National Grid 2007 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2007 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24 National Grid Electricity Transmission Annual Report and Accounts 2006/07

Financial position and

financial management

Going concern

Having made enquiries, the Directors consider that the

Company and its subsidiaries have adequate resources to

continue in business for the foreseeable future and that it is

therefore appropriate to adopt the going concern basis in

preparing the accounts.

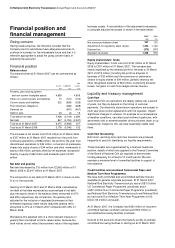

Financial position

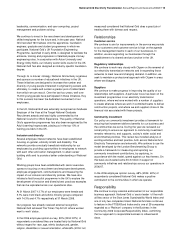

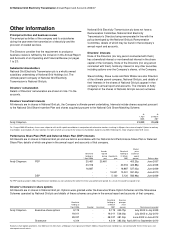

Balance sheet

Our balance sheet at 31 March 2007 can be summarised as

follows:

Assets

Liabilities

Net

assets

£m

£m

£m

Property, plant and equipment

and non-current intangible assets 4,858

-

4,858

Other non-current assets and liabilities 15

(147)

(132)

Current assets and liabilities 532

(858)

(326)

Post retirement obligations -

(488)

(488)

Deferred tax -

(647)

(647)

Held for sale 23

(4)

19

Total before net debt 5,428

(2,144)

3,284

Net debt 847

(3,794)

(2,947)

Total as at 31 March 2007 6,275

(5,938)

337

Total as at 31 March 2006 5,178

(5,046)

132

The increase in net assets from £132 million at 31 March 2006

to £337 million at 31 March 2007 resulted from the profit from

continuing operations of £286 million, the profit for the year from

discontinued operations of £49 million, conversion of preference

shares into equity shares of £44 million and other movements in

equity of £8 million, partially offset by net expenses recognised

directly in equity of £62 million and dividends paid of £120

million.

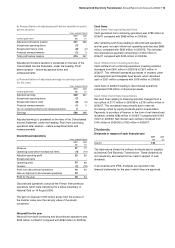

Net debt and gearing

Net debt decreased by £15 million from £2,962 million at 31

March 2006 to £2,947 million at 31 March 2007.

The composition of net debt at 31 March 2007 is shown in note

31(c) to the accounts.

Gearing at 31 March 2007 and 31 March 2006, calculated as

net debt at that date expressed as a percentage of net debt

plus net assets shown in the balance sheet, amounted to 47%

and 49% respectively. By comparison, the gearing ratio,

adjusted for the inclusion of regulated businesses at their

estimated regulatory asset values (adjusted gearing ratio),

amounted to 41% at 31 March 2007 compared with 43% 31

March 2006.

We believe this adjusted ratio is a more relevant measure of

gearing than one based on book values alone, because the

book values do not reflect the economic value of the regulated

business assets. A reconciliation of the adjustments necessary

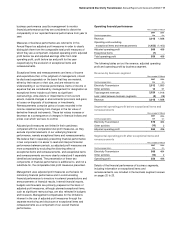

to calculate adjusted net assets is shown in the table below:

2007

2006

£m

£m

Net assets per balance sheet 337

132

Adjustments for regulatory asset values 1,244

1,124

Deferred tax (373)

(337)

Adjusted net assets 1,208

919

Equity shareholders’ funds

Equity shareholders’ funds rose from £132 million at 31 March

2006 to £337 million at 31 March 2007. The increase was

mainly explained by the retained profit for the year to 31 March

2007 of £215 million (including the profit on disposal of

business of £33 million) and the conversion of preference

shares to equity shares of £44 million, partially offset by net

other recognised expense of £62 million, comprising actuarial

losses, net gains on cash flow hedges and tax thereon.

Liquidity and treasury management

Cash flow

Cash flows from our operations are largely stable over a period

of years, but they do depend on the timing of customer

payments. Our electricity transmission operations are subject to

multi-year price control agreements with the regulator, Ofgem.

Significant changes in volumes, for example as a consequence

of weather conditions, can affect cash inflows in particular, with

abnormally mild or extreme weather driving volumes down or up

respectively. Subject to this, we have essentially stable cash

flows.

Cash flow forecasting

Both short- and long-term cash flow forecasts are produced

frequently to assist in identifying our liquidity requirements.

These forecasts are supplemented by a financial headroom

position, details of which are supplied to the Finance Committee

of the Board of National Grid plc regularly to demonstrate

funding adequacy for at least a 12 month period. We also

maintain a minimum level of committed facilities in support of

that objective.

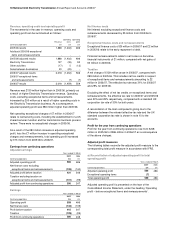

Credit facilities and unutilised Commercial Paper and

Medium Term Note Programmes

We have both committed and uncommitted facilities that are

available for general corporate purposes. At 31 March 2007,

National Grid Electricity Transmission plc had a US$1.0 billion

US Commercial Paper Programme (unutilised) and a

US$1.0 billion Euro Commercial Paper Programme (unutilised);

and National Grid Electricity Transmission plc and National Grid

plc had a joint Euro Medium Term Note Programme of €12

billion (€3.2 billion unissued).

At 31 March 2007, the Company had £450 million of long term

committed facilities (undrawn) and around £500 million of

uncommitted borrowing facilities (undrawn).

Note 24 to the accounts shows the maturity profile of undrawn

committed borrowing facilities in sterling as at 31 March 2007.