Home Depot 2012 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2012 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

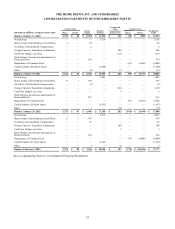

4. PROPERTY AND LEASES

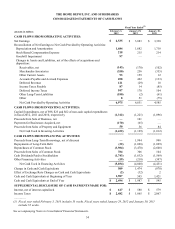

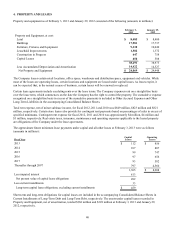

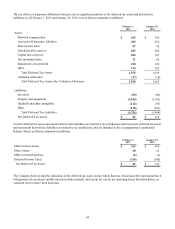

Property and equipment as of February 3, 2013 and January 29, 2012 consisted of the following (amounts in millions):

February 3,

2013 January 29,

2012

Property and Equipment, at cost:

Land $ 8,485 $ 8,480

Buildings 17,981 17,737

Furniture, Fixtures and Equipment 9,338 10,040

Leasehold Improvements 1,382 1,372

Construction in Progress 647 758

Capital Leases 658 588

38,491 38,975

Less Accumulated Depreciation and Amortization 14,422 14,527

Net Property and Equipment $ 24,069 $ 24,448

The Company leases certain retail locations, office space, warehouse and distribution space, equipment and vehicles. While

most of the leases are operating leases, certain locations and equipment are leased under capital leases. As leases expire, it

can be expected that, in the normal course of business, certain leases will be renewed or replaced.

Certain lease agreements include escalating rents over the lease terms. The Company expenses rent on a straight-line basis

over the lease term, which commences on the date the Company has the right to control the property. The cumulative expense

recognized on a straight-line basis in excess of the cumulative payments is included in Other Accrued Expenses and Other

Long-Term Liabilities in the accompanying Consolidated Balance Sheets.

Total rent expense, net of minor sublease income, for fiscal 2012, 2011 and 2010 was $849 million, $823 million and $821

million, respectively. Certain store leases also provide for contingent rent payments based on percentages of sales in excess of

specified minimums. Contingent rent expense for fiscal 2012, 2011 and 2010 was approximately $4 million, $4 million and

$3 million, respectively. Real estate taxes, insurance, maintenance and operating expenses applicable to the leased property

are obligations of the Company under the lease agreements.

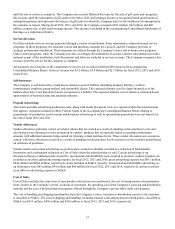

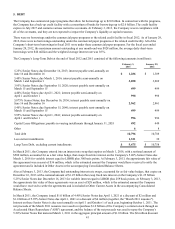

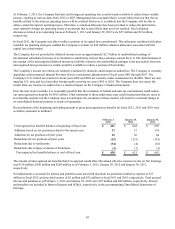

The approximate future minimum lease payments under capital and all other leases at February 3, 2013 were as follows

(amounts in millions):

Fiscal Year Capital

Leases Operating

Leases

2013 $ 112 $ 856

2014 107 807

2015 99 747

2016 97 656

2017 93 582

Thereafter through 2097 797 4,560

1,305 $ 8,208

Less imputed interest 813

Net present value of capital lease obligations 492

Less current installments 33

Long-term capital lease obligations, excluding current installments $ 459

Short-term and long-term obligations for capital leases are included in the accompanying Consolidated Balance Sheets in

Current Installments of Long-Term Debt and Long-Term Debt, respectively. The assets under capital leases recorded in

Property and Equipment, net of amortization, totaled $368 million and $328 million at February 3, 2013 and January 29,

2012, respectively.