Macy's 2009 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2009 Macy's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

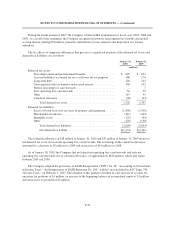

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

11. Financing

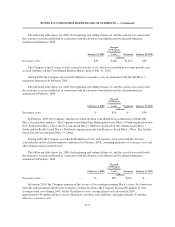

The Company’s debt is as follows:

January 30,

2010

January 31,

2009

(millions)

Short-term debt:

10.625% Senior debentures due 2010 .............................. $ 150 $ –

8.5% Senior notes due 2010 ..................................... 76 –

4.8% Senior notes due 2009 ..................................... – 600

6.3% Senior notes due 2009 ..................................... – 350

Capital lease and current portion of other long-term obligations ......... 16 16

$ 242 $ 966

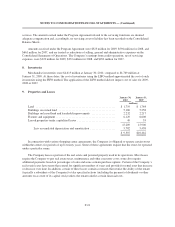

Long-term debt:

5.35% Senior notes due 2012 .................................... $1,100 $1,100

5.9% Senior notes due 2016 ..................................... 1,100 1,100

7.875% Senior notes due 2015 * .................................. 650 650

6.625% Senior notes due 2011 ................................... 500 500

5.75% Senior notes due 2014 .................................... 500 500

6.375% Senior notes due 2037 ................................... 500 500

6.9% Senior debentures due 2029 ................................. 400 400

6.7% Senior debentures due 2034 ................................. 400 400

5.875% Senior notes due 2013 ................................... 350 350

7.45% Senior debentures due 2017 ................................ 300 300

6.65% Senior debentures due 2024 ................................ 300 300

7.0% Senior debentures due 2028 ................................. 300 300

6.9% Senior debentures due 2032 ................................. 250 250

8.0% Senior debentures due 2012 ................................. 200 200

6.7% Senior debentures due 2028 ................................. 200 200

6.79% Senior debentures due 2027 ................................ 165 165

7.45% Senior debentures due 2011 ................................ 150 150

7.625% Senior debentures due 2013 ............................... 125 125

7.45% Senior debentures due 2016 ................................ 125 125

7.875% Senior debentures due 2036 ............................... 108 108

7.5% Senior debentures due 2015 ................................. 100 100

8.125% Senior debentures due 2035 ............................... 76 76

8.75% Senior debentures due 2029 ................................ 61 61

9.5% amortizing debentures due 2021 ............................. 41 44

8.5% Senior debentures due 2019 ................................. 36 36

10.25% Senior debentures due 2021 ............................... 33 33

7.6% Senior debentures due 2025 ................................. 24 24

9.75% amortizing debentures due 2021 ............................ 22 24

7.875% Senior debentures due 2030 ............................... 18 18

10.625% Senior debentures due 2010 .............................. – 150

8.5% Senior notes due 2010 ..................................... – 76

Premium on acquired debt, using an effective

interest yield of 4.854% to 6.165% .............................. 275 308

Capital lease and other long-term obligations ........................ 47 60

$8,456 $8,733

* The rate of interest payable in respect of these senior notes was increased by one percent per annum to 8.875% in

April 2009 as a result of a downgrade of the notes by specified rating agencies. The rate of interest payable in respect

of these senior notes could increase or decrease by up to one percent per annum from its current level in the event of

one or more downgrades or upgrades of the notes by specified rating agencies.

F-25