Macy's 2009 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2009 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

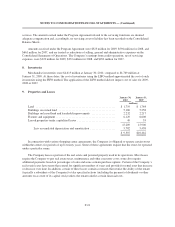

Interest expense is as follows:

2009 2008 2007

(millions)

Interest on debt ............................................................ $587 $621 $617

Amortization of debt premium ................................................ (33) (34) (37)

Amortization of financing costs ............................................... 10 7 6

Interest on capitalized leases ..................................................354

567 599 590

Less interest capitalized on construction ......................................... 5 11 11

$562 $588 $579

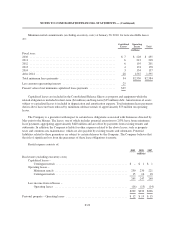

Future maturities of long-term debt, other than capitalized leases and premium on acquired debt, are shown

below:

(millions)

Fiscal year:

2011 ......................................................... $ 662

2012 ......................................................... 1,663

2013 ......................................................... 138

2014 ......................................................... 508

2015 ......................................................... 756

After 2015 ..................................................... 4,429

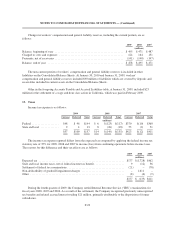

Between January 30, 2010 and the date of this report, consistent with its strategy to reduce its indebtedness,

the Company has used approximately $526 million of cash to repurchase approximately $500 million of

indebtedness prior to its maturity. In connection with these repurchases, the Company has recognized additional

interest expense of approximately $27 million due to the expenses associated with the early retirement of this

debt.

The rate of interest payable in respect of $650 million in aggregate principal amount of the Company’s

senior notes outstanding at January 30, 2010 was increased by one percent per annum to 8.875% in April 2009 as

a result of a downgrade of the notes by specified rating agencies. The rate of interest payable in respect of these

senior notes outstanding at January 30, 2010 could increase or decrease by up to one percent per annum from its

current level in the event of one or more downgrades or upgrades of the notes by specified rating agencies.

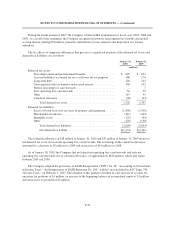

On February 10, 2009, the Company, through its wholly owned subsidiary, Macy’s Retail Holdings, Inc.,

completed a cash tender offer pursuant to which it purchased approximately $199 million of its outstanding

6.30% Senior Notes due April 1, 2009 (resulting in approximately $151 million of such notes remaining

outstanding until they were paid at maturity on April 1, 2009) and approximately $481 million of its outstanding

4.80% Senior Notes due July 15, 2009 (resulting in approximately $119 million of such notes remaining

outstanding until they were paid at maturity on July 15, 2009) for aggregate consideration, including accrued and

unpaid interest, of approximately $686 million. By using cash on hand to repurchase and retire this debt early,

the Company has reduced its interest expense in 2009 by approximately $7 million, net of expenses associated

with the debt tender offer.

On June 23, 2008, the Company issued $650 million aggregate principal amount of 7.875% senior notes due

2015. The net proceeds of the debt issuance were used for the repayment of amounts due on debt maturing in

2008.

F-26