Home Depot 2012 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2012 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

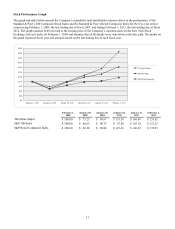

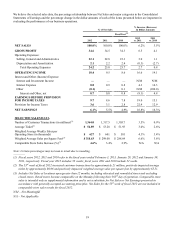

Executive Summary and Selected Consolidated Statements of Earnings Data

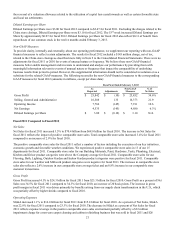

For the fiscal year ended February 3, 2013 ("fiscal 2012"), we reported Net Earnings of $4.5 billion and Diluted Earnings per

Share of $3.00 compared to Net Earnings of $3.9 billion and Diluted Earnings per Share of $2.47 for the fiscal year ended

January 29, 2012 ("fiscal 2011"). The results for fiscal 2012 included a total charge of $145 million, net of tax, related to the

closing of our remaining seven big box stores in China ("China store closings") in fiscal 2012, which had a negative impact

of $0.10 to Diluted Earnings per Share. Excluding the charges related to the China store closings, Net Earnings were $4.7

billion and Diluted Earnings per Share were $3.10 for fiscal 2012.

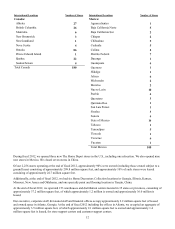

Net Sales increased 6.2% to $74.8 billion for fiscal 2012 from $70.4 billion for fiscal 2011. Our comparable store sales

increased 4.6% in fiscal 2012, driven by a 2.9% increase in our comparable store average ticket and an increase in our

comparable store customer transactions. Comparable store sales for our U.S. stores increased 4.9% in fiscal 2012.

Fiscal 2012 consisted of 53 weeks compared with 52 weeks for fiscal 2011. The 53rd week added approximately $1.2 billion

in Net Sales and increased Diluted Earnings per Share by approximately $0.07 for fiscal 2012.

In fiscal 2012, we continued to focus on the following four key initiatives:

Customer Service – Our focus on customer service is anchored on the principles of creating an emotional connection with

customers, putting customers first and simplifying the business. In fiscal 2012, we opened new customer call centers in Utah

and Georgia to support our interconnected business. In addition, as a result of initiatives such as our new scheduling system

for our associates and a centralized return to vendor process initiated in fiscal 2011, we now have approximately 57% of our

store labor hours dedicated to customer-facing activity and expect to achieve our goal of 60% in fiscal 2013. Through these

and other efforts, we continue to see our customer satisfaction survey scores improve.

Product Authority – Our focus on product authority is facilitated by our merchandising transformation and portfolio strategy,

which is aimed at delivering product innovation, assortment and value. As part of this effort, we introduced innovative new

products and great values for both our professional and D-I-Y customers in a variety of departments. Also in fiscal 2012, we

expanded some of our appliance showrooms to include the Electrolux®, Whirlpool® and Frigidaire® brands. These brands

were also added to our e-commerce platform in fiscal 2012.

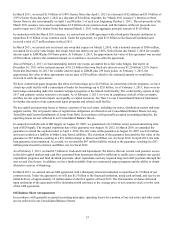

Disciplined Capital Allocation, Productivity and Efficiency – Our approach to driving productivity and efficiency is advanced

through continuous operational improvement, incremental supply chain benefits, disciplined capital allocation and expense

control and building shareholder value through higher returns on invested capital and total value returned to shareholders in

the form of dividends and share repurchases. In fiscal 2012, we completed the mechanization of all of our RDCs, which we

expect to further improve the cost effectiveness of this platform. Our inventory turnover ratio was 4.5 times at the end of

fiscal 2012 compared to 4.3 times at the end of fiscal 2011.

We repurchased a total of 74 million shares for $4.0 billion through ASR agreements and the open market during fiscal 2012.

In addition, in February 2013, our Board of Directors authorized a new $17.0 billion share repurchase program that replaces

the previous authorization, and announced a 34% increase in our quarterly cash dividend to $0.39 per share.

Interconnected Retail – Our focus on interconnected retail is based on building a competitive platform across all commerce

channels. During fiscal 2012, we launched improvements to our website, including MyInstall, which is designed to improve

transparency and communication in installation projects and to simplify the customer experience. We made several

enhancements to our professional customer website, including adding an online bulk pricing program that mirrors our in-

store bulk pricing program. We also introduced new programs, such as Buy Online, Return In Store ("BORIS") and Buy

Online, Ship To Store ("BOSS") in fiscal 2012, to expand upon Buy Online, Pick-Up In Store ("BOPIS"), which we

introduced in fiscal 2011.

In May 2012, we acquired MeasureComp L.L.C., a flooring measurement and quote building company. MeasureComp's

business was largely dedicated to The Home Depot and by in-sourcing this service under Home Depot Measurement

Services, we expect to build a seamless process for our flooring customers that is designed to provide a better experience for

them and a better close rate for us.

In October 2012, we completed the acquisition of U.S. Home Systems, Inc. ("USHS"). USHS was an exclusive provider of

kitchen and bath refacing products and services as well as closet and garage organizational systems to The Home Depot. This

acquisition will allow us to create more effective interconnection between our stores and the USHS in-home selling platform

under Home Depot Interiors, similar to what we have done with our roofing, siding and windows businesses.