Macy's 2009 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2009 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

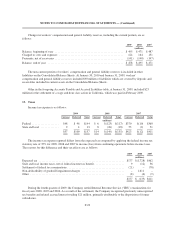

The fair values of the Pension Plan assets as of January 30, 2010, excluding interest and dividend

receivables and pending investment purchases and sales, by asset category are as follows:

Fair Value Measurements

Total

Quoted Prices in

Active Markets for

Identical Assets

(Level 1)

Significant

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

(millions)

Cash and cash equivalents .......................... $ 184 $ – $ 184 $ –

Equity securities:

U.S ........................................ 613 163 450 –

International ................................. 262 – 262 –

Fixed income securities:

U. S. Treasury bonds .......................... 41 – 41 –

Other Government bonds ....................... 11 – 11 –

Agency backed bonds ......................... 15 – 15 –

Corporate bonds .............................. 91 – 91 –

Mortgage-backed securities ..................... 91 – 91 –

Asset-backed securities ........................ 20 – 20 –

Pooled funds ................................. 164 – 164 –

Other types of investments:

Real estate .................................. 156 – – 156

Hedge funds ................................. 133 – – 133

Private equity ................................ 124 – – 124

Total ........................................... $1,905 $163 $1,329 $413

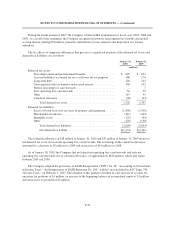

Corporate bonds consist primarily of investment grade bonds of U.S. issuers from diverse industries.

The fair value of the real estate, hedge funds and private equity investments represents the reported net asset

value of shares or underlying assets of the investment. Private equity and real estate investments are valued using

fair values per the most recent financial reports provided by the investment sponsor, adjusted as appropriate for

any lag between the date of the financial reports and January 30, 2010. The real estate investments are diversified

across property types and geographical areas primarily in the United States of America. Private equity

investments generally invest in limited partnerships in the United States of America and Europe. The hedge fund

investments are through a fund of funds approach.

Due to the nature of the underlying assets of the real estate, hedge funds and private equity investments,

changes in market conditions and the economic environment may significantly impact the net asset value of these

investments and, consequently, the fair value of the Pension Plan’s investments. These investments are

redeemable at net asset value to the extent provided in the documentation governing the investments. However,

these redemption rights may be restricted in accordance with the governing documents. Redemption of these

investments is subject to restrictions including lock-up periods where no redemptions are allowed, restrictions on

redemption frequency and advance notice periods for redemptions. As of January 30, 2010, certain of these

investments are generally subject to lock-up periods, ranging from four to ten years, certain of these investments

are subject to restrictions on redemption frequency, ranging from daily to twice per year, and certain of these

investments are subject to advance notice requirements, ranging from sixty-day notification to ninety-day

notification. As of January 30, 2010, the Pension Plan had unfunded commitments related to certain of these

investments totaling approximately $78 million.

F-35