Macy's 2009 Annual Report Download - page 23

Download and view the complete annual report

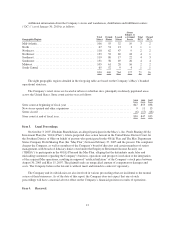

Please find page 23 of the 2009 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(“SG&A”) expenses, as compared to expected levels absent the consolidations. The savings from the division

consolidation process announced in February 2008, net of the amount to be invested in the My Macy’s

localization initiative, are expected to reduce SG&A expenses, as compared to expected levels absent the

consolidation, by approximately $100 million per year. The partial year benefit in SG&A expenses for 2008 was

more than $60 million. The savings from the division consolidation process announced in February 2009, net of

the amount to be invested in the My Macy’s localization expansion, are expected to reduce SG&A expenses, as

compared to expected levels absent the consolidation, by approximately $400 million per year, beginning in

2010. The total benefit to SG&A expenses for 2009 from the division consolidation processes announced in 2008

and 2009 was more than $350 million.

During 2008, the Company incurred approximately $146 million of costs and expenses associated with the

division consolidations announced in February 2008 and approximately $30 million of costs and expenses

associated with the division consolidations announced in February 2009, consisting primarily of severance and

other human resource-related costs. During 2009, the Company incurred approximately $270 million of costs and

expenses associated with the division consolidations announced in February 2009, consisting primarily of

severance and other human resource-related costs.

During January 2010, the Company announced plans to launch a new Bloomingdale’s Outlet store concept

in 2010, consisting of four Bloomingdale’s Outlet stores, each with approximately 25,000 square feet, to open

prior to the Christmas season of 2010. Additional Bloomingdale’s Outlet stores are expected to roll out to

selected locations across the country in 2011 and beyond. Bloomingdale’s Outlet stores will offer a range of

apparel and accessories, including women’s ready-to-wear, men’s children’s, women’s shoes, fashion

accessories, jewelry, handbags and intimate apparel.

Additionally, in February 2010, Bloomingdale’s opened in Dubai, United Arab Emirates under a license

agreement with Al Tayer Insignia, a company of Al Tayer Group, LLC.

The Company’s operations are impacted by competitive pressures from department stores, specialty stores,

mass merchandisers and all other retail channels. The Company’s operations are also impacted by general

consumer spending levels, including the impact of general economic conditions, consumer disposable income

levels, consumer confidence levels, the availability, cost and level of consumer debt, the costs of basic necessities

and other goods and the effects of weather or natural disasters and other factors over which the Company has

little or no control.

In recent periods, consumer spending levels have been adversely affected by a number of factors, including

substantial declines in the level of general economic activity and real estate and investment values, substantial

increases in consumer pessimism, unemployment and the costs of basic necessities, and a significant tightening

of consumer credit. These conditions adversely affected, and to varying degrees continue to adversely affect, the

amount of funds that consumers are willing and able to spend for discretionary purchases, including purchases of

some of the merchandise offered by the Company. These conditions also adversely affected the projected future

cash flows attributable to the Company’s operations, including the projected future cash flows assumed in

connection with the acquisition of May, resulting in the Company recording in the fourth quarter of 2008 a

reduction in the carrying value of its goodwill, and a related non-cash impairment charge, in the amount of

$5,382 million.

The effects of the factors and conditions described above have been, and may continue to be experienced

differently, or at different times, in the various geographic regions in which the Company operates, in relation to

the different types of merchandise that the Company offers for sale, or in relation to the Company’s Macy’s-

branded and Bloomingdale’s-branded operations. All of these effects, however, ultimately affect the Company’s

overall operations.

17