Home Depot 2012 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2012 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

At February 3, 2013, the Company had state and foreign net operating loss carryforwards available to reduce future taxable

income, expiring at various dates from 2012 to 2029. Management has concluded that it is more likely than not that the tax

benefits related to the state net operating losses will be realized. However, it is unlikely that the Company will be able to

utilize certain foreign net operating losses. Therefore, a valuation allowance has been provided to reduce the deferred tax

asset related to foreign net operating losses to an amount that is more likely than not to be realized. Total valuation

allowances related to net operating losses at February 3, 2013 and January 29, 2012 were $27 million and $19 million,

respectively.

In fiscal 2011, the Company was able to utilize a portion of its capital loss carryforward. This utilization combined with other

available tax planning strategies enabled the Company to release its $45 million valuation allowance associated with the

capital loss carryforward.

The Company has not provided for deferred income taxes on approximately $2.7 billion of undistributed earnings of

international subsidiaries because of its intention to indefinitely reinvest these earnings outside the U.S. The determination of

the amount of the unrecognized deferred income tax liability related to the undistributed earnings is not practicable; however,

unrecognized foreign income tax credits would be available to reduce a portion of this liability.

The Company’s income tax returns are routinely examined by domestic and foreign tax authorities. The Company is currently

appealing certain proposed Internal Revenue Service examination adjustments for fiscal years 2005 through 2007. The

Company's U.S. federal tax returns for fiscal years 2008 and 2009 are currently under examination by the IRS. There are also

ongoing U.S. state and local and other foreign audits covering tax years 2005 to 2010. The Company does not expect the

results from any income tax audit to have a material impact on the Company’s financial statements.

Over the next twelve months, it is reasonably possible that the resolution of federal and state tax examinations could reduce

our unrecognized tax benefits by $105 million. Final settlement of these audit issues may result in payments that are more or

less than this amount, but the Company does not anticipate the resolution of these matters will result in a material change to

its consolidated financial position or results of operations.

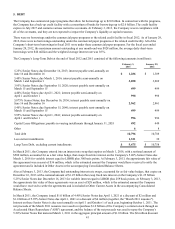

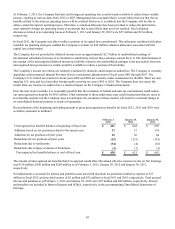

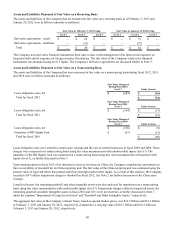

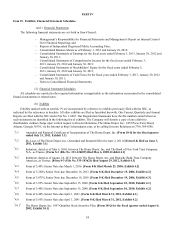

Reconciliations of the beginning and ending amount of gross unrecognized tax benefits for fiscal 2012, 2011 and 2010 were

as follows (amounts in millions):

February 3,

2013 January 29,

2012 January 30,

2011

Unrecognized tax benefits balance at beginning of fiscal year $ 621 $ 662 $ 659

Additions based on tax positions related to the current year 37 37 174

Additions for tax positions of prior years 92 56 84

Reductions for tax positions of prior years (15)(123)(181)

Reductions due to settlements (94)(4)(65)

Reductions due to lapse of statute of limitations (3)(7)(9)

Unrecognized tax benefits balance at end of fiscal year $ 638 $ 621 $ 662

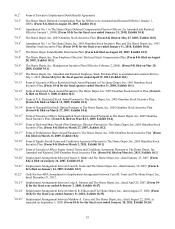

The amount of unrecognized tax benefits that if recognized would affect the annual effective income tax rate on Net Earnings

was $314 million, $246 million and $298 million as of February 3, 2013, January 29, 2012 and January 30, 2011,

respectively.

Net adjustments to accruals for interest and penalties associated with uncertain tax positions resulted in expense of $15

million in fiscal 2012 and provided income of $2 million and $32 million in fiscal 2011 and 2010, respectively. Total accrued

interest and penalties as of February 3, 2013 and January 29, 2012 were $97 million and $80 million, respectively. Interest

and penalties are included in Interest Expense and SG&A, respectively, in the accompanying Consolidated Statements of

Earnings.