National Grid 2007 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2007 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

National Grid Electricity Transmission plc Annual Report and Accounts 2006/07

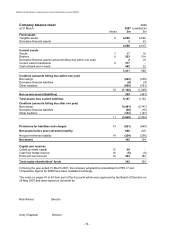

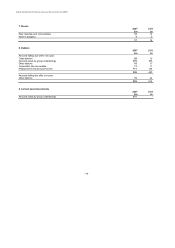

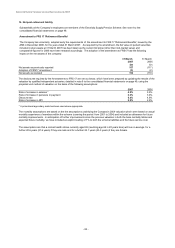

14. Net post-retirement liability (continued)

The amounts recognised in the balance sheet in respect of the Company's section of the Electricity Supply Pension Scheme

are as follows:

2007

2006

£m

£m

Fair value of plan assets

1,336

1,334

Present value of funded obligations

(1,787)

(1,688)

(451)

(354)

Present value of unfunded obligations

(12)

(13)

Deficit in the scheme

(463)

(367)

Related deferred tax asset

139

111

Net pension liability

(324)

(256)

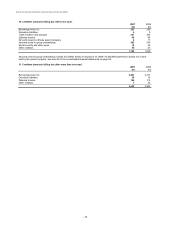

2007

2006

£m

£m

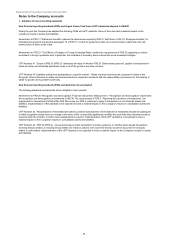

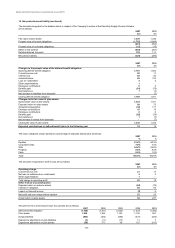

Changes in the present value of the defined benefit obligation:

Opening defined benefit obligation

1,701

1,562

Current service cost

20

17

Interest cost

82

82

Actuarial losses

66

124

Loss on curtailments

3

2

Other augmentations

1

-

Employee contributions

6

6

Benefits paid

(81)

(78)

Net transfers in

1

(7)

Net increase in liabilities from disposals

-

(7)

Closing defined benefit obligation

1,799

1,701

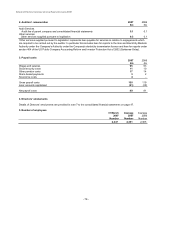

Changes in the fair value of plan assets:

Opening fair value of plan assets

1,334

1,161

Expected return on plan assets

89

73

Actuarial (losses)/gains

(30)

171

Employer contributions

18

15

Employee contributions

6

6

Benefits paid

(82)

(78)

Net transfers in

1

(7)

Net increase in assets from disposals

-

(7)

Closing fair value of plan assets

1,336

1,334

Expected contributions to defined benefit plans in the following year

12

12

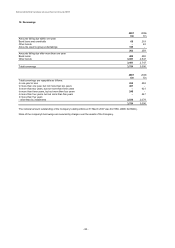

The major categories of plan assets as a percentage of total plan assets were as follows:

2007

2006

%

%

Equities

61.2%

60.9%

Corporate bonds

7.6%

7.5%

Gilts

24.2%

22.0%

Property

6.6%

8.4%

Cash

0.4%

1.2%

Total

100.0%

100.0%

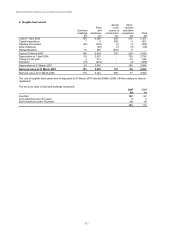

The amounts recognised in profit or loss are as follows:

2007

2006

£m

£m

Operating charge

Current service cost

21

17

Net loss on settlements or curtailments

3

2

Other augmentations

1

-

Total charge to operating profit

25

19

Other finance (income)/expense

Expected return on scheme assets

(84)

(76)

Interest on obligation

82

82

Impact on financial income

(2)

6

Net profit and loss charge before taxation

23

25

Actual return on plan assets

54

247

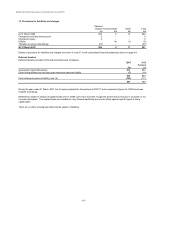

Amounts for the current and previous four periods are as follows:

2007

2006

2005

2004

2003

Defined benefit obligation

(1,799)

(1,701)

(1,562)

(1,537)

(1,392)

Plan assets

1,336

1,339

1,163

1,106

967

Surplus/(deficit)

(463)

(362)

(399)

(431)

(425)

Experience adjustment on plan liabilities

(3)

(11)

(17)

11

7

Experience adjustment on plan assets

(30)

171

38

127

(317)

- 83 -