National Grid 2007 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2007 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.40 National Grid Electricity Transmission Annual Report and Accounts 2006/07

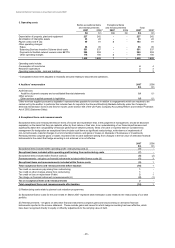

(q) Business performance, exceptional items and

remeasurements

Our financial performance is analysed into two components:

business performance, which excludes exceptional items and

remeasurements; and exceptional items and remeasurements.

Exceptional items and remeasurements are excluded from the

measures of business performance used by management to

monitor financial performance, as they are considered to distort

the comparability of our reported financial performance from

year to year. Business performance measures presented on the

face of the income statement or in the notes to the accounts

include operating profit before exceptional items and

remeasurements, profit before tax before exceptional items and

remeasurements and profit for the year before exceptional

items and remeasurements.

Exceptional items and remeasurements are items of income

and expenditure that, in the judgment of management, should

be disclosed separately on the basis that they are material,

either by their nature or their size, to an understanding of our

financial performance between periods. Items of income or

expense that are considered by management for designation as

exceptional items include such items as significant

restructurings, write-downs or impairments of non-current

assets, material changes in environmental provisions and gains

or losses on disposals of businesses or investments.

Remeasurements comprise gains or losses recorded in the

income statement arising from changes in the fair value of

derivative financial instruments to the extent that hedge

accounting is not achieved or is not effective.

(r) Restructuring costs

Costs arising from restructuring programmes primarily relate to

redundancy costs. Redundancy costs are charged to the

income statement in the year in which an irrevocable

commitment is made to incur the costs and the main features of

the restructuring plan have been announced to affected

employees.

(s) Cash and cash equivalents

Cash and cash equivalents include cash held at bank and in

hand, together with short-term highly liquid investments with an

original maturity of less than three months that are readily

convertible to known amounts of cash and subject to an

insignificant change in value.

(t) Dividends

Dividends are recognised in the financial year in which they are

approved.

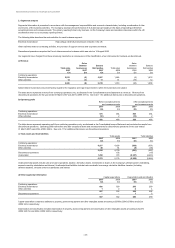

(u) Key sources of estimation uncertainty

The preparation of financial statements requires management

to make estimates and assumptions that affect the reported

amounts of assets and liabilities, disclosures of contingent

assets and liabilities and the reported amounts of revenue and

expenses during the reporting period. Actual results could differ

from these estimates. Information about such judgements and

estimation is contained in the accounting policies and/or the

notes to the accounts, and the key areas are summarised

below.

Areas of judgement that have the most significant effect on the

amounts recognised in the financial statements:

1 The categorisation of certain items as exceptional and the

definition of adjusted earnings – note 5.

1 The exemptions adopted under IFRS including, in particular,

those relating to business combinations – Accounting

policies (a) Basis of preparation of consolidated financial

statements.

1 Classification of business activities as held for sale and

discontinued operations – Accounting Policies (h)

Discontinued operations, assets and businesses held for

sale.

Key sources of estimation uncertainty that have a significant

risk of causing a material adjustment to the carrying amounts of

assets and liabilities within the next financial year:

1 Review of residual lives, carrying values and impairment

charges for other intangible assets and property, plant and

equipment – Accounting policies (d) Intangible assets other

than goodwill, (e) Property, plant and equipment and (f)

Impairment of assets.

1 Estimation of liabilities for pensions – note 8.

1 Valuation of financial instruments and derivatives – note 18.

1 Revenue recognition and assessment of unbilled revenue –

Accounting policies (k) Revenue.

1 Recoverability of deferred tax assets – Accounting policies

(g) Taxation and note 16.

1 Environmental liabilities – note 27.

1 Hedge accounting and derivative financial instruments –

Accounting Polices (o) Hedge accounting and derivative

financial instruments.