Macy's 2009 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2009 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

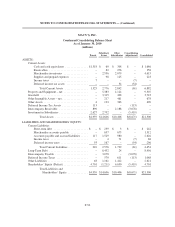

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

MACY’S, INC.

Condensed Consolidating Statement of Cash Flows

For 2007

(millions)

Parent

Subsidiary

Issuer

Other

Subsidiaries

Consolidating

Adjustments Consolidated

Cash flows from continuing operating activities:

Net income ............................. $ 893 $ 265 $1,107 $(1,372) $ 893

Loss from discontinued operations ........... – – – 16 16

May integrations costs .................... – 139 87 (7) 219

Equity in earnings of subsidiaries ............ (752) (620) – 1,372 –

Dividends received from subsidiaries ........ 1,512 210 – (1,722) –

Depreciation and amortization .............. 1 701 602 – 1,304

(Increase) decrease in working capital ........ 6 (315) 109 (16) (216)

Other, net .............................. 46 898 (948) – (4)

Net cash provided by continuing operating

activities ......................... 1,706 1,278 957 (1,729) 2,212

Cash flows from continuing investing activities:

Purchase of property and equipment and

capitalized software, net ................. – (370) (492) 7 (855)

Proceeds from the disposition of discontinued

operations ............................ 66 – – – 66

Other, net .............................. – – 29 – 29

Net cash provided (used) by continuing

investing activities ................. 66 (370) (463) 7 (760)

Cash flows from continuing financing activities:

Debt issued, net of debt repaid .............. – 1,303 (2) – 1,301

Dividends paid .......................... (230) (1,000) (722) 1,722 (230)

Acquisition of common stock, net of common

stock issued ........................... (3,065) – – – (3,065)

Intercompany activity, net ................. 922 (1,163) 240 1 –

Other, net .............................. (32) (46) 2 1 (75)

Net cash used by continuing financing

activities ......................... (2,405) (906) (482) 1,724 (2,069)

Net cash provided (used) by continuing

operations ................................ (633) 2 12 2 (617)

Net cash used by discontinued operations ......... – – – (1) (1)

Net increase (decrease) in cash and cash

equivalents ............................... (633) 2 12 1 (618)

Cash and cash equivalents at beginning of period . . . 968 73 254 (1) 1,294

Cash and cash equivalents at end of period ........ $ 335 $ 75 $ 266 $ – $ 676

F-57