Macy's 2009 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2009 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company cannot predict whether, when or the manner in which the economic conditions described

above will change. Based on its assessment of current and anticipated market conditions and its most recent

fourth quarter performance, the Company is assuming that its comparable store sales in 2010 will increase in the

range of 1% to 2% from 2009 levels.

The discussion in this Item 7 should be read in conjunction with our Consolidated Financial Statements and

the related notes included elsewhere in this report. The discussion in this Item 7 contains forward-looking

statements that reflect the Company’s plans, estimates and beliefs. The Company’s actual results could materially

differ from those discussed in these forward-looking statements. Factors that could cause or contribute to those

differences include, but are not limited to, those discussed below and elsewhere in this report, particularly in

“Risk Factors” and “Forward-Looking Statements.”

Results of Operations

Comparison of the 52 Weeks Ended January 30, 2010 and January 31, 2009. Net income for 2009 was $350

million, compared to the net loss of $4,803 million for 2008. The net income for 2009 includes the impact of

$276 million of division consolidation costs and store closing-related costs and $115 million of asset impairment

charges. The net loss for 2008 included the impact of $5,382 million of goodwill impairment charges, $187

million of division consolidation costs and store closing-related costs and $211 million of asset impairment

charges.

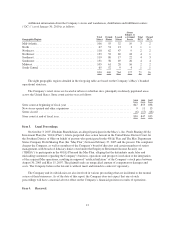

Net sales for 2009 totaled $23,489 million, compared to net sales of $24,892 million for 2008, a decrease of

$1,403 million or 5.6%. On a comparable store basis, net sales for 2009 were down 5.3% compared to 2008.

Sales from the Company’s Internet businesses in 2009 increased 19.6% compared to 2008 and positively affected

the Company’s 2009 comparable store sales by 0.6%. The Company has realized continued success in the My

Macy’s localization strategy. Geographically, sales in 2009 were strong in the Midwest and weaker in Florida

and California. By family of business, sales in 2009 were strongest in moderate apparel, updated better women’s

sportswear, women’s shoes, outerwear, jewelry and watches, housewares, home textiles and mattresses. Sales of

the Company’s private label brands continued to be strong and represented approximately 19% of net sales in the

Macy’s-branded stores in 2009. The weaker businesses during 2009 included traditional better women’s

sportswear, men’s suits, handbags, fragrances, fine china and crystal and furniture. The Company calculates

comparable store sales as net sales from stores in operation throughout 2008 and 2009 and all net Internet sales.

Stores undergoing remodeling, expansion or relocation remain in the comparable store sales calculation unless

the store is closed for a significant period of time. Definitions and calculations of comparable store sales differ

among companies in the retail industry.

Cost of sales was $13,973 million or 59.5% of net sales for 2009, compared to $15,009 million or 60.3% of

net sales for 2008, a decrease of $1,036 million. The improved cost of sales rate reflects the benefit of good

inventory management throughout 2009. The valuation of department store merchandise inventories on the

last-in, first-out basis did not impact cost of sales in either period.

SG&A expenses were $8,062 million or 34.3% of net sales for 2009, compared to $8,481 million or 34.1%

of net sales for 2008, a decrease of $419 million. The SG&A rate as a percent of net sales was higher in 2009, as

compared to 2008, primarily because of weaker sales. SG&A expenses in 2009 benefited from consolidation-

related expense savings, lower depreciation and amortization expenses, lower workers’ compensation and

general liability insurance costs and lower advertising expenses, partially offset by higher stock-based

compensation expenses, higher performance based incentive compensation expense, lower income from credit

operations and higher costs in support of the Company’s multi-channel operations. Depreciation and amortization

expense was $1,210 million for 2009, compared to $1,278 million for 2008. Workers’ compensation and general

liability insurance costs were $124 million for 2009, compared to $164 million for 2008. Stock-based

compensation expense was $76 million for 2009, compared to $43 million for 2008. Pension and supplementary

retirement plan expense amounted to $110 million for 2009, compared to $114 million for 2008. Income from

18