NetFlix 2007 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2007 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETFLIX, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Taxes. Specifically, the pronouncement prescribes a recognition threshold and a measurement attribute for the

financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return.

The interpretation also provides guidance on the related derecognition, classification, interest and penalties,

accounting for interim periods, disclosure and transition of uncertain tax positions. The interpretation was

effective for fiscal years beginning after December 15, 2006. The adoption of this standard did not have a

material effect on our financial position or results of operations.

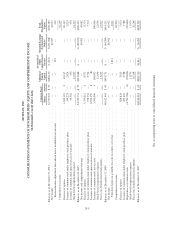

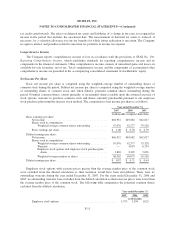

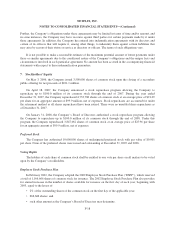

2. Short-term Investments

At December 31, 2007, short-term investments were classified as available-for-sale securities and are

reported at fair value as follows:

Gross

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Estimated

Fair Value

(in thousands)

Corporate debt securities . . . . . . . . . . . . . . . . . . . . . $ 36,445 $ 315 $ (85) $ 36,675

Government and agency securities . . . . . . . . . . . . . 130,884 2,155 (33) 133,006

Asset and mortgage backed securities . . . . . . . . . . . 37,842 307 (127) 38,022

$205,171 $2,777 $(245) $207,703

The Company recognized gross realized gains of $0.7 million and gross realized losses of $0.05 million

during 2007 from the sales of available-for-sale securities. The Company recognized interest income related to

available-for-sale securities of $9.6 million during 2007. Realized gains and losses and interest income are

included in interest and other income (expense).

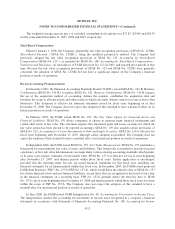

The estimated fair value of short-term investments by contractual maturity as of December 31, 2007 is as

follows:

(in thousands)

Duewithinoneyear.............................................. $ 22,950

Due after one year and through 5 years . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 165,695

Due after 5 years and through 10 years . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,950

Dueafter10years ............................................... 16,108

Totalshort-terminvestments ....................................... $207,703

As the portfolio has been in existence for less than one year as of December 31, 2007, there are no

investments which have been in a continuous loss position for more than twelve months.

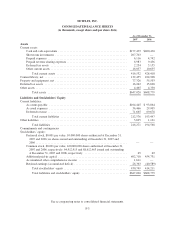

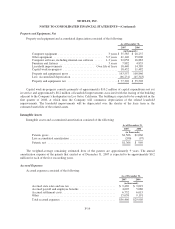

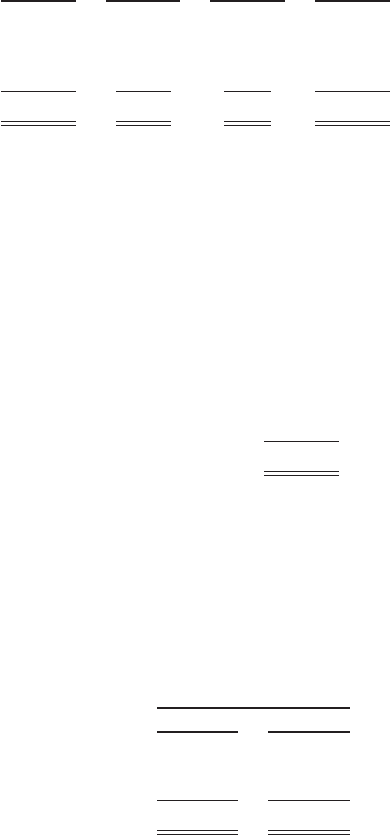

3. Balance Sheet Components

Content Library, Net

Content library and accumulated amortization consisted of the following:

As of December 31,

2007 2006

(in thousands)

Content library, gross . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 698,704 $ 484,034

Less accumulated amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . (566,249) (379,126)

Contentlibrary,net ..................................... $132,455 $104,908

F-13