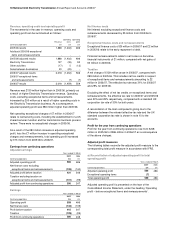

National Grid 2007 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2007 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

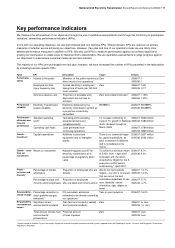

18 National Grid Electricity Transmission Annual Report and Accounts 2006/07

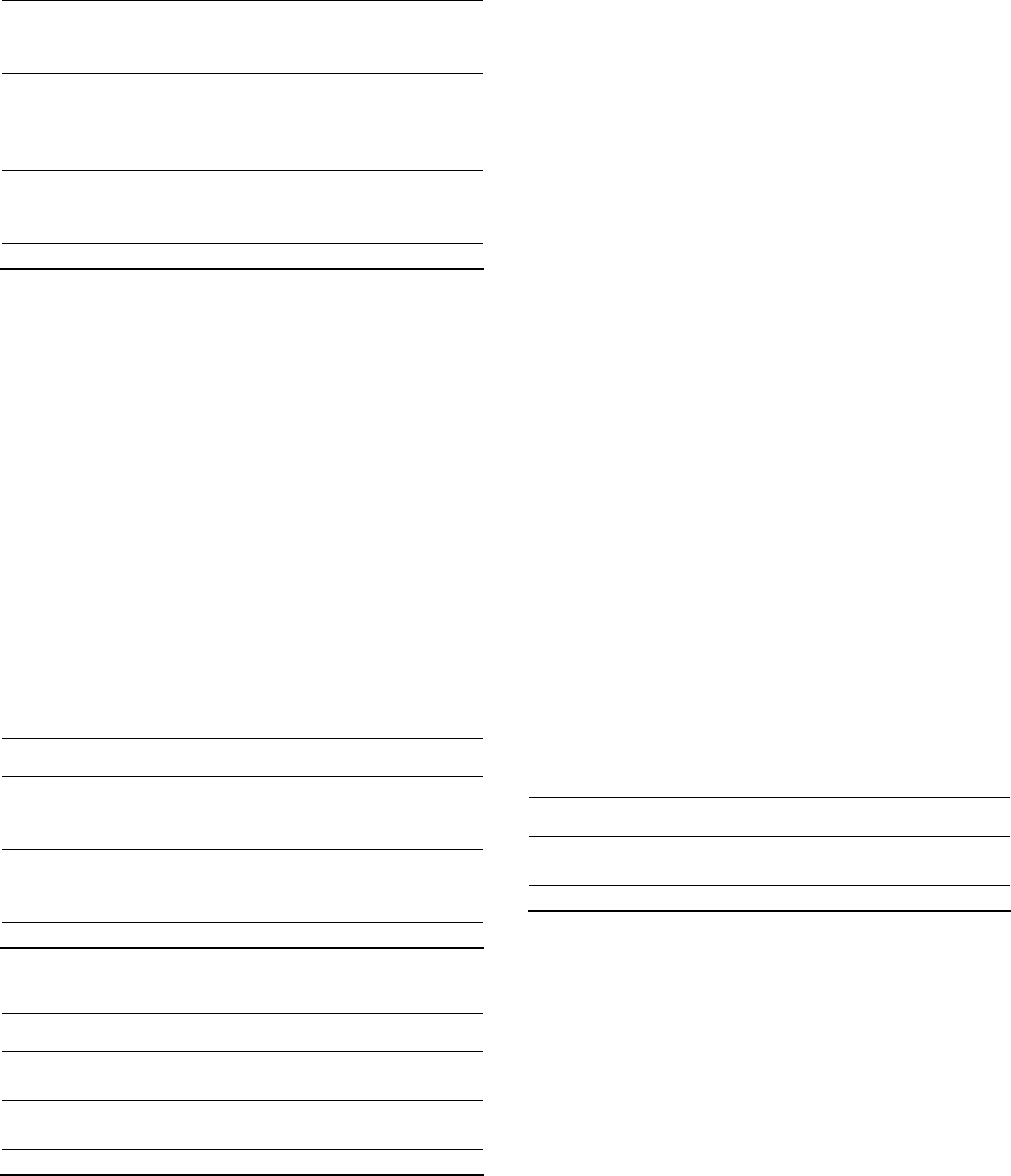

Revenue, operating costs and operating profit

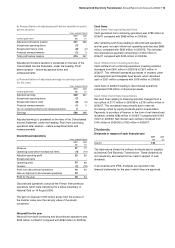

The movements in the year in revenue, operating costs and

operating profit can be summarised as follows:

Revenue

Operating

costs

Operating

profit

Continuing operations £m

£m

£m

2005/06 results 1,888

(1,402)

486

Add back 2005/06 exceptional

items and remeasurements -

-

-

2005/06 adjusted results 1,888

(1,402)

486

Electricity Transmission 127

(35)

92

Other activities (17)

5

(12)

Sales between businesses 20

(20)

-

2006/07 adjusted results 2,018

(1,452)

566

2006/07 exceptional items

and remeasurements -

(7)

(7)

2006/07 results 2,018

(1,459)

559

Revenue was £130 million higher than in 2005/06, primarily as

a result of higher Electricity Transmission revenue. Operating

costs, excluding exceptional items and remeasurements,

increased by £50 million as a result of higher operating costs in

the Electricity Transmission business. As a consequence,

adjusted operating profit was £80 million higher than 2005/06.

Net operating exceptional charges of £7 million in 2006/07

relate to restructuring costs, including the establishment of a UK

shared services function and the transmission business process

review. There were no exceptional charges in 2005/06.

As a result of the £80 million increase in adjusted operating

profit, less the £7 million increase in operating exceptional

charges and remeasurements, total operating profit increased

by £73 million from 2005/06 to 2006/07.

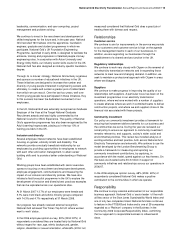

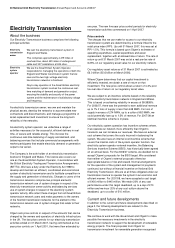

Earnings from continuing operations

Adjusted earnings

Years ended 31 March

2007

2006

Continuing operations £m

£m

Adjusted operating profit 566

486

Net finance costs excluding

exceptional items and remeasurements (135)

(140)

Adjusted profit before taxation 431

346

Taxation excluding taxation on

exceptional items and remeasurements (131)

(99)

Adjusted profit from continuing operations 300

247

Earnings

Years ended 31 March

2007

2006

Continuing operations £m

£m

Operating profit 559

486

Net finance costs (144)

(139)

Profit before taxation 415

347

Taxation (129)

(99)

Profit from continuing operations 286

248

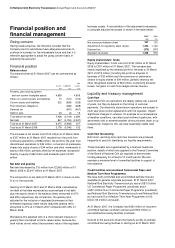

Net finance costs

Net interest excluding exceptional finance costs and

remeasurements decreased by £5 million from 2005/06 to

2006/07.

Exceptional finance costs and remeasurements

Exceptional finance costs of £8 million in 2006/07 and £2 million

in 2005/06 relate to the early repayment of debt.

Financial remeasurements relate to net losses on derivative

financial instruments of £1 million, compared with net gains of

£3 million in 2005/06.

Taxation

A net charge of £129 million arose in 2006/07, compared with

£99 million in 2005/06. This includes net tax credits in respect

of exceptional items and remeasurements amounting to £2

million in 2006/07. The effective tax rate was 31% for 2006/07

and 29% for 2005/06.

Excluding the effect of net tax credits on exceptional items and

remeasurements, the effective tax rate for 2006/07 and 2005/06

was 30% and 29% respectively, compared with a standard UK

corporation tax rate of 30% for both years.

A reconciliation of the main components giving rise to the

difference between the relevant effective tax rate and the UK

standard corporation tax rate is shown in note 10 to the

accounts.

Profit for the year from continuing operations

Profit for the year from continuing operations rose from £248

million in 2005/06 to £286 million in 2006/07 as a consequence

of the above changes.

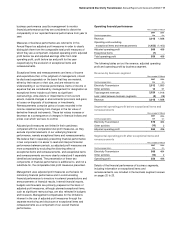

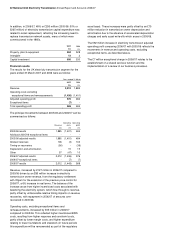

Adjusted profit measures

The following tables reconcile the adjusted profit measure to the

corresponding total profit measure in accordance with IFRS.

a) Reconciliation of adjusted operating profit to total

operating profit

Years ended 31 March

2007

2006

Continuing operations £m

£m

Adjusted operating profit 566

486

Exceptional operating items (7)

-

Total operating profit 559

486

Adjusted operating profit is presented on the face of the

Consolidated Income Statement, under the heading ‘Operating

profit – before exceptional items and remeasurements’.