National Grid 2007 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2007 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14 National Grid Electricity Transmission Annual Report and Accounts 2006/07

Growth

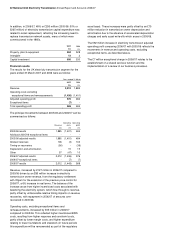

Capital investment

Our capital investment continues to increase as changing

energy requirements and the renewal of our networks require

increased investment in infrastructure and we invested

£595 million in the form of capital investment during 2006/07,

compared with £530 million in 2005/06. In the UK, there are

plans for significant expansion of renewable energy sources, as

well as the need to increase the rate of asset replacement, as

assets built in the 1960s and 1970s approach the end of their

useful lives. The UK transmission price controls for the next five

years include an allowance of £3.5 billion for investment in our

electricity networks over that period. This investment is to

respond to changing sources of energy and to replace our

ageing assets.

Acquisitions and disposals

Legislative changes which became effective on 14 August

2006, meant that as a holder of an electricity transmission

licence, we were no longer allowed to own or operate the

French Interconnector. Therefore, on 14 August 2006, we

transferred our French Interconnector assets and related

operating activities to National Grid Interconnectors Limited, a

fellow subsidiary company of National Grid for a price of

£128 million.

There were no other significant acquisitions or disposals

completed during the year ended 31 March 2007.

Assets held for sale

As part of its strategy of focusing on energy markets in the UK

and the US, National Grid committed during 2006/07 to exit

from its wireless infrastructure operations in the UK and in the

US. As a consequence, certain assets and liabilities relating to

those wireless infrastructure operations have been reclassified

as held for sale. Subsequent to the end of the 2006/07 financial

year, on 3 April 2007, National Grid completed the sale of its

UK wireless infrastructure operations, including these assets

and liabilities, for proceeds of £2.5 billion. For further details of

the sale see the National Grid Annual Report and Accounts

2006/07.

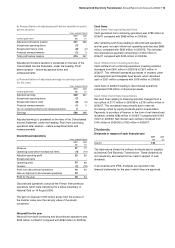

Generating value from our investments

This year we are reporting for the first time a return on

investment measure, the purpose of which is to allow us to

monitor how we are performing in generating value from our

businesses and from the investments we make. Return on

investment has been calculated using the measure developed

by Ofgem when setting our transmission price controls for the 5-

year period commencing 1 April 2007. If we perform in

accordance with Ofgem’s projections for the 5 year price control

period, then we would earn an average annual return of 5.05%

using Ofgem’s measure. For 2006/07, our return on investment

using this measure is 4.7%, compared with 4.5% in 2005/06.

The returns in 2005/06 and 2006/07 were mainly suppressed by

an increased investment programme prior to the price control

outcome but for which higher revenue will be allowed in future

years.

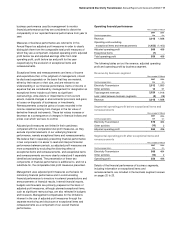

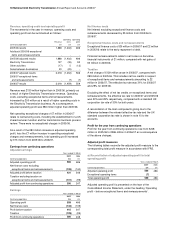

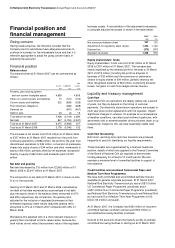

The following table shows how return on investment has been

calculated:

Years ended 31 March

2007

2006

£m

£m

Electricity Transmission adjusted operating profit1

576

484

Adjustment of operating costs onto a price control

basis2

(26)

(10)

Excess of regulatory value depreciation over

accounting depreciation and amortisation

(177)

(130)

Regulatory operating profit 373

344

Notional current taxation on a price control basis3 (104)

(104)

Regulatory return 269

240

Estimated regulatory value at 1 April4 5,759

5,351

Return on investment – regulatory return as a

percentage of regulatory value 4.7% 4.5%

1 Adjusted operating profit is operating profit before exceptional items and

remeasurements.

2 Adjustments to operating costs primarily comprise an allocation of corporate centre costs

which are reported in these financial statements within other activities and certain

additions to fixed assets which are treated as an operating cost for price control purposes.

3 Notional current taxation is an allocation of the actual current tax for the year, excluding

prior year items and adjusted for the effect of actual interest payments being less than

would result from the gearing assumed by Ofgem when setting the price control.

4 Regulatory values have been restated from previous estimates to reflect the outcome of

the price control review for the 5 years from 1 April 2007 and are stated at average year

values

Talent

Motivation and performance

In July 2006, National Grid conducted a company-wide

employee opinion survey. 58% of employees took part in the

process – a 9% increase on the response rate compared with

the 2004 survey. For over 90% of the questions asked, a more

favourable response rate was received than in 2004. The

survey demonstrated that the workforce better understand our

strategy and the need for change. Our employees believe that

the business is heading in the right direction and are willing to

do their jobs differently to help National Grid improve. Respect

and integrity, two of our three core values, are also becoming

embedded in the culture of the organisation and safety

continues to be recognised as one of National Grid’s key

strengths.

Areas which the survey results highlighted as needing

improvement included general management behaviours around

communication with employees and performance management.

Action plans have been developed by each of the businesses to

address their key priorities for improvement.

Greater use is being made of electronic communication

channels with the new Chief Executive of National Grid outlining

the new strategy for all employees via video and issuing a New

Year video message to all employees.

Development of talent

Development and recruitment of employees is undertaken on

an integrated basis for all National Grid’s UK businesses.

Our focus on developing the talent of our current and future

business leaders has intensified, with participants in our

leadership and management development programmes more

than doubled over last year. Specific areas of focus include