Macy's 2009 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2009 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

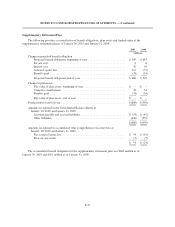

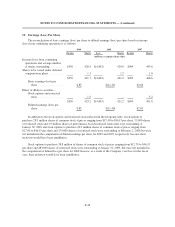

The fair value of stock-based awards granted during 2009, 2008 and 2007 and the weighted average

assumptions used to estimate the fair value of stock options are as follows:

2009 2008 2007

Weighted average grant date fair value of stock options granted

during the period ........................................... $ 2.51 $ 7.42 $ 16.64

Weighted average grant date fair value of restricted stock granted

during the period ........................................... $ – $ 24.85 $ 44.10

Dividend yield ............................................... 2.3% 2.2% 1.2%

Expected volatility ............................................ 36.4% 36.2% 36.9%

Risk-free interest rate ......................................... 1.9% 2.7% 4.6%

Expected life ................................................ 5.4years 5.3 years 5.3 years

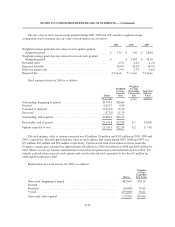

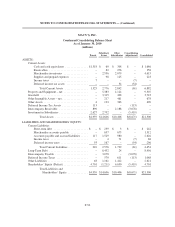

Stock option activity for 2009 is as follows:

Shares

Weighted

Average

Exercise

Price

Weighted

Average

Remaining

Contractual

Life

Aggregate

Intrinsic

Value

(thousands) (years) (millions)

Outstanding, beginning of period .......................... 38,794.4 $28.64

Granted .............................................. 6,091.7 8.80

Canceled or forfeited .................................... (5,554.2) 30.24

Exercised ............................................. (527.0) 15.79

Outstanding, end of period ............................... 38,804.9 $25.47

Exercisable, end of period ................................ 25,474.8 $27.08 4.1 $(284)

Options expected to vest ................................. 11,730.5 $22.39 8.2 $ (76)

The total intrinsic value of options exercised was $2 million, $1 million and $145 million in 2009, 2008 and

2007, respectively. The total grant-date fair value of stock options that vested during 2009, 2008 and 2007 was

$71 million, $65 million and $54 million, respectively. Cash received from stock option exercises under the

Company’s equity plan amounted to approximately $8 million for 2009, $6 million for 2008 and $204 million for

2007. There were no tax benefits realized from exercised stock options and vested restricted stock for 2009. Tax

benefits realized from exercised stock options and vested restricted stock amounted to less than $1 million for

2008 and $51 million for 2007.

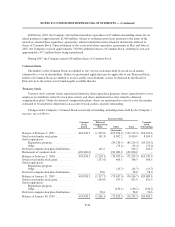

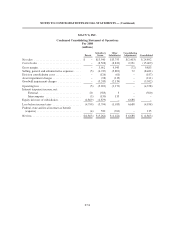

Restricted stock award activity for 2009 is as follows:

Shares

Weighted

Average

Grant Date

Fair Value

Nonvested, beginning of period .................................... 482,864 $34.18

Granted ....................................................... – –

Forfeited ...................................................... (10,000) 35.83

Vested ........................................................ (293,808) 34.44

Nonvested, end of period .......................................... 179,056 $33.66

F-44