National Grid 2007 Annual Report Download - page 45

Download and view the complete annual report

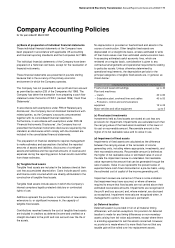

Please find page 45 of the 2007 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. National Grid Electricity Transmission Annual Report and Accounts 2006/07 73

loss account. An equal and opposite amount is recorded as an

adjustment to the carrying value of hedged items, with a

corresponding entry in the profit and loss account, to the extent

that the change is attributable to the risk being hedged and that

the fair value hedge is effective.

Changes in the fair value of derivatives that do not qualify for

hedge accounting are recognised in the profit and loss account

as they arise.

Hedge accounting is discontinued when the hedging instrument

expires or is sold, terminated, or exercised, or no longer

qualifies for hedge accounting. At that time, any cumulative

gains or losses relating to cash flow hedges recognised in

equity are initially retained in equity and subsequently

recognised in the profit and loss account in the same periods in

which the previously hedged item affects net profit or loss. For

fair value hedges, the cumulative adjustment recorded to its

carrying value, at the date hedge accounting is discontinued, is

amortised to the profit and loss account using the effective

interest method.

If a hedged transaction is no longer expected to occur, the net

cumulative gain or loss recognised in equity is transferred to the

profit and loss account immediately.

Derivatives embedded in other financial instruments or other

host contracts are treated as separate derivatives when their

risks and characteristics are not closely related to those of host

contracts.

(m) Share-based payments

National Grid issues equity-settled share-based payments to

certain employees of the Company. Equity-settled share-based

payments are measured at fair value at the date of grant. The

fair value determined at the grant date of the equity-settled

share-based payments, based on an estimate of shares that will

eventually vest, is recognised by the Company on a straight-line

basis over the vesting period, as an operating cost and an

increase in equity and. Payments made by the Company to

National Grid in respect of share-based payments are

recognised as a reduction in equity.

(n) Restructuring costs

Costs arising from the Company’s restructuring programmes

primarily relate to redundancy costs. Redundancy costs are

charged to the profit and loss account in the period in which the

Company becomes irrevocably committed to incurring the costs

and the main features of the restructuring plan have been

announced to affected employees.

(o) Dividends

Dividends are recognised in the financial year in which they are

approved.