Macy's 2009 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2009 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

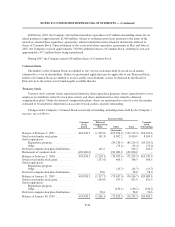

outstanding as of January 30, 2010, relating to the 2008 grant. In general, with respect to the stock credits

awarded to participants in 2008, the value of one-half of the stock credits earned plus reinvested dividend

equivalents will be paid in cash in early 2012 and the value of the other half of such earned stock credits plus

reinvested dividend equivalents will be paid in cash in early 2013. Compensation expense for stock credit awards

is recorded on a straight-line basis primarily over the vesting period and is calculated based on the ending stock

price for each reporting period. At January 30, 2010 and January 31, 2009, the liabilities under the stock credit

plans, which is reflected in other liabilities on the Consolidated Balance Sheets, was $45 million and $23 million,

respectively.

During 2009, the CMD Committee approved awards of performance-based restricted stock units to certain

senior executives of the Company (the “Founders Awards”). The Founders Awards may be earned upon the

completion of a three-year performance period ending January 28, 2012. Whether units are earned at the end of

the performance period will be determined based on the achievement of relative total shareholder return (“TSR”)

performance objectives set by the CMD Committee in connection with the issuance of the units. Relative TSR

reflects the change in the value of the Company’s common stock over the performance period in relation to the

change in the value of the common stock of a ten-company executive compensation peer group over the

performance period, assuming the reinvestment of dividends. If the Company’s TSR for the performance period

is equal to or less than the median TSR for the peer group, the entire Founders Award opportunity will be

forfeited. If the Company’s TSR for the performance period is above the median but equal to or below the 66th

percentile for the peer group, 75% of the award opportunity will vest. If the Company’s TSR for the performance

period is above the 66th percentile for the peer group, 100% of the award opportunity will vest.

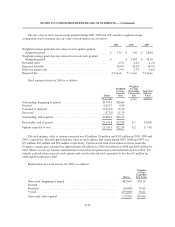

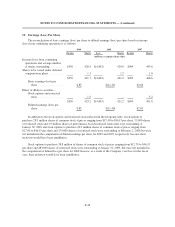

During 2009, the Company recorded approximately $43 million of stock-based compensation expense for

stock options, approximately $26 million of stock-based compensation expense for stock credits, approximately

$3 million of stock-based compensation expense for restricted stock and approximately $4 million of stock-based

compensation expense for performance-based restricted stock units. During 2008, the Company recorded

approximately $55 million of stock-based compensation expense for stock options and approximately $6 million

of stock-based compensation expense for restricted stock. Also during 2008, the Company recorded a credit of

approximately $18 million related to stock credits, reflecting a decrease in the stock price used to calculate

settlement amounts. During 2007, the Company recorded approximately $63 million of stock-based

compensation expense for stock options and approximately $4 million of stock-based compensation expense for

restricted stock. Also during 2007, the Company recorded a credit of approximately $7 million related to stock

credits, reflecting a decrease in the stock price used to calculate settlement amounts. All stock-based

compensation expense is recorded in selling, general and administrative expense in the Consolidated Statements

of Operations. The income tax benefit recognized in the Consolidated Statements of Operations related to stock-

based compensation was approximately $28 million, approximately $16 million, and approximately $22 million,

for 2009, 2008 and 2007, respectively.

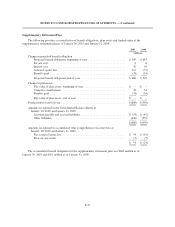

The fair value of each stock option grant is estimated on the date of grant using the Black-Scholes option-

pricing model. The Company estimates the expected volatility and expected option life assumption consistent

with ASC Topic 718, “Compensation – Stock Compensation.” The expected volatility of the Company’s

common stock at the date of grant is estimated based on a historic volatility rate and the expected option life is

calculated based on historical stock option experience as the best estimate of future exercise patterns. The

dividend yield assumption is based on historical and anticipated dividend payouts. The risk-free interest rate

assumption is based on observed interest rates consistent with the expected life of each stock option grant. The

Company uses historical data to estimate pre-vesting option forfeitures and records stock-based compensation

expense only for those awards that are expected to vest. For options granted, the Company recognizes the fair

value on a straight-line basis primarily over the vesting period of the options.

F-43