NetFlix 2007 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2007 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETFLIX, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

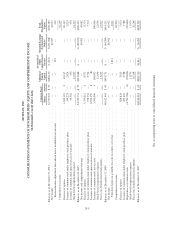

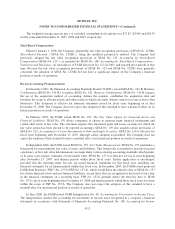

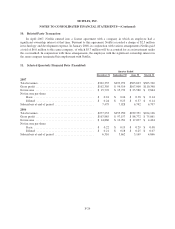

Property and Equipment, Net

Property and equipment and accumulated depreciation consisted of the following:

As of December 31,

2007 2006

(in thousands)

Computer equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 years $ 35,585 $ 28,237

Other equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3-5 years 41,140 25,000

Computer software, including internal-use software . . . . . 1-3 years 22,058 16,883

Furniture and fixtures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 years 7,882 4,855

Leasehold improvements . . . . . . . . . . . . . . . . . . . . . Over life of lease 18,440 14,389

Capital work-in-progress . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18,452 11,482

Property and equipment, gross . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 143,557 100,846

Less: Accumulated depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (66,231) (45,343)

Property and equipment, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 77,326 $ 55,503

Capital work-in-progress consists primarily of approximately $10.2 million of capital expenditures not yet

in service and approximately $8.2 million of leasehold improvements associated with the leasing of the building

adjacent to the Company’s headquarters in Los Gatos, California. The building is expected to be completed in the

first quarter of 2008, at which time the Company will commence depreciation of the related leasehold

improvements. The leasehold improvements will be depreciated over the shorter of the lease term or the

estimated useful life of the related assets.

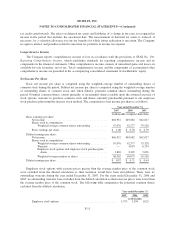

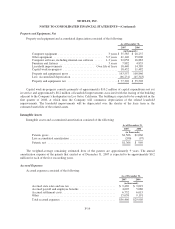

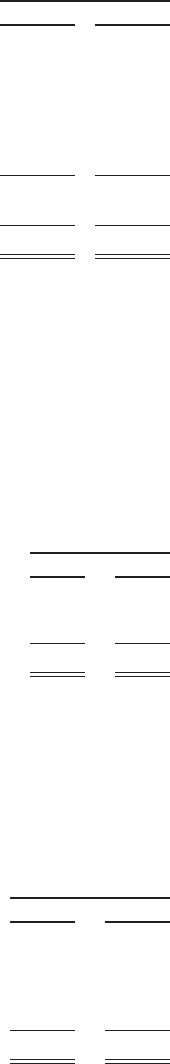

Intangible Assets

Intangible assets and accumulated amortization consisted of the following:

As of December 31,

2007 2006

(in thousands)

Patents,gross............................................... $1,566 $1,066

Less accumulated amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (200) (97)

Patents,net ................................................ $1,366 $ 969

The weighted-average remaining estimated lives of the patents are approximately 9 years. The annual

amortization expense of the patents that existed as of December 31, 2007 is expected to be approximately $0.2

million for each of the five succeeding years.

Accrued Expenses

Accrued expenses consisted of the following:

As of December 31,

2007 2006

(in thousands)

Accrued state sales and use tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 9,469 $ 9,019

Accrued payroll and employee benefits . . . . . . . . . . . . . . . . . . . . . . . . 4,607 5,080

Accruedsettlementcosts.................................... 6,732 6,615

Other ................................................... 15,658 9,191

Totalaccruedexpenses ..................................... $36,466 $29,905

F-14