National Grid 2007 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2007 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26 National Grid Electricity Transmission Annual Report and Accounts 2006/07

Counterparty risk management

Counterparty risk arises from the investment of surplus funds

and from the use of derivative instruments. The Finance

Committee of National Grid plc has agreed a policy for

managing such risk, which is controlled through credit limits,

approvals and monitoring procedures. Where multiple

transactions are entered into with a single counterparty, a

master netting arrangement can be put in place to reduce our

exposure to credit risk of that counterparty. At the present time,

we use standard International Swap Dealers Association (ISDA)

documentation, which provides for netting in respect of all

transactions governed by a specific ISDA agreement with a

counterparty, when transacting interest rate and exchange rate

derivatives.

Derivative financial instruments held for purposes other

than trading

As part of our business operations, we are exposed to risks

arising from fluctuations in interest rates and exchange rates.

We use financial instruments, including derivatives, to manage

exposures of this type and they are a useful tool in reducing

risk. Our policy is not to use derivatives for trading purposes.

Derivative transactions can, to varying degrees, carry both

counterparty and market risk.

We enter into interest rate swaps to manage the composition of

floating and fixed rate debt and so hedge the exposure of

borrowings to interest rate movements. In addition, we enter

into bought and written option contracts on interest rate swaps.

These contracts are known as swaptions. We also enter into

foreign currency swaps to manage the currency composition of

borrowings and so hedge the exposure to exchange rate

movements. Certain agreements are combined foreign currency

and interest rate swap transactions. Such agreements are

known as cross-currency swaps.

We enter into forward rate agreements to hedge interest rate

risk on short-term debt and money market investments.

Forward rate agreements are commitments to fix an interest

rate that is to be paid or received on a notional deposit of

specified maturity, starting at a future specified date.

More details on derivative financial instruments are provided in

note 18 to the accounts.

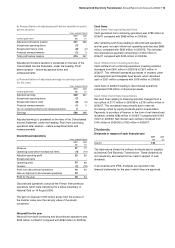

Valuation and sensitivity analysis

We calculate the fair value of debt and derivative instruments

by discounting all future cash flows by the market yield curve at

the balance sheet date. The market yield curve for each

currency is obtained from external sources for interest and

foreign exchange rates. In the case of instruments that include

options, the Black’s variation of the Black-Scholes model is

used to calculate fair value.

The valuation techniques described above for interest rate

swaps and currency swaps are a standard market

methodology. These techniques do not take account of the

credit quality of either party, but this is not considered to be a

significant factor, unless there is a material deterioration in the

credit quality of either party.

In relation to swaptions, we only use swaptions for hedging

purposes with a European style exercise. As a consequence,

the Black’s variation of the Black-Scholes model is considered

to be sufficiently accurate for the purpose of providing fair value

information in relation to these types of swaptions. More

sophisticated valuation models exist but we do not believe it is

necessary to employ these models, given the extent of our

activities in this area.

For debt and derivative instruments held, we utilise a sensitivity

analysis technique to evaluate the effect that changes in

relevant rates or prices will have on the market value of such

instruments.

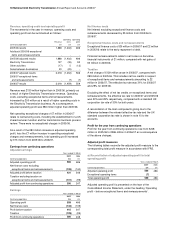

Details of the sensitivity of our income statement and equity to

changes in the UK Retail Prices Index and UK interest rates are

set out in note 19(d). Under the assumptions set out in note

19(d) a 0.5% change in the UK Retail Prices Index would affect

the income statement by £8 million, but would have no effect on

equity, while a 0.5% change in UK interest rates would affect

the income statement by £2 million and equity by £3 million.

Commodity contracts

Commodity trading

We have entered into electricity options, pursuant to the

requirement to stabilise the electricity market in Great Britain

through the operation of the British Electricity Trading and

Transmission Arrangements (BETTA). The options are for

varying terms and have been entered into so that we have the

ability to deliver electricity as required to meet our obligations

under our electricity transmission licence. We have not and do

not expect to enter into any significant derivatives in connection

with our BETTA role.

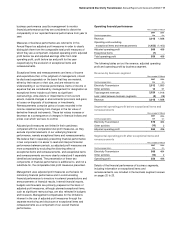

Commitments and contingencies

Commitments and contingencies outstanding at 31 March 2007

and 2006 are summarised in the table below:

2007

2006

£m

£m

Future capital expenditure

contracted but not provided for 665

337

Total operating lease commitments 77

28

Other commitments and contingencies 19

19

Information regarding obligations under pension and other post-

retirement benefits is given below under the heading

‘Retirement arrangements’.

We propose to meet all of our commitments from operating

cash flows, existing credit facilities, future facilities and other

financing that we reasonably expect to be able to secure in the

future.

Details of material litigation as at 31 March 2007

We were not party to litigation that we considered to be material

at 31 March 2007.