National Grid 2007 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2007 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

National Grid Electricity Transmission plc Annual Report and Accounts 2006/07

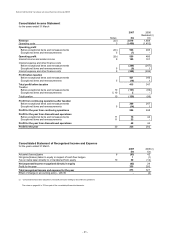

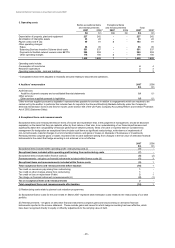

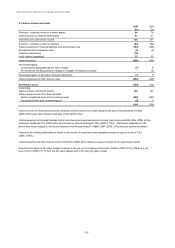

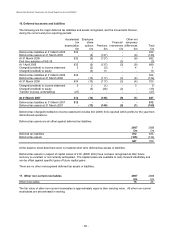

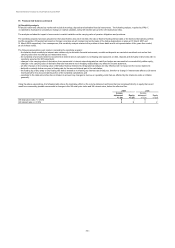

9. Finance income and costs

2007 2006

£m £m

Pensions - expected return on scheme assets 84 76

Interest income on financial instruments 41 31

Interest income and similar income 125 107

Pensions - interest on scheme liabilities (83) (84)

Interest expense on financial liabilities held at amortised cost (193) (196)

Exceptional debt redemption costs (8) (2)

Interest on derivatives (16) -

Less: interest capitalised 32 33

Interest expense (268) (249)

Net (losses)/gains:

On derivatives designated as fair value hedges (1) 6

On derivatives not designated as hedges or ineligible for hedge accounting - (3)

Net (losses)/gains on derivative financial instruments (1) 3

Interest expense and other finance costs (269) (246)

Net finance costs (144) (139)

Comprising:

Interest income and similar income 125 107

Interest expense and other financial costs

Before exceptional items and remeasurements (260) (247)

Exceptional items and remeasurements (9) 1

(144) (139)

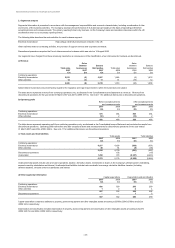

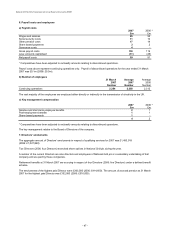

Interest income on financial instruments comprises interest income from bank deposits and other financial assets of £38m

(2006: £27m) and other interest receivable of £3m (2006: £4m).

Interest expense on financial liabilities held at amortised cost comprises interest on bank loans and overdrafts £20m (2006: £21m),

preference dividends £1m (2006: £3m) and interest on other borrowings £172m (2006: £172m). Preference dividends of 2.78

pence have been charged to the income statement for the year ended 31 March 2007 (2006: 5.79 pence per preference share).

Interest on the funding attributable to assets in the course of construction was capitalised during the year at a rate of 5.5%

(2006: 5.85%).

Interest expense and other finance costs include £8m (2006: £2m) relating to losses incurred on the repurchase of debt.

Derivative net gains on fair value hedges comprise a net gain on the hedging instruments of £36m (2006: £17m), offset by a net

loss of £37m (2006: £11m) from the fair value adjustments to the carrying value of debt.

- 50 -