Macy's 2009 Annual Report Download - page 26

Download and view the complete annual report

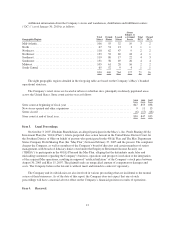

Please find page 26 of the 2009 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.from the Company’s Internet businesses in 2008 increased 29.0% compared to 2007 and positively affected the

Company’s 2008 comparable store sales by 0.8%. Sales of the Company’s private label brands represented

approximately 19% of net sales in the Macy’s-branded stores in both 2008 and 2007. By family of business, sales

in 2008 were strongest in young men’s apparel, shoes and housewares. The weaker businesses during 2008 were

women’s apparel and furniture. The Company calculates comparable store sales as net sales from stores in

operation throughout 2007 and 2008 and all net Internet sales. Stores undergoing remodeling, expansion or

relocation remain in the comparable store sales calculation unless the store is closed for a significant period of

time. Definitions and calculations of comparable store sales differ among companies in the retail industry.

Cost of sales was $15,009 million or 60.3% of net sales for 2008, compared to $15,677 million or 59.6% of

net sales for 2007, a decrease of $668 million. The cost of sales rate for 2008 as a percent of net sales reflected

the weak sales trend and resulted in increased net markdowns taken to maintain inventories at appropriate levels.

The valuation of department store merchandise inventories on the last-in, first-out basis did not impact cost of

sales in either period.

SG&A expenses were $8,481 million or 34.1% of net sales for 2008, compared to $8,554 million or 32.5%

of net sales for 2007, a decrease of $73 million. The SG&A rate as a percent of net sales was higher in 2008, as

compared to 2007, primarily because of weaker sales. SG&A expenses in 2008 benefited from consolidation-

related expense savings, lower selling-related costs, lower depreciation and amortization expenses, lower stock-

based compensation expenses and lower pension and supplementary retirement plan expenses, partially offset by

lower income from credit operations, higher logistics related costs in support of the Company’s multi-channel

operations and higher advertising expenses. Depreciation and amortization expense was $1,278 million for 2008,

compared to $1,304 million for 2007. Stock-based compensation expense was $43 million for 2008, compared to

$60 million for 2007. Pension and supplementary retirement plan expense amounted to $114 million for 2008,

compared to $132 million for 2007. Income from credit operations was $372 million in 2008 as compared to

$450 million in 2007. Advertising expense, net of cooperative advertising allowances, was $1,239 million for

2008 compared to $1,194 million for 2007.

Division consolidation costs and store closing-related costs for 2008 amounted to $187 million and included

$146 million of costs and expenses associated with the division consolidation and localization initiatives

announced in February 2008, primarily severance and other human resource-related costs, $30 million of

severance costs in connection with the division consolidation and localization initiatives announced in February

2009, and $11 million of costs and expenses related to the store closings announced in January 2009.

Asset impairment charges for 2008 amounted to $211 million and included $136 million of asset

impairment charges related to properties held and used, of which $40 million related to the store closings

announced in January 2009, $63 million of asset impairment charges associated with acquired indefinite-lived

private brand tradenames and $12 million of asset impairment charges associated with marketable securities.

Goodwill impairment charges for 2008 amounted to $5,382 million, which represented a write down of

goodwill in the amount of the excess of the previous carrying value of goodwill over the implied fair value of

goodwill, as calculated under the two-step goodwill impairment process in accordance with ASC Subtopic

350-20, “Goodwill.”

May integration costs for 2007 amounted to $219 million. Approximately $121 million of these costs related

to impairment charges in connection with store locations and distribution facilities planned to be closed and

disposed of, including $74 million related to nine underperforming stores identified in the fourth quarter of 2007

for closure. The remaining $98 million of May integration costs for 2007 included additional costs related to

closed locations, severance, system conversion costs, impairment charges associated with acquired indefinite-

lived private brand tradenames and costs related to other operational consolidations, partially offset by

approximately $41 million of gains from the sale of previously closed distribution center facilities.

20