Honda 2016 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2016 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Q. What are the future directions for

capital expenditure and R&D

expenditure?

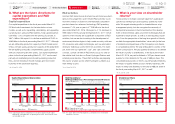

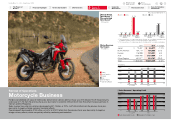

Capital expenditure

Our capital expenditure in the fiscal year ended March 31,

2016 included investments for the introduction of new

models, as well as for expanding, rationalizing, and upgrading

our production, sales and R&D facilities. Total capital expendi-

ture fell by 1.0% compared with the previous fiscal year, to

¥647.4 billion. We expect it to decline an additional 13.5% to

¥560 billion in the fiscal year ending March 31, 2017*. Although

we are still lacking production capacity in North America and

China, we have surplus production capacity at the global level.

We are building a mutually complementary supply system

without constructing any new plants. Our capital expenditure

plans for the fiscal year ending March 31, 2017 are focused

primarily on maintaining and renovating existing production

lines, and on investing in model changes and new model

launches in the automobile business.

* As of June 16, 2016

R&D activities

Honda’s R&D divisions are structured as autonomous subsid-

iaries to encourage free, open-minded R&D activities to pro-

mote the creation of distinctive, internationally competitive

products based on advanced technology. R&D spending

increased 7.4% year on year to ¥719.8 billion in the fiscal

year ended March 31, 2016. We expect a 4.1% decrease to

¥690 billion in the fiscal year ending March 31, 2017*. Devel-

opment of new models are a significant component of R&D

activities, but we are also investing in the development of

environmental technologies to help create a society with zero

CO2 emissions and safety technologies such as automated

driving for realizing a society free from accidents. For exam-

ple, in line with our “generate”, “use”, and “get connected”

concept, our fuel cell vehicle R&D efforts focus not only on

the vehicle itself, but also on Smart Hydrogen Stations and

external power devices. These R&D activities are preparing

the way for a future society where hydrogen is utilized as a

main energy source.

* As of June 16, 2016

Q. What is your view on shareholder

returns?

Honda strives to increase corporate value from a global per-

spective by developing its local business operations world-

wide. We regard returning profits to shareholders as a top

management priority, but also recognize the necessity of

having internal reserves to fund investments in the develop-

ment of environmental, safety, and other technologies that are

essential for future growth, as well as to fund business expan-

sion. From the perspective of the long-term growth of Honda,

we think the appropriate shareholders’ return ratio (in the form

of dividends and repurchases of the Company’s own shares)

to consolidated profit for the year attributable to owners of the

parent is around 30%. We pay quarterly dividends to accelerate

the return of profits to shareholders. In the fiscal year ended

March 31, 2016, we paid a dividend of ¥22 per share in each

quarter, for total dividends for the year of ¥88 per share. The

consolidated payout ratio of 46.0% was temporarily inflated by

the impact of quality related product warranty expenses. We

expect to keep total dividends for the year at ¥88 per share in

the fiscal year ending March 31, 2017 as well*.

* As of June 16, 2016

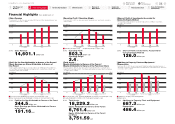

Yen (billions)

Capital Expenditures/Depreciation

Years ended March 31

Capital Expenditures Depreciation

250

500

750

012 13 14 15 16

Note: Capital Expenditure and Depreciation in the above graph exclude Capital

Expenditure and Depreciation in operating lease assets, financial lease assets,

and intangible assets.

Note: This figure differs from R&D expenses as itemized in the consolidated

statement of income.

U.S. GAAP IFRS

Yen (billions) (%)

R&D Expenditure/

R&D Expenditure as a Percentage of Sales Revenues

Years ended March 31

R&D Expenditure (left scale)

R&D Expenditure as a Percentage of Sales Revenues (right scale)

200

600

400

800

0

2

6

4

8

0

12 13 14 15 16

U.S. GAAP IFRS

(Yen)

Dividend per Share

Years ended March 31

25

75

50

100

012 13 14 15 16

* From 2012 to 2013, the above was named “R&D

expenses” and stated in accordance with U.S. GAAP.

Honda Motor Co., Ltd. Annual Report 2016 10

4CFO Interview

Return to last

page opened

Go to

contents page

2Financial Highlights

3To Our Shareholders

5Review of

Operations

6Corporate

Governance

7Financial Section

8Investor Relations

Information

1The Power of

Dreams