National Grid 2007 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2007 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

National Grid Electricity Transmission plc Annual Report and Accounts 2006/07

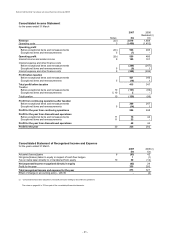

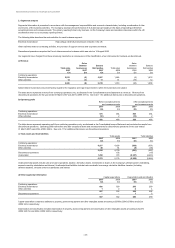

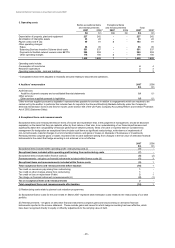

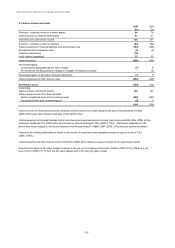

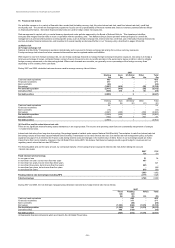

10. Taxation

Taxation on items charged/(credited) to the income statement

2007

2006

*

£m

£m

United Kingdom

Corporation tax at 30%

136

128

Adjustments in respect of prior years (i)

(15)

(29)

Deferred tax (ii)

8

-

Taxation

129

99

Comprising:

Taxation - excluding exceptional items and remeasurements

131

99

Taxation - exceptional items and remeasurements (note 5)

(2)

-

129

99

* Comparatives have been adjusted to reclassify amounts relating to discontinued operations.

(i) The corporation tax adjustment in respect of prior years does not include any adjustments relating to exceptional items.

(ii) Deferred tax includes an exceptional tax credit of £2m (2006: £nil).

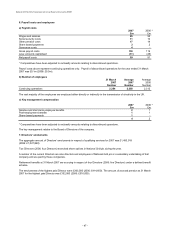

Taxation on items charged/(credited) to equity

2007

2006

£m

£m

Deferred tax credit on revaluation of cash flow hedges

(2)

-

Deferred tax (credit)/charge on actuarial gains/losses

(28)

12

Tax on items recognised in

Consolidated Statement of Recognised Income and Expense

(30)

12

Deferred tax credit on employee share schemes recognised directly in equity

(5)

(3)

(35)

9

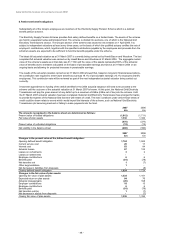

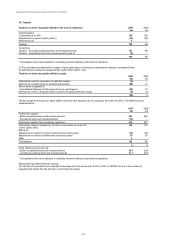

The tax charge for the period is higher (2006: lower) than the standard rate of corporation tax in the UK (30%). The differences are

explained below:

2007

2006

*

£m

£m

Profit before taxation

Before exceptional items and remeasurements

431

346

Exceptional items and remeasurements

(16)

1

Profit before taxation from continuing operations

415

347

Profit before taxation multiplied by the rate of corporation tax in the UK

125

104

of 30% (2006: 30%)

Effects of:

Adjustments in respect of current income tax of previous years

(15)

(29)

Adjustments in respect of deferred tax of previous years

15

24

Other

4

-

Total taxation

129

99

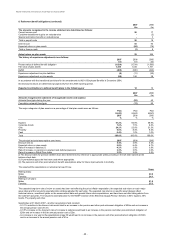

%

%

At the effective income tax rate

Before exceptional items and remeasurements

30.3

28.6

Including exceptional items and remeasurements

31.1

28.5

* Comparatives have been adjusted to reclassify amounts relating to discontinued operations.

Factors that may affect future tax charges

The UK rate of corporation tax is expected to decrease from the current rate of 30% to 28% in 2008/09. We are in the process of

evaluating the impact this rate will have on the future tax charge.

- 51 -