National Grid 2007 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2007 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

National Grid Electricity Transmission Annual Report and Accounts 2006/07 25

Regulatory restrictions

As part of our regulatory arrangements, our operations are

subject to a number of restrictions on the way we can operate.

These include a regulatory ‘ring-fence’ that require us to

maintain adequate financial resources and restricts our ability to

transfer funds or levy charges between the Company and other

companies in the National Grid group of companies.

Treasury policy

The funding and treasury risk management for National Grid

Electricity Transmission is carried out on its behalf by a central

department operating under policies and guidelines approved

by the Board of National Grid plc. The Finance Committee, a

committee of the Board of National Grid plc, is responsible for

regular review and monitoring of treasury activity and for

approval of specific transactions, the authority for which may be

delegated. National Grid plc has a Treasury function that raises

funding and manages interest rate and foreign exchange rate

risk for National Grid Electricity Transmission.

There is a separate financing programme for National Grid

Electricity Transmission. The Finance Committees of both

National Grid and of National Grid Electricity Transmission

approve all funding programmes.

The Treasury function is not operated as a profit centre. Debt

and treasury positions are managed in a non-speculative

manner, such that all transactions in financial instruments or

products are matched to an underlying current or anticipated

business requirement.

The use of derivative financial instruments is controlled by

policy guidelines set by the Board of National Grid plc.

Derivatives entered into in respect of gas commodities are used

in support of the business’ operational requirements and the

policy regarding their use is explained below.

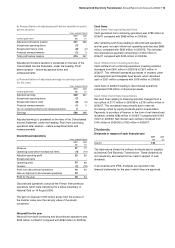

We had borrowings outstanding at 31 March 2007 amounting to

£3,728 million (31 March 2006: £2,990 million). The table in

note 24 shows the expected maturity of these borrowings.

Appropriate committed facilities are in place, such that we

believe that the maturing amounts in respect of our contractual

obligations, as shown in ‘Commitments and Contingencies’, can

be met from these facilities, operating cash flows and other

refinancings that we reasonably expect to be able to secure in

the future. Our financial position and expected future operating

cash flows are such that we can borrow on the wholesale

capital and money markets and most of our borrowings are

through public bonds and commercial paper.

We place surplus funds on the money markets, usually in the

form of short-term fixed deposits that are invested with

approved banks and counterparties. Details relating to cash,

short-term investments and other financial assets at 31 March

2007 are shown in notes 22 and 23 to the accounts.

As of 31 March 2007, the long-term senior unsecured debt and

short-term debt credit ratings respectively provided by Moody’s,

Standard & Poor’s (S&P) and Fitch were as follows:

Moody’s A2/P1

Standard & Poor’s (S&P) A/A1

Fitch A/F2

In connection with the proposed acquisition of KeySpan

Corporation by National Grid, our ratings have been moved to

‘creditwatch with negative implications’ by S&P. Moody’s have

placed our ratings on ‘review for downgrade’ and Fitch have

maintained our ratings as ‘stable’.

It is a condition of the regulatory ring-fence around the

Company that it uses reasonable endeavours to maintain an

investment grade credit rating. At these ratings, we should have

good access to the capital and money markets for future

funding when necessary.

The main risks arising from our financial activities are set out

below, as are the policies for managing these risks, which are

agreed and reviewed by the Board of National Grid and the

Finance Committee of that Board.

Refinancing risk management

The Board of National Grid plc controls refinancing risk mainly

by limiting the amount of financing obligations (both principal

and interest) arising on borrowings in any financial year. This

policy is intended to prevent National Grid and its subsidiaries

from having an excessively large amount of debt to refinance in

a given time-frame.

Interest rate risk management

Our interest rate exposure arising from borrowings and deposits

is managed by the use of fixed and floating rate debt, interest

rate swaps, swaptions and forward rate agreements. Our

interest rate risk management policy is to seek to minimise total

financing costs (being interest costs and changes in the market

value of debt) subject to constraints so that, even with large

movements in interest rates, neither the interest cost nor the

total financing cost can exceed pre-set limits. Some of our

bonds in issue are index-linked, that is their cost is linked to

changes in the UK Retail Price Index (RPI). We believe that

these bonds provide a good hedge for revenues and our

regulatory asset values that are also RPI-linked under our

price control formulae.

The performance of the Treasury function in interest rate risk

management is measured by comparing the actual total

financing costs of our debt with those of a passively-managed

benchmark portfolio. More information on the interest rate

profile of our debt is included in note 19 to the accounts.

Foreign exchange risk management

We have a policy of hedging certain contractually committed

foreign exchange transactions over a prescribed minimum size.

This covers a minimum of 75% of such transactions expected to

occur up to six months in advance and a minimum of 50% of

transactions six to twelve months in advance. Cover generally

takes the form of forward sale or purchase of foreign currencies

and must always relate to underlying operational cash flows.