Home Depot 2012 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2012 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

million of expenses related to natural disasters. Additionally, we experienced an expense benefit of $44 million in fiscal 2010

related to our private label credit card that did not repeat in fiscal 2011.

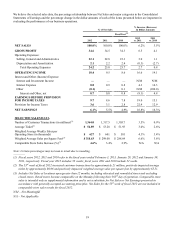

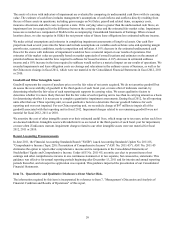

Depreciation and Amortization was $1.6 billion for both fiscal 2011 and 2010. Depreciation and Amortization as a percent of

Net Sales was 2.2% for fiscal 2011 compared to 2.4% for fiscal 2010. The decrease in Depreciation and Amortization as a

percent of Net Sales reflects expense leverage in the positive comparable store sales environment and an increase in fully

depreciated assets.

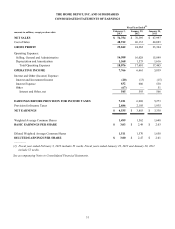

Operating Income

Operating Income increased 14.1% to $6.7 billion for fiscal 2011 from $5.8 billion for fiscal 2010. Operating Income as a

percent of Net Sales was 9.5% for fiscal 2011 compared to 8.6% for fiscal 2010.

Interest and Other, net

In fiscal 2011, we recognized $593 million of Interest and Other, net, compared to $566 million for fiscal 2010. Interest and

Other, net, as a percent of Net Sales was 0.8% for both fiscal 2011 and 2010. Interest and Other, net, for fiscal 2010 reflects a

$51 million pretax charge related to the extension of our HD Supply Guarantee. Additionally, we experienced a $44 million

benefit in fiscal 2010 that arose from favorable Internal Revenue Service guidance and a resulting reversal of an interest

accrual.

Provision for Income Taxes

Our combined effective income tax rate decreased to 36.0% for fiscal 2011 from 36.7% for fiscal 2010. The effective income

tax rate for fiscal 2011 reflects a benefit from the reversal of a valuation allowance related to the utilization of capital loss

carryforwards as well as certain favorable state and local tax settlements.

Diluted Earnings per Share

Diluted Earnings per Share were $2.47 for fiscal 2011 compared to $2.01 for fiscal 2010. Diluted Earnings per Share for

fiscal 2011 reflect $0.13 of benefit from repurchases of our common stock in the twelve months ended January 29, 2012.

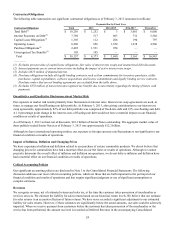

Liquidity and Capital Resources

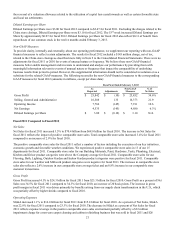

Cash flow generated from operations provides us with a significant source of liquidity. For fiscal 2012, Net Cash Provided by

Operating Activities was $7.0 billion compared to $6.7 billion for fiscal 2011. This increase reflects a $652 million increase

in Net Earnings resulting from higher comparable store sales and expense controls. In support of sales growth, we grew

merchandise inventory. The increase in inventory, net of the corresponding increase in accounts payable and accrued

expenses, partially offsets the increase in operating cash flows generated by Net Earnings by $330 million.

Net Cash Used in Investing Activities for fiscal 2012 was $1.4 billion compared to $1.1 billion for fiscal 2011. This change

was primarily due to a $105 million increase in Payments for Businesses Acquired, net, in fiscal 2012 compared to fiscal

2011, no Proceeds from Sale of Business, net, in fiscal 2012 compared to $101 million in fiscal 2011 related to the sale of a

non-core carpet cleaning and cabinet refinishing business, and a $91 million increase in Capital Expenditures in fiscal 2012

compared to fiscal 2011.

Net Cash Used in Financing Activities for fiscal 2012 was $5.0 billion compared to $4.0 billion for fiscal 2011. This change

was primarily the result of how we funded our share repurchase program. In fiscal 2012, we repurchased $4.0 billion of our

outstanding shares of common stock using cash flow generated from operations. In fiscal 2011, we repurchased $3.5 billion

of our outstanding shares, and funded $1.0 billion of those repurchases with proceeds from long-term borrowings. We did not

issue any long-term borrowings in fiscal 2012. The repurchases of common stock in fiscal 2012 were partially offset by $478

million more in proceeds from sales of common stock due to increased stock option exercises in fiscal 2012 compared to

fiscal 2011.

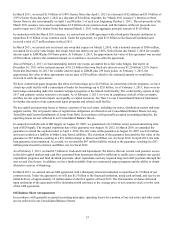

In fiscal 2012, we entered into ASR agreements with third-party financial institutions to repurchase $3.05 billion of our

common stock. Under the agreements, we paid $3.05 billion to the financial institutions, using cash on hand, and received a

total of 58 million shares in fiscal 2012. Also in fiscal 2012, we repurchased 16 million additional shares of our common

stock for $950 million through the open market. Since the inception of our share repurchase program in fiscal 2002, we have

repurchased 1.0 billion shares of our common stock for a total of $37.6 billion. In February 2013, our Board of Directors

authorized a new $17.0 billion share repurchase program that replaces the previous authorization.