National Grid 2007 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2007 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

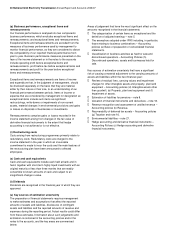

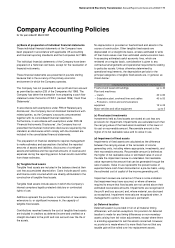

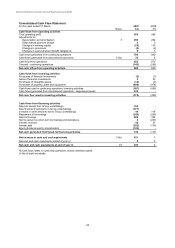

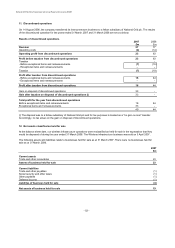

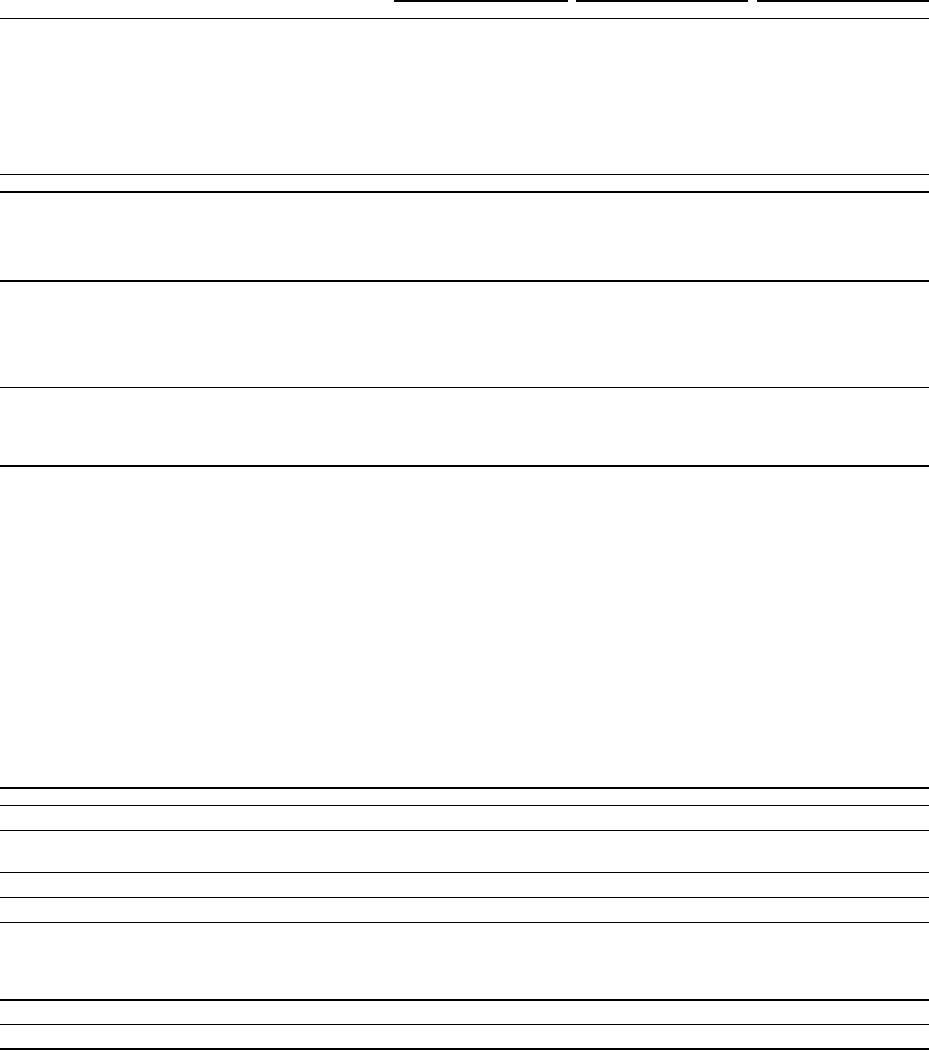

National Grid Electricity Transmission plc Annual Report and Accounts 2006/07

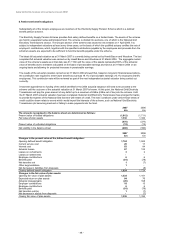

3. Operating costs

2007

2006

*

2007

2006

2007

2006*

£m

£m

£m

£m

£m

£m

Depreciation of property, plant and equipment

227

242

-

-

227

242

Amortisation of intangible assets

23

22

-

-

23

22

Payroll costs (note 6 (a))

99

91

4

-

103

91

Other operating charges:

Rates

96

95

-

-

96

95

Balancing Services Incentive Scheme direct costs

551

537

-

-

551

537

Payments to Scottish network owners under BETTA

280

259

-

-

280

259

Other operating charges

176

156

3

-

179

156

1,452

1,402

7

-

1,459

1,402

Operating costs include:

Consumption of inventories

4

4

Research expenditure

3

3

Operating lease rentals - land and buildings

5

3

* Comparatives have been adjusted to reclassify amounts relating to discontinued operations.

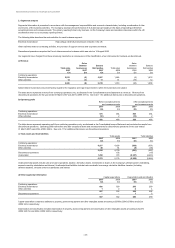

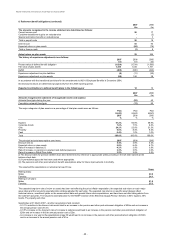

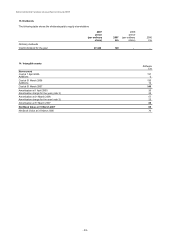

4. Auditors' remuneration

2007

2006

£m

£m

Audit Services

Audit fee of parent company and consolidated financial statements

0.1

0.1

Other services:

Other services supplied pursuant to legislation

0.3

0.1

'Other services supplied pursuant to legislation' represents fees payable for services in relation to engagements which are required to be

carried out by the auditor. In particular this includes fees for reports to the Gas and Electricity Markets Authority under the Company's

electricity transmission licence and fees for reports under section 404 of the US Public Company Accounting Reform and Investor Protection

Act of 2002 (Sarbanes-Oxley).

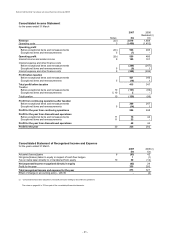

5. Exceptional items and remeasurements

Exceptional items and remeasurements are items of income and expenditure that, in the judgment of management, should be disclosed

separately on the basis that they are material, either by their nature or their size, to an understanding of our financial performance and

significantly distort the comparability of financial performance between periods. Items of income or expense that are considered by

management for designation as exceptional items include such items as significant restructurings, write-downs or impairments of

non-current assets, material changes in environmental provisions, and gains or losses on disposals of businesses or investments.

Remeasurements comprise gains or losses recorded in the income statement arising from changes in the fair value of derivative financial

instruments to the extent that hedge acounting is not achieved or is not effective.

2007

2006

£m

£m

Exceptional items included within operating profit - restructuring costs (i)

(7)

-

Exceptional items included within operating profit arising from restructuring costs

(7)

-

Exceptional items included within finance costs (ii)

(8)

(2)

Remeasurements - net gains on financial instruments included within finance costs (iii)

(1)

3

Exceptional items and remeasurements included within finance costs

(9)

1

Total exceptional items and remeasurements before taxation

(16)

1

Tax credit on severance pay arising from restructuring

1

-

Tax credit on other charges arising from restructuring

1

-

Tax credit on loss on repurchase of debt

2

1

Tax charge on financial instrument remeasurements (iii)

(2)

(1)

Tax on exceptional items and remeasurements

2

-

Total exceptional items and remeasurements after taxation

(14)

1

(i) Restructuring costs relate to planned cost reduction programmes.

(ii) Exceptional finance costs for the year ended 31 March 2007 represent debt redemption costs related to the restructuring of our debt

portfolio.

(iii) Remeasurements - net gains on derivative financial instruments comprise gains and losses arising on derivative financial

instruments reported in the income statement. These exclude gains and losses for which hedge accounting has been effective, which

have been recognised directly in equity or offset by adjustments to the carrying value of debt.

- 46 -

Before exceptional items

and remeasurements

Exceptional items

and remeasurements Total