Macy's 2009 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2009 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

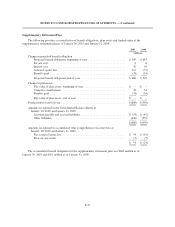

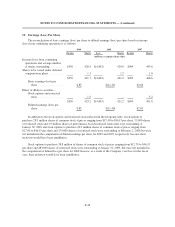

The following benefit payments are estimated to be funded by the Company and paid from the accumulated

postretirement benefit obligations:

(millions)

Fiscal year:

2010 ......................................................... $ 29

2011 ......................................................... 29

2012 ......................................................... 28

2013 ......................................................... 27

2014 ......................................................... 26

2015-2019 ..................................................... 112

The estimated benefit payments reflect estimated federal subsidies expected to be received under the

Medicare Prescription Drug, Improvement and Modernization Act of 2003 of $2 million in each of 2010, 2011,

2012 and 2013, $1 million in 2014 and $6 million for the period 2015 to 2019.

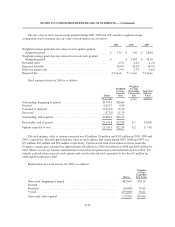

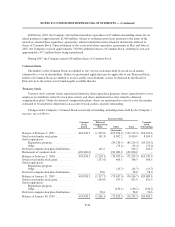

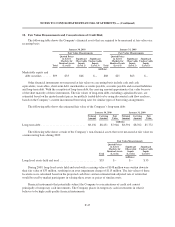

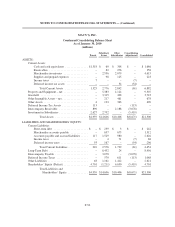

16. Stock Based Compensation

During 2009, the Company obtained shareholder approval for the Macy’s 2009 Omnibus Incentive

Compensation Plan under which up to fifty-one million shares of Common Stock may be issued. This plan is

intended to help the Company attract and retain directors, officers, other key executives and employees and is

also intended to provide incentives and rewards relating to the Company’s business plans to encourage such

persons to devote themselves to the business of the Company. Prior to 2009, the Company had two equity

plans. As of the date of the Merger, the Company assumed May’s equity plan, which was subsequently amended

to have identical terms and provisions of the Company’s other equity plan. At the date of the Merger, all

outstanding May options under May’s equity plan were fully vested and were converted into options to acquire

common stock of the Company in accordance with the Merger agreement. The following disclosures present the

Company’s equity plans prior to 2009 on a combined basis. The equity plan is administered by the Compensation

and Management Development Committee of the Board of Directors (the “CMD Committee”). The CMD

Committee is authorized to grant options, stock appreciation rights, restricted stock and restricted stock units to

officers and key employees of the Company and its subsidiaries and to non-employee directors. Stock option

grants have an exercise price at least equal to the market value of the underlying common stock on the date of

grant, have ten-year terms and typically vest ratably over four years of continued employment.

The Company also has a stock credit plan. Beginning in 2004, key management personnel became eligible

to earn a stock credit grant over a two-year performance period ended January 28, 2006. In general, each stock

credit is intended to represent the right to receive the value associated with one share of the Company’s common

stock, including dividends paid on shares of the Company’s common stock during the period from the end of the

performance period until such stock credit is settled in cash. The total remaining stock credit awards outstanding

as of January 31, 2009, including reinvested dividend equivalents earned during the holding period, relating to

the 2004 grant was paid in cash in early 2009. In 2006, key management personnel became eligible to earn a

stock credit grant over a two-year performance period ending February 2, 2008. There were a total of 1,451,889

stock credit awards outstanding as of January 30, 2010, including reinvested dividend equivalents earned during

the holding period, relating to the 2006 grant. In general, with respect to the stock credits awarded to participants

in 2006, the value of one-half of the stock credits earned plus reinvested dividend equivalents was paid in cash in

early 2010 and the value of the other half of such earned stock credits plus reinvested dividend equivalents will

be paid in cash in early 2011. In 2008, key management personnel became eligible to earn a stock credit grant

over a two-year performance period ending January 30, 2010. There were a total of 1,815,466 stock credit awards

F-42