Home Depot 2012 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2012 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

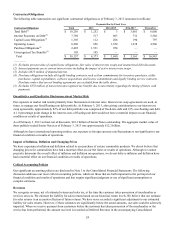

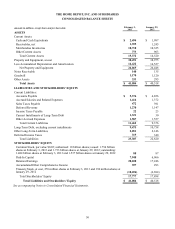

Contractual Obligations

The following table summarizes our significant contractual obligations as of February 3, 2013 (amounts in millions):

Payments Due by Fiscal Year

Contractual Obligations Total 2013 2014-2015 2016-2017 Thereafter

Total Debt(1) $ 10,256 $ 1,252 $ 3 $ 3,001 $ 6,000

Interest Payments on Debt(2) 7,798 517 963 732 5,586

Capital Lease Obligations(3) 1,305 112 206 190 797

Operating Leases 8,208 856 1,554 1,238 4,560

Purchase Obligations(4) 2,485 1,531 954 — —

Unrecognized Tax Benefits(5) 105 105 — — —

Total $ 30,157 $ 4,373 $ 3,680 $ 5,161 $ 16,943

—————

(1) Excludes present value of capital lease obligations, fair value of interest rate swaps and unamortized debt discounts.

(2) Interest payments are at current interest rates including the impact of active interest rate swaps.

(3) Includes $813 million of imputed interest.

(4) Purchase obligations include all legally binding contracts such as firm commitments for inventory purchases, utility

purchases, capital expenditures, software acquisitions and license commitments and legally binding service contracts.

Purchase orders that are not binding agreements are excluded from the table above.

(5) Excludes $533 million of noncurrent unrecognized tax benefits due to uncertainty regarding the timing of future cash

payments.

Quantitative and Qualitative Disclosures about Market Risk

Our exposure to market risk results primarily from fluctuations in interest rates. Interest rate swap agreements are used, at

times, to manage our fixed/floating rate debt portfolio. At February 3, 2013, after giving consideration to our interest rate

swap agreements, approximately 82% of our debt portfolio was comprised of fixed-rate debt and 18% was floating-rate debt.

A 1.0 percentage point change in the interest costs of floating-rate debt would not have a material impact on our financial

condition or results of operations.

As of February 3, 2013 we had, net of discounts, $10.3 billion of Senior Notes outstanding. The aggregate market value of

these publicly traded Senior Notes as of February 3, 2013 was approximately $12.2 billion.

Although we have international operating entities, our exposure to foreign currency rate fluctuations is not significant to our

financial condition or results of operations.

Impact of Inflation, Deflation and Changing Prices

We have experienced inflation and deflation related to our purchase of certain commodity products. We do not believe that

changing prices for commodities have had a material effect on our Net Sales or results of operations. Although we cannot

precisely determine the overall effect of inflation and deflation on operations, we do not believe inflation and deflation have

had a material effect on our financial condition or results of operations.

Critical Accounting Policies

Our significant accounting policies are disclosed in Note 1 to the Consolidated Financial Statements. The following

discussion addresses our most critical accounting policies, which are those that are both important to the portrayal of our

financial condition and results of operations and that require significant judgment or use of significant assumptions or

complex estimates.

Revenues

We recognize revenue, net of estimated returns and sales tax, at the time the customer takes possession of merchandise or

receives services. We estimate the liability for sales returns based on our historical return levels. We believe that our estimate

for sales returns is an accurate reflection of future returns. We have never recorded a significant adjustment to our estimated

liability for sales returns. However, if these estimates are significantly below the actual amounts, our sales could be adversely

impacted. When we receive payment from customers before the customer has taken possession of the merchandise or the

service has been performed, the amount received is recorded as Deferred Revenue in the accompanying Consolidated