Home Depot 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HOME DEPOT ANNUAL REPORT 2012

•HOMEDEPOTAR.COM

ANNUAL REPORT

2 012

Table of contents

-

Page 1

ANNUAL REPORT 2012 HOMEDEPOTAR.COM -

Page 2

-

Page 3

..., online and in our stores. CUSTOMER SERVICE Each year we dedicate over 10 million hours in training for our associates. In 2012, we re-trained all of our store associates on our customer service initiative we launched in 2009 called "Customers FIRST." We also enabled our store managers to customize... -

Page 4

... adding new capabilities to simplify and improve the customer experience for installation projects with our online tool MyInstall. INTERNATIONAL Our business in Canada had positive comparable store sales for every quarter of the year and is gaining share in the Canadian market. In Mexico, we opened... -

Page 5

...reporting company Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes The number of shares outstanding of the Registrant's common stock as of March 11, 2013 was 1,485,517,485 shares. No The aggregate market value of the common stock... -

Page 6

... HOME DEPOT, INC. FISCAL YEAR 2012 FORM 10-K TABLE OF CONTENTS PART I Item 1. Business 1 7 10 11 13 13 Item 1A. Risk Factors Item 1B. Item 2. Item 3. Item 4. PART II Item 5. Item 6. Item 7. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities... -

Page 7

... on Net Sales for the fiscal year ended February 3, 2013 ("fiscal 2012"). The Home Depot stores sell a wide assortment of building materials, home improvement products and lawn and garden products and provide a number of services. The Home Depot stores average approximately 104,000 square feet of... -

Page 8

..., small business owners and tradesmen. We offer a variety of special programs to these customers, including delivery and will-call services, dedicated staff, expanded credit programs, designated parking spaces close to store entrances and bulk pricing programs for both online and in-store purchases... -

Page 9

... business analytics and product ordering features. We can now spread the basic functionality and customer service benefits of the First Phone throughout the store at a lower cost. We also implemented a new "Store to Store" feature, which allows our associates to look up inventory in other stores... -

Page 10

... Building Council, we launched a website in fiscal 2012 to help our customers easily identify products with potential Leadership in Energy and Environmental Design ("LEED") point values. At the end of fiscal 2012, we had approximately 3,500 "LEED for Homes" products sold in our stores and online... -

Page 11

... chain costs. Our fiscal 2012 initiatives have been to further optimize and efficiently operate our network, build new logistics capabilities and improve our inventory management systems and processes. Our distribution strategy is to provide the optimal flow path for a given product. RDCs play a key... -

Page 12

... of our business, including energy usage, supply chain, store construction and maintenance, and, as noted above under "Energy Saving Products and Programs," product selection and delivery of product knowledge to our customers. In fiscal 2012, we continued to implement strict operational standards... -

Page 13

... design stores, showrooms, discount stores, local, regional and national hardware stores, mail order firms, warehouse clubs, independent building supply stores and, to a lesser extent, other retailers, as well as with installers of home improvement products. In addition, we face growing competition... -

Page 14

...those associated with managing third-party service providers and employing new web-based tools and services, could disrupt or reduce the efficiency of our operations in the near term. In addition, our improved supply chain and new or upgraded technology might not provide the anticipated benefits, it... -

Page 15

... prices may affect the demand for our products, our sales and our profit margins. Our ability to obtain additional financing on favorable terms, if needed, could be adversely affected by the volatility in the capital markets. We obtain and manage liquidity from the positive cash flow we generate... -

Page 16

... affect our financial results or financial condition. Generally accepted accounting principles and related accounting pronouncements, implementation guidelines and interpretations with regard to a wide range of matters that are relevant to our business, such as revenue recognition, asset... -

Page 17

... territories and the 280 The Home Depot stores outside the U.S. at the end of fiscal 2012: U.S. Locations Number of Stores U.S. Locations Number of Stores Alabama Alaska Arizona Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Guam Hawaii Idaho Illinois Indiana... -

Page 18

...in Georgia, Illinois, Kansas, Missouri, New Jersey and Oklahoma, and one specialty paint and flooring location in Tianjin, China. At the end of fiscal 2012, we operated 153 warehouses and distribution centers located in 35 states or provinces, consisting of approximately 37.2 million square feet, of... -

Page 19

...South Coast Air Quality Management District (the "SCAQMD") and the City of Los Angeles regarding allegations that the Company sold products in those counties with VOC (volatile organic compound) levels in excess of amounts permitted by SCAQMD rules. In June 2011, two related complaints were filed in... -

Page 20

... by the Board of Directors. The table below sets forth the high and low sales prices of our common stock on the New York Stock Exchange and the quarterly cash dividends declared per share of common stock for the periods indicated. Price Range High Low Cash Dividends Declared Fiscal Year 2012 First... -

Page 21

... of fiscal 2007, and ending February 1, 2013, the last trading day of fiscal 2012. The graph assumes $100 invested at the closing price of the Company's common stock on the New York Stock Exchange and each index on February 1, 2008 and assumes that all dividends were reinvested on the date paid. The... -

Page 22

... Equity Securities Since the inception of the Company's share repurchase program in fiscal 2002 through the end of fiscal 2012, the Company has repurchased shares of its common stock having a value of approximately $37.6 billion. The number and average price of shares purchased in each fiscal month... -

Page 23

... customer call centers in Utah and Georgia to support our interconnected business. In addition, as a result of initiatives such as our new scheduling system for our associates and a centralized return to vendor process initiated in fiscal 2011, we now have approximately 57% of our store labor hours... -

Page 24

...in Canada and Mexico. We generated $7.0 billion of cash flow from operations in fiscal 2012. We used this cash flow to fund $4.0 billion of share repurchases, pay $1.7 billion of dividends and fund $1.3 billion in capital expenditures. Our return on invested capital (computed on net operating profit... -

Page 25

... average sales per square foot by approximately $5.51. (3) Includes Net Sales at locations open greater than 12 months, including relocated and remodeled stores and excluding closed stores. Retail stores become comparable on the Monday following their 365th day of operation. Comparable store sales... -

Page 26

...the China store closings. Gross Profit as a percent of Net Sales was 34.6% for fiscal 2012 compared to 34.5% for fiscal 2011, an increase of 10 basis points. The increase in gross profit margin in fiscal 2012 was driven primarily by a change in mix of products sold and benefits from our supply chain... -

Page 27

... sales for fiscal 2011 reflect a number of factors including the execution of our key initiatives, economic growth and favorable weather conditions. We experienced positive comparable store sales in 13 of our 15 departments for fiscal 2011. Comparable store sales for our Building Materials, Paint... -

Page 28

...per Share for fiscal 2011 reflect $0.13 of benefit from repurchases of our common stock in the twelve months ended January 29, 2012. Liquidity and Capital Resources Cash flow generated from operations provides us with a significant source of liquidity. For fiscal 2012, Net Cash Provided by Operating... -

Page 29

... paper programs and related credit facility. We use capital and operating leases to finance a portion of our real estate, including our stores, distribution centers and store support centers. The net present value of capital lease obligations is reflected in our Consolidated Balance Sheets in... -

Page 30

... change in the interest costs of floating-rate debt would not have a material impact on our financial condition or results of operations. As of February 3, 2013 we had, net of discounts, $10.3 billion of Senior Notes outstanding. The aggregate market value of these publicly traded Senior Notes as of... -

Page 31

...trends in the business. Actual shrink results did not vary materially from estimated amounts for fiscal 2012, 2011 or 2010. Self-Insurance We have established liabilities for certain losses related to general liability (including products liability), workers' compensation, employee group medical and... -

Page 32

... margin on Net Sales, payroll and related items, occupancy costs, insurance allocations and other costs to operate a store. If the carrying value is greater than the undiscounted cash flows, an impairment loss is recognized for the difference between the carrying value and the estimated fair market... -

Page 33

... of the Public Company Accounting Oversight Board (United States). The Audit Committee of the Board of Directors, consisting solely of independent directors, meets five times a year with the independent registered public accounting firm, the internal auditors and representatives of management to... -

Page 34

... of the Public Company Accounting Oversight Board (United States), the Consolidated Balance Sheets of The Home Depot, Inc. and subsidiaries as of February 3, 2013 and January 29, 2012, and the related Consolidated Statements of Earnings, Comprehensive Income, Stockholders' Equity, and Cash Flows for... -

Page 35

Report of Independent Registered Public Accounting Firm The Board of Directors and Stockholders The Home Depot, Inc.: We have audited the accompanying Consolidated Balance Sheets of The Home Depot, Inc. and subsidiaries as of February 3, 2013 and January 29, 2012, and the related Consolidated ... -

Page 36

...-Term Debt, excluding current installments Other Long-Term Liabilities Deferred Income Taxes Total Liabilities STOCKHOLDERS' EQUITY Common Stock, par value $0.05; authorized: 10 billion shares; issued: 1.754 billion shares at February 3, 2013 and 1.733 billion shares at January 29, 2012; outstanding... -

Page 37

THE HOME DEPOT, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF EARNINGS Fiscal Year Ended amounts in millions, except per share data February 3, 2013 January 29, 2012 (1) January 30, 2011 NET SALES Cost of Sales GROSS PROFIT Operating Expenses: Selling, General and Administrative Depreciation ... -

Page 38

THE HOME DEPOT, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME Fiscal Year Ended amounts in millions February 3, 2013 January 29, 2012 (1) January 30, 2011 Net Earnings Other Comprehensive Income (Loss): Foreign Currency Translation Adjustments Cash Flow Hedges, net of tax ... -

Page 39

... Stock Treasury Stock Shares Amount Stockholders' Equity amounts in millions, except per share data Balance, January 31, 2010 Net Earnings Shares Issued Under Employee Stock Plans Tax Effect of Stock-Based Compensation Foreign Currency Translation Adjustments Cash Flow Hedges, net of tax Stock... -

Page 40

... OF CASH FLOWS Fiscal Year Ended amounts in millions February 3, 2013 January 29, 2012 (1) January 30, 2011 CASH FLOWS FROM OPERATING ACTIVITIES: Net Earnings Reconciliation of Net Earnings to Net Cash Provided by Operating Activities: Depreciation and Amortization Stock-Based Compensation Expense... -

Page 41

...CONSOLIDATED FINANCIAL STATEMENTS 1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Business, Consolidation and Presentation The Home Depot, Inc. and its subsidiaries (the "Company") operate The Home Depot stores, which are full-service, warehouse-style stores averaging approximately 104,000 square feet... -

Page 42

operations in Canada and Mexico, and distribution centers, record Merchandise Inventories at the lower of cost or market, as determined by a cost method. These Merchandise Inventories represent approximately 24% of the total Merchandise Inventories balance. The Company evaluates the inventory valued... -

Page 43

... in the accompanying Consolidated Statements of Earnings as a reduction in SG&A. Services Revenue Net Sales include services revenue generated through a variety of installation, home maintenance and professional service programs. In these programs, the customer selects and purchases material for... -

Page 44

... margin on Net Sales, payroll and related items, occupancy costs, insurance allocations and other costs to operate a store. If the carrying value is greater than the undiscounted cash flows, an impairment loss is recognized for the difference between the carrying value and the estimated fair market... -

Page 45

... adopted in the current fiscal year. 2. CHINA STORE CLOSINGS In fiscal 2012, the Company closed its remaining seven big box stores in China. As a result of the closings, the Company recorded a total charge of $145 million, net of tax, in fiscal 2012. Inventory markdown costs of $10 million are... -

Page 46

... and Other Long-Term Liabilities in the accompanying Consolidated Balance Sheets. Total rent expense, net of minor sublease income, for fiscal 2012, 2011 and 2010 was $849 million, $823 million and $821 million, respectively. Certain store leases also provide for contingent rent payments based on... -

Page 47

... paper programs or the related credit facility. All of the Company's short-term borrowings in fiscal 2011 were under these commercial paper programs. For the fiscal year ended January 29, 2012, the maximum amount outstanding at any month-end was $828 million, the average daily short-term borrowings... -

Page 48

... cash on hand, and received a total of 58 million shares in fiscal 2012. The final number of shares delivered upon settlement of each agreement was determined with reference to the average price of the Company's common stock over the term of the applicable ASR agreement. The $3.05 billion of shares... -

Page 49

... actual tax expense for the applicable fiscal years was as follows (amounts in millions): Fiscal Year Ended February 3, 2013 January 29, 2012 January 30, 2011 Income taxes at federal statutory rate State income taxes, net of federal income tax benefit Other, net Total $ 2,527 197 (38) $ 2,125... -

Page 50

...): February 3, 2013 January 29, 2012 Assets: Deferred compensation Accrued self-insurance liabilities State income taxes Non-deductible reserves Capital loss carryover Net operating losses Impairment of investment Other Total Deferred Tax Assets Valuation Allowance Total Deferred Tax Assets after... -

Page 51

... Internal Revenue Service examination adjustments for fiscal years 2005 through 2007. The Company's U.S. federal tax returns for fiscal years 2008 and 2009 are currently under examination by the IRS. There are also ongoing U.S. state and local and other foreign audits covering tax years 2005 to 2010... -

Page 52

... age 60, provided the associate has had five years of continuous service. The Company recorded stock-based compensation expense related to deferred shares of $13 million, $12 million and $14 million in fiscal 2012, 2011 and 2010, respectively. The Company maintains two Employee Stock Purchase Plans... -

Page 53

...summarizes stock options outstanding at February 3, 2013, January 29, 2012 and January 30, 2011, and changes during the fiscal years ended on these dates (shares in thousands): Number of Shares Weighted Average Exercise Price Outstanding at January 31, 2010 Granted Exercised Canceled Outstanding at... -

Page 54

... purchase shares of the Company's common stock in the open market. The Company's contributions to the Benefit Plans and the restoration plan were $182 million, $171 million and $171 million for fiscal 2012, 2011 and 2010, respectively. At February 3, 2013, the Benefit Plans and the restoration plan... -

Page 55

...Losses) Fair Value Measured During Fiscal 2010 Level 3 Lease obligation costs, net Guarantee of HD Supply loan Total for fiscal 2010 $ $ (158) (67) $ $ (9) (51) (60) Lease obligation costs were related to certain store closings and the exit of certain businesses in fiscal 2009 and 2008. These... -

Page 56

... consolidated financial condition, results of operations or cash flows. 13. QUARTERLY FINANCIAL DATA (UNAUDITED) The following is a summary of the quarterly consolidated results of operations for the fiscal years ended February 3, 2013 and January 29, 2012 (amounts in millions, except per share data... -

Page 57

... term is defined in Rule 13a-15(f) under the Exchange Act) and a report of KPMG LLP, an independent registered public accounting firm, on the effectiveness of the Company's internal control over financial reporting are incorporated by reference to Item 8, "Financial Statements and Supplementary Data... -

Page 58

... as a director of United Parcel Service, Inc., a package delivery company, and as deputy chair of the board of directors of the Federal Reserve Bank of Atlanta. TERESA WYNN ROSEBOROUGH, age 54, has been Executive Vice President, General Counsel and Corporate Secretary since November 2011. From April... -

Page 59

... "Executive Compensation," "Leadership Development and Compensation Committee Report" and "Director Compensation" in the Company's Proxy Statement. Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. The information required by this item is... -

Page 60

... in Item 8 hereof: - Management's Responsibility for Financial Statements and Management's Report on Internal Control Over Financial Reporting; and - Reports of Independent Registered Public Accounting Firm. - Consolidated Balance Sheets as of February 3, 2013 and January 29, 2012; - Consolidated... -

Page 61

... March 13, 2009, Exhibit 10.6] Form of Equity Award Terms and Conditions Agreement Pursuant to The Home Depot, Inc. 2005 Omnibus Stock Incentive Plan. [Form 8-K filed on March 2, 2011, Exhibit 10.1] Form of Executive Officer Equity Award Terms and Conditions Agreement Pursuant to The Home Depot, Inc... -

Page 62

...; (iv) the Consolidated Statements of Stockholders' Equity; (v) the Consolidated Statements of Cash Flows; and (vi) the Notes to the Consolidated Financial Statements. * 10.27 * 10.28 12 21 23 31.1 31.2 32.1‡ 32.2‡ 101 ----- †‡ Management contract or compensatory plan or arrangement... -

Page 63

... by the undersigned, thereunto duly authorized. THE HOME DEPOT, INC. (Registrant) By: /s/ FRANCIS S. BLAKE (Francis S. Blake, Chairman and Chief Executive Officer) Date: March 27, 2013 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the... -

Page 64

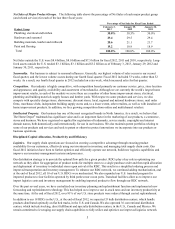

...term debt Stockholders' equity Book value per share ($) Long-term debt-to-equity (%) Total debt-to-equity (%) Current ratio Inventory turnover Return on invested capital (%) STATEMENT OF CASH FLOWS DATA Depreciation and amortization Capital expenditures Cash dividends per share ($) STORE DATA Number... -

Page 65

.... and zulily, Inc. Director since 2012 1, 2 Karen L. Katen Senior Advisor, Essex Woodlands Health Ventures Director since 2007 1, 4 Board of Directors Committee Membership as of 2012 fiscal year end: 1. Audit 2. Finance 3. Leadership Development & Compensation 4. Nominating & Corporate Governance -

Page 66

..., access the shareholder services link on The Home Depot Investor Relations web site at http://ir.homedepot.com, or call (800) 577-0177 to contact Computershare. FINANCIAL AND OTHER COMPANY INFORMATION Our Annual Report on Form 10-K for the fiscal year ended February 3, 2013 is available on The Home... -

Page 67

-

Page 68

THE HOME DEPOT INC, 2455 PACES FERRY ROAD, NW ATLANTA, GA 30339-4042 • 770.433.8211