not have a material effect on our financial position or

results of operations.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk

The primary objective of our investment activities is to preserve principal, while at the same time

maximizing income we receive from investments without significantly increased risk. To achieve this objective,

we maintain a portfolio of cash equivalents and short-term investments in a variety of securities. These securities

are classified as available-for-sale and are recorded at fair value with unrealized gains and losses, net of tax,

included in accumulated other comprehensive income within stockholders equity in the consolidated balance

sheet.

Some of the securities we invest in may be subject to market risk. This means that a change in prevailing

interest rates may cause the principal amount of the investment to fluctuate. For example, if we hold a security

that was issued with a fixed interest rate at the then-prevailing rate and the prevailing interest rate later rises, the

value of our investment will decline. To minimize this risk, we intend to maintain our portfolio of cash

equivalents and short-term investments in a variety of securities. At December 31, 2007, our cash equivalents

were generally invested in money market funds, which are not subject to market risk because the interest paid on

such funds fluctuates with the prevailing interest rate. Our short-term investments were comprised of corporate

debt securities, government and agency securities and asset and mortgage-backed securities. The majority of the

portfolio is invested in “AAA” rated residential and commercial mortgage-backed securities. A hypothetical

1.00% (100 basis point) increase in interest rates would have resulted in a decrease in the fair market value of our

short-term investments of approximately $3.5 million.

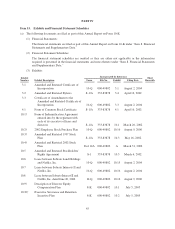

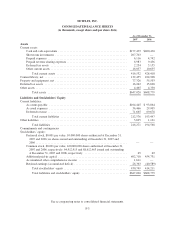

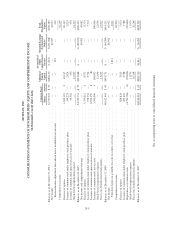

Item 8. Financial Statements and Supplementary Data

See “Financial Statements” beginning on page F-1 which are incorporated herein by reference.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

None.

Item 9A. Controls and Procedures

(a) Evaluation of Disclosure Controls and Procedures

Our management, with the participation of our Chief Executive Officer and Chief Financial Officer,

evaluated the effectiveness of our disclosure controls and procedures (as defined in Rules 13a-15(e) and

15d-15(e) under the Securities Exchange Act of 1934, as amended) as of the end of the period covered by this

Annual Report on Form 10-K. Based on that evaluation, our Chief Executive Officer and Chief Financial Officer

concluded that our disclosure controls and procedures as of the end of the period covered by this Annual Report

on Form 10-K were effective in providing reasonable assurance that information required to be disclosed by us in

reports that we file or submit under the Securities Exchange Act of 1934, as amended, is recorded, processed,

summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules

and forms, and that such information is accumulated and communicated to our management, including our Chief

Executive Officer and Chief Financial Officer, as appropriate, to allow timely decisions regarding required

disclosures.

Our management, including our Chief Executive Officer and Chief Financial Officer, does not expect that

our disclosure controls and procedures or our internal controls will prevent all error and all fraud. A control

system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the

objectives of the control system are met. Further, the design of a control system must reflect the fact that there

42