National Grid 2007 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2007 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

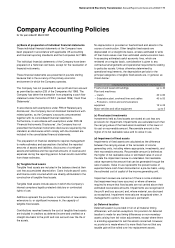

National Grid Electricity Transmission plc Annual Report and Accounts 2006/07

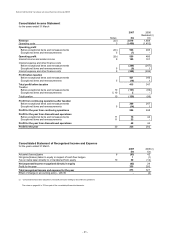

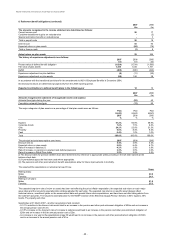

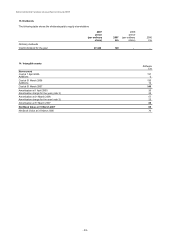

8. Retirement benefit obligations

2007

2006

£m

£m

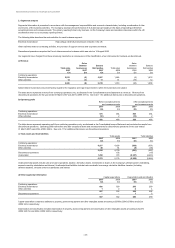

The amounts recognised in the balance sheet are determined as follows:

Present value of funded obligations

(1,812)

(1,711)

Fair value of plan assets

1,336

1,334

(476)

(377)

Present value of unfunded obligations

(12)

(13)

Net Liability in the balance sheet

(488)

(390)

2007

2006

£m

£m

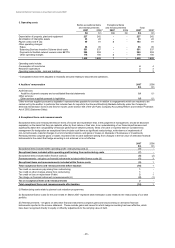

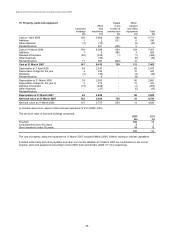

Changes in the present value of the defined benefit obligation:

Opening defined benefit obligation 1,724 1,583

Current service cost

20

17

Interest cost

83

84

Actuarial losses

67

125

Losses on curtailments 32

Losses on settlements

-

-

Employee contributions

6

6

Benefits paid

(81)

(78)

Net transfers out

1

(7)

Other augmentations 1-

Net decrease in liabilities from disposals

-

(8)

Closing defined benefit obligation

1,824

1,724

Changes in the fair value of plan assets:

Opening fair value of plan assets

1,334

1,161

Expected return on plan assets

84

76

Actuarial (losses)/gains

(26)

168

Employer contributions

18

15

Employee contributions

6

6

Benefits paid

(81)

(78)

Net transfers out/(in)

1

(7)

Net decrease in assets from disposals

-

(7)

Closing fair value of plan assets

1,336

1,334

- 48 -

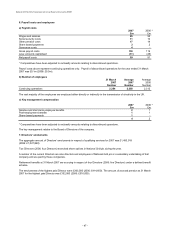

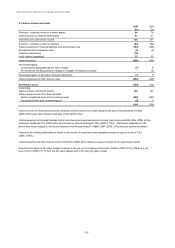

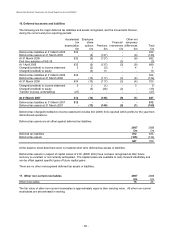

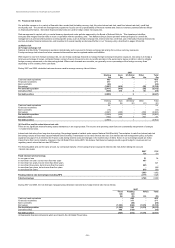

Substantially all of the Group's employees are members of the Electricity Supply Pension Scheme which is a defined

benefit pension scheme.

The Electricity Supply Pension Scheme provides final salary defined benefits on a funded basis. The assets of the scheme

are held in a separate trustee administered fund. The scheme is divided into sections, one of which is the National Grid

Electricity Tranmission's section. The Group's section of the scheme was closed to new entrants on 1 April 2006. It is

subject to independent valuations at least every three years, on the basis of which the qualified actuary certifies the rate of

employers' contributions, which, together with the specified contributions payable by the employees and proceeds from the

scheme's assets, are expected to be sufficient to fund the benefits payable under the scheme.

The latest full actuarial valuation as at 31 March 2007 is currently being carried out by Hewitt Bacon and Woodrow. The last

completed full actuarial valuation was carried out by Hewitt Bacon and Woodrow at 31 March 2004. The aggregate market

value of the scheme's assets as at that date was £1,110m and the value of the assets represented 80% of the actuarial

value of benefits due to members calculated on the basis of pensionable earnings and service at 31 March 2004 on an

ongoing basis and allowing for projected increases in pensionable earnings.

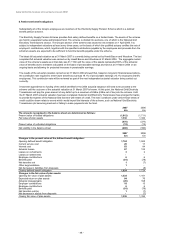

The results of the actuarial valuation carried out at 31 March 2004 showed that, based on long-term financial assumptions,

the contribution rate required to meet future benefit accrual was 19.1% of pensionable earnings (13.1% employers and 6%

employees). This contribution rate will be reviewed as part of the next independent actuarial valuation being carried out

currently.

It has been agreed that no funding of the deficit identified in the 2004 actuarial valuation will need to be provided to the

scheme until the outcome of the actuarial valuation at 31 March 2007 is known. At this point, the National Grid Electricity

Transmission will pay the gross amount of any deficit up to a maximum of £68m (£48m net of tax) into the scheme. Until

the 31 March 2007 actuarial valuation has been completed, National Grid Electricity Transmission has arranged for banks

to provide the trustees of the National Grid Scheme with letters of credit. The main conditions under which these letters of

credit could be drawn relate to events which would imperil the interests of the scheme, such as National Grid Electricity

Transmission plc becoming insolvent or failing to make payments into the fund.