Macy's 2009 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2009 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

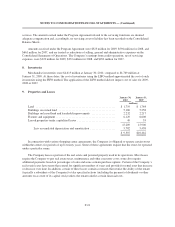

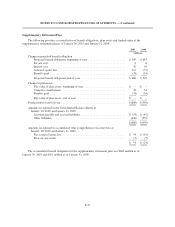

The following summarizes certain components of the Company’s debt:

Bank Credit Agreement

The Company is a party to a credit agreement with certain financial institutions providing for revolving

credit borrowings and letters of credit in an aggregate amount not to exceed $2,000 million (which amount may

be increased to $2,500 million at the option of the Company, subject to the willingness of existing or new lenders

to provide commitments for such additional financing) outstanding at any particular time. This credit agreement

is set to expire August 30, 2012.

As of January 30, 2010, and January 31, 2009, there were no revolving credit loans outstanding under the

credit agreement. However, there were $52 million and $48 million of standby letters of credit outstanding at

January 30, 2010, and January 31, 2009, respectively. There were no borrowings under this agreement during

2009. The amount of borrowings under this agreement, net of invested cash and cash equivalent balances by

Macy’s, Inc. (“Parent”), increased to its highest level for 2008 of $163 million on November 28, 2008. Revolving

loans under the credit agreement bear interest based on various published rates.

This agreement, which is an obligation of a wholly-owned subsidiary of Macy’s, Inc., is not secured.

However, Parent and each direct and indirect subsidiary of such wholly owned subsidiary of Macy’s, Inc. has

fully and unconditionally guaranteed this obligation, subject to specified limitations.

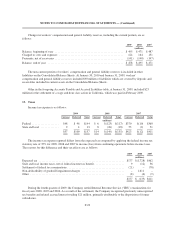

The Company’s interest coverage ratio for 2009 was 4.54 and its leverage ratio at January 30, 2010 was

3.15, in each case as calculated in accordance with the credit agreement. The credit agreement requires the

Company to maintain a specified interest coverage ratio for the latest four quarters of no less than 3.00 (3.25 after

October 2010) and a specified leverage ratio as of and for the latest four quarters of no more than 4.75 (4.50 after

October 2010 and 4.90 prior to October 2009). The interest coverage ratio is defined as EBITDA (earnings

before interest, taxes, depreciation and amortization) over net interest expense and the leverage ratio is defined as

debt over EBITDA. For purposes of these calculations EBITDA is calculated as net income plus interest expense,

taxes, depreciation, amortization, non-cash impairment of goodwill, intangibles and real estate, non-recurring

cash charges not to exceed in the aggregate $500 million from the date of the amended agreement and

extraordinary losses less interest income and non-recurring or extraordinary gains. Debt and net interest are

adjusted to exclude the premium on acquired debt and the resulting amortization, respectively.

A breach of a restrictive covenant in the Company’s credit agreement or the inability of the Company to

maintain the financial ratios described above could result in an event of default under the credit agreement. In

addition, an event of default would occur under the credit agreement if any indebtedness of the Company in

excess of an aggregate principal amount of $150 million becomes due prior to its stated maturity or the holders of

such indebtedness become able to cause it to become due prior to its stated maturity. Upon the occurrence of an

event of default, the lenders could, subject to the terms and conditions of the credit agreement, elect to declare

the outstanding principal, together with accrued interest, to be immediately due and payable. Moreover, most of

the Company’s senior notes and debentures contain cross-default provisions based on the non-payment at

maturity, or other default after an applicable grace period, of any other debt, the unpaid principal amount of

which is not less than $100 million, that could be triggered by an event of default under the credit agreement. In

such an event, the Company’s senior notes and debentures that contain cross-default provisions would also be

subject to acceleration.

Commercial Paper

The Company is a party to a $2,000 million unsecured commercial paper program. The Company may issue

and sell commercial paper in an aggregate amount outstanding at any particular time not to exceed its then-

F-27