Home Depot 2012 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2012 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

operations in Canada and Mexico, and distribution centers, record Merchandise Inventories at the lower of cost or market, as

determined by a cost method. These Merchandise Inventories represent approximately 24% of the total Merchandise

Inventories balance. The Company evaluates the inventory valued using a cost method at the end of each quarter to ensure

that it is carried at the lower of cost or market. The valuation allowance for Merchandise Inventories valued under a cost

method was not material to the Consolidated Financial Statements of the Company as of the end of fiscal 2012 or 2011.

Independent physical inventory counts or cycle counts are taken on a regular basis in each store and distribution center to

ensure that amounts reflected in the accompanying Consolidated Financial Statements for Merchandise Inventories are

properly stated. During the period between physical inventory counts in stores, the Company accrues for estimated losses

related to shrink on a store-by-store basis based on historical shrink results and current trends in the business. Shrink (or in

the case of excess inventory, "swell") is the difference between the recorded amount of inventory and the physical inventory.

Shrink may occur due to theft, loss, inaccurate records for the receipt of inventory or deterioration of goods, among other

things.

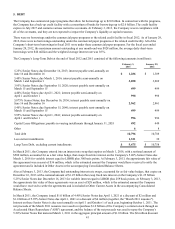

Income Taxes

Income taxes are accounted for under the asset and liability method. The Company provides for federal, state and foreign

income taxes currently payable, as well as for those deferred due to timing differences between reporting income and

expenses for financial statement purposes versus tax purposes. Deferred tax assets and liabilities are recognized for the future

tax consequences attributable to temporary differences between the financial statement carrying amounts of existing assets

and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted income tax rates

expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled.

The effect of a change in income tax rates is recognized as income or expense in the period that includes the enactment date.

The Company recognizes the effect of income tax positions only if those positions are more likely than not of being

sustained. Recognized income tax positions are measured at the largest amount that is greater than 50% likely of being

realized. Changes in recognition or measurement are reflected in the period in which the change in judgment occurs.

The Company and its eligible subsidiaries file a consolidated U.S. federal income tax return. Non-U.S. subsidiaries and

certain U.S. subsidiaries, which are consolidated for financial reporting purposes, are not eligible to be included in the

Company’s consolidated U.S. federal income tax return. Separate provisions for income taxes have been determined for these

entities. The Company intends to reinvest substantially all of the unremitted earnings of its non-U.S. subsidiaries and

postpone their remittance indefinitely. Accordingly, no provision for U.S. income taxes for these non-U.S. subsidiaries was

recorded in the accompanying Consolidated Statements of Earnings.

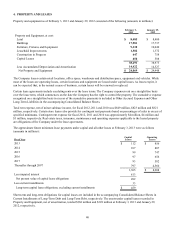

Depreciation and Amortization

The Company’s Buildings, Furniture, Fixtures and Equipment are recorded at cost and depreciated using the straight-line

method over the estimated useful lives of the assets. Leasehold Improvements are amortized using the straight-line method

over the original term of the lease or the useful life of the improvement, whichever is shorter. The Company’s Property and

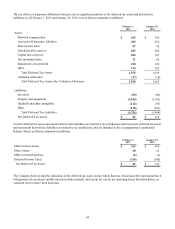

Equipment is depreciated using the following estimated useful lives:

Life

Buildings 5 – 45 years

Furniture, Fixtures and Equipment 2 – 20 years

Leasehold Improvements 5 – 45 years

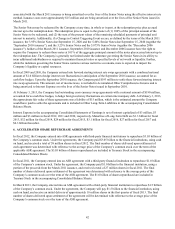

Capitalized Software Costs

The Company capitalizes certain costs related to the acquisition and development of software and amortizes these costs using

the straight-line method over the estimated useful life of the software, which is three to six years. These costs are included in

Furniture, Fixtures and Equipment as discussed further in Note 4. Certain development costs not meeting the criteria for

capitalization are expensed as incurred.

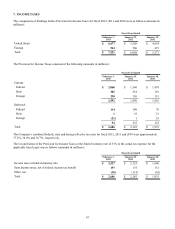

Revenues

The Company recognizes revenue, net of estimated returns and sales tax, at the time the customer takes possession of

merchandise or receives services. The liability for sales returns is estimated based on historical return levels. When the

Company receives payment from customers before the customer has taken possession of the merchandise or the service has

been performed, the amount received is recorded as Deferred Revenue in the accompanying Consolidated Balance Sheets