Home Depot 2012 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2012 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

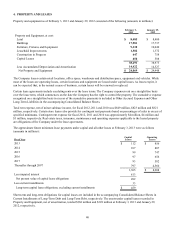

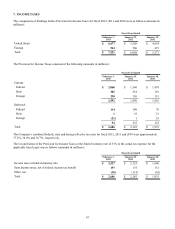

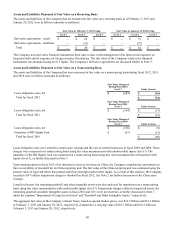

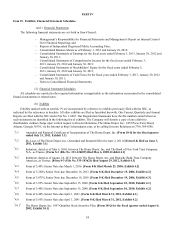

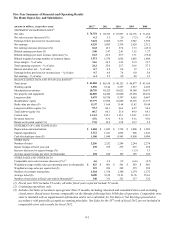

Assets and Liabilities Measured at Fair Value on a Recurring Basis

The assets and liabilities of the Company that are measured at fair value on a recurring basis as of February 3, 2013 and

January 29, 2012 were as follows (amounts in millions):

Fair Value at February 3, 2013 Using Fair Value at January 29, 2012 Using

Level 1 Level 2 Level 3 Level 1 Level 2 Level 3

Derivative agreements - assets $ — $ 64 $ — $ — $ 91 $ —

Derivative agreements - liabilities — (15) — — (27) —

Total $ — $ 49 $ — $ — $ 64 $ —

The Company uses derivative financial instruments from time to time in the management of its interest rate exposure on

long-term debt and its exposure on foreign currency fluctuations. The fair value of the Company’s derivative financial

instruments was measured using level 2 inputs. The Company’s derivative agreements are discussed further in Note 5.

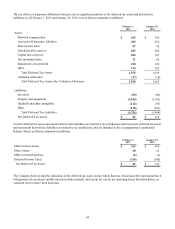

Assets and Liabilities Measured at Fair Value on a Nonrecurring Basis

The assets and liabilities of the Company that were measured at fair value on a nonrecurring basis during fiscal 2012, 2011

and 2010 were as follows (amounts in millions):

Fair Value Measured

During Fiscal 2012

Level 3 Gains (Losses)

Lease obligation costs, net $(137) $ (16)

Total for fiscal 2012 $(16)

Fair Value Measured

During Fiscal 2011

Level 3 Gains (Losses)

Lease obligation costs, net $(144) $ (15)

Total for fiscal 2011 $(15)

Fair Value Measured

During Fiscal 2010

Level 3 Gains (Losses)

Lease obligation costs, net $(158) $ (9)

Guarantee of HD Supply loan $(67)(51)

Total for fiscal 2010 $(60)

Lease obligation costs were related to certain store closings and the exit of certain businesses in fiscal 2009 and 2008. These

charges were measured on a nonrecurring basis using fair value measurements with unobservable inputs (level 3). The

guarantee of the HD Supply loan was measured on a nonrecurring basis using fair value measurements with unobservable

inputs (level 3), as further discussed in Note 3.

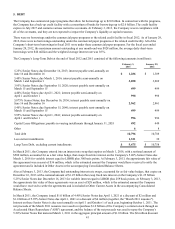

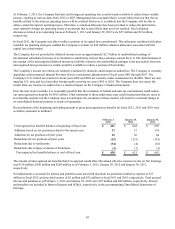

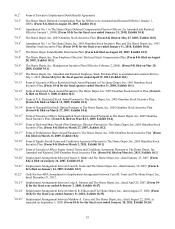

Upon announcement in fiscal 2012 of its intention to close seven stores in China, the Company completed an assessment on

the recoverability of Goodwill for its China reporting unit. The fair value of the China reporting unit was estimated using the

present value of expected future discounted cash flows through unobservable inputs. As a result of this analysis, the Company

recorded a $97 million impairment charge to Goodwill in fiscal 2012. See Note 2 for further discussion of the China store

closings.

Long-lived assets, the remaining goodwill and other intangible assets were also analyzed for impairment on a nonrecurring

basis using fair value measurements with unobservable inputs (level 3). Impairment charges related to long-lived assets, the

remaining goodwill and other intangible assets in fiscal 2012 and 2011 were not material, as further discussed in Note 1

under the captions "Impairment of Long-Lived Assets" and "Goodwill and Other Intangible Assets," respectively.

The aggregate fair value of the Company’s Senior Notes, based on quoted market prices, was $12.2 billion and $12.1 billion

at February 3, 2013 and January 29, 2012, respectively, compared to a carrying value of $10.3 billion and $10.3 billion at

February 3, 2013 and January 29, 2012, respectively.