NetFlix 2007 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2007 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NETFLIX, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Company’s DVD amortization policy. This payment may also include a contractually specified prepayment of

future revenue sharing obligations that is classified as prepaid revenue sharing expense and is charged to expense

as future revenue sharing obligations are incurred.

The Company amortizes license fees on Internet-based content on a straight-line basis consistent with the

terms of the license agreements.

Amortization of Intangible Assets

Intangible assets are carried at cost less accumulated amortization. The Company amortizes the intangible

assets with finite lives using the straight-line method over the estimated economic lives of the assets, ranging

from approximately 10 years to 14 years. Intangible assets are included as part of other assets in the consolidated

balance sheets. In the first quarter of 2007, the Company wrote off fully amortized intangible assets of $11.9

million. See Note 3 for further discussion.

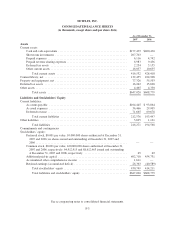

Property and Equipment

Property and equipment are carried at cost less accumulated depreciation. Depreciation is calculated using

the straight-line method over the shorter of the estimated useful lives of the respective assets, generally up to 5

years, or the lease term for leasehold improvements, if applicable. See Note 3 for further discussion.

Impairment of Long-Lived Assets

In accordance with SFAS No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets, long-lived

assets such as content library, property and equipment and intangible assets subject to amortization, are reviewed for

impairment whenever events or changes in circumstances indicate that the carrying amount of an asset group may not

be recoverable. Recoverability of asset groups to be held and used is measured by a comparison of the carrying amount

of an asset group to estimated undiscounted future cash flows expected to be generated by the asset group. If the

carrying amount of an asset group exceeds its estimated future cash flows, an impairment charge is recognized by the

amount by which the carrying amount of an asset group exceeds fair value of the asset group. The Company evaluated

its long-lived assets, and impairment charges were not material for any of the years presented.

Capitalized Software Costs

The Company accounts for software development costs, including costs to develop software products or the

software component of products to be marketed to external users, as well as software programs to be used solely

to meet the Company’s internal needs in accordance with SFAS No. 86, Accounting for the Costs of Computer

Software to Be Sold, Leased, or Otherwise Marketed, and Statement of Position (SOP) No. 98-1, Accounting for

Costs of Computer Software Developed or Obtained for Internal Use. Costs incurred during the application

development stage for software programs to be used solely to meet our internal needs are capitalized. Capitalized

software costs are included in property and equipment, net and are amortized over the estimated useful life of the

software, generally up to three years. The net book value of capitalized software costs is not significant as of

December 31, 2007 and 2006.

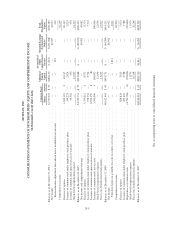

Revenue Recognition

Subscription revenues are recognized ratably over each subscriber’s monthly subscription period. Refunds

to subscribers are recorded as a reduction of revenues. Revenues from sales of advertising are recognized upon

completion of the campaign. Revenues are presented net of the taxes that are collected from customers and

remitted to governmental authorities. Deferred revenue consists of subscriptions revenues billed to subscribers

that have not been recognized and gift subscriptions that have not been redeemed.

F-9