Home Depot 2012 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2012 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

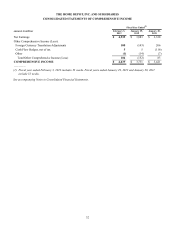

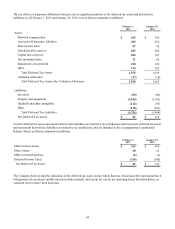

Comprehensive Income

Comprehensive Income includes Net Earnings adjusted for certain gains and losses that are excluded from Net Earnings

under U.S. generally accepted accounting principles. Adjustments to Net Earnings and Accumulated Other Comprehensive

Income consist primarily of foreign currency translation adjustments.

Foreign Currency Translation

Assets and liabilities denominated in a foreign currency are translated into U.S. dollars at the current rate of exchange on the

last day of the reporting period. Revenues and expenses are generally translated using average exchange rates for the period

and equity transactions are translated using the actual rate on the day of the transaction.

Segment Information

The Company operates within a single reportable segment primarily within North America. Net Sales for the Company

outside the U.S. were $8.4 billion, $8.0 billion and $7.5 billion for fiscal 2012, 2011 and 2010, respectively. Long-lived assets

outside the U.S. totaled $3.1 billion and $3.1 billion as of February 3, 2013 and January 29, 2012, respectively.

Reclassifications

Certain amounts in prior fiscal years have been reclassified to conform with the presentation adopted in the current fiscal

year.

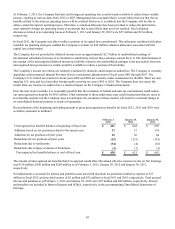

2. CHINA STORE CLOSINGS

In fiscal 2012, the Company closed its remaining seven big box stores in China. As a result of the closings, the Company

recorded a total charge of $145 million, net of tax, in fiscal 2012. Inventory markdown costs of $10 million are included in

Cost of Sales, and $135 million of costs related to the impairment of Goodwill and other assets, lease terminations, severance

and other charges are included in SG&A in the accompanying Consolidated Statements of Earnings.

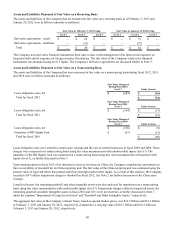

3. DEBT GUARANTEE

In connection with the sale of HD Supply, Inc. on August 30, 2007, the Company guaranteed a $1.0 billion senior secured

amortizing term loan of HD Supply. The original expiration date of the guarantee was August 30, 2012. In March 2010, the

Company amended the guarantee to extend the expiration date to April 1, 2014. The fair value of the guarantee at August 30,

2007 was $16 million and was recorded as a liability of the Company in Other Long-Term Liabilities. The extension of the

guarantee increased the fair value of the guarantee to $67 million, resulting in a $51 million charge to Interest and Other, net,

for fiscal 2010. In April 2012, the term loan guarantee was terminated. As a result, the Company reversed its $67 million

liability related to the guarantee, resulting in a $67 million pretax benefit to Interest and Other, net, for fiscal 2012.