Macy's 2009 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2009 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

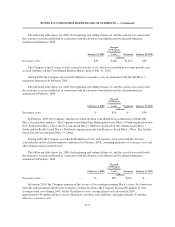

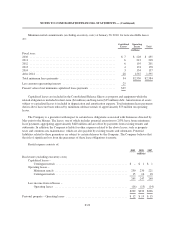

Minimum rental commitments (excluding executory costs) at January 30, 2010, for noncancellable leases

are:

Capitalized

Leases

Operating

Leases Total

(millions)

Fiscal year:

2010 ............................................................ $ 7 $ 228 $ 235

2011 ............................................................ 6 212 218

2012 ............................................................ 6 195 201

2013 ............................................................ 4 174 178

2014 ............................................................ 3 154 157

After 2014 ........................................................ 28 1,567 1,595

Total minimum lease payments ....................................... 54 $2,530 $2,584

Less amount representing interest ..................................... 25

Present value of net minimum capitalized lease payments .................. $29

Capitalized leases are included in the Consolidated Balance Sheets as property and equipment while the

related obligation is included in short-term ($4 million) and long-term ($25 million) debt. Amortization of assets

subject to capitalized leases is included in depreciation and amortization expense. Total minimum lease payments

shown above have not been reduced by minimum sublease rentals of approximately $73 million on operating

leases.

The Company is a guarantor with respect to certain lease obligations associated with businesses divested by

May prior to the Merger. The leases, one of which includes potential extensions to 2070, have future minimum

lease payments aggregating approximately $420 million and are offset by payments from existing tenants and

subtenants. In addition, the Company is liable for other expenses related to the above leases, such as property

taxes and common area maintenance, which are also payable by existing tenants and subtenants. Potential

liabilities related to these guarantees are subject to certain defenses by the Company. The Company believes that

the risk of significant loss from the guarantees of these lease obligations is remote.

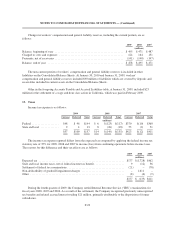

Rental expense consists of:

2009 2008 2007

(millions)

Real estate (excluding executory costs)

Capitalized leases –

Contingent rentals ..................................................$–$1$1

Operating leases –

Minimum rentals ................................................... 230 230 221

Contingent rentals .................................................. 15 16 18

245 247 240

Less income from subleases –

Operating leases ................................................... (16) (15) (14)

$229 $232 $226

Personal property – Operating leases ........................................... $ 12 $ 19 $ 15

F-22