Home Depot 2010 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2010 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

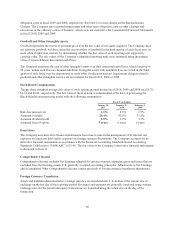

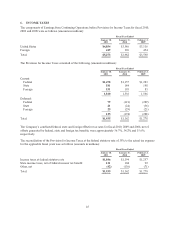

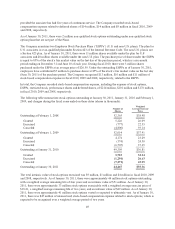

The following table summarizes restricted stock and performance shares outstanding at January 30, 2011 (shares

in thousands):

Number of

Shares

Weighted

Average Grant

Date Fair Value

Outstanding at February 3, 2008 11,715 $39.14

Granted 7,938 27.14

Restrictions lapsed (1,251) 34.37

Canceled (2,115) 34.86

Outstanding at February 1, 2009 16,287 $34.22

Granted 8,257 23.41

Restrictions lapsed (1,686) 34.65

Canceled (2,195) 31.84

Outstanding at January 31, 2010 20,663 $30.11

Granted 5,799 32.31

Restrictions lapsed (5,276) 32.28

Canceled (1,747) 30.11

Outstanding at January 30, 2011 19,439 $30.18

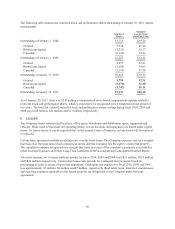

As of January 30, 2011, there was $259 million of unamortized stock-based compensation expense related to

restricted stock and performance shares, which is expected to be recognized over a weighted average period of

two years. The total fair value of restricted stock and performance shares vesting during fiscal 2010, 2009 and

2008 was $168 million, $41 million and $33 million, respectively.

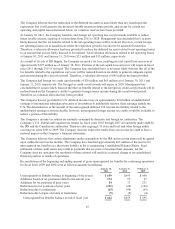

8. LEASES

The Company leases certain retail locations, office space, warehouse and distribution space, equipment and

vehicles. While most of the leases are operating leases, certain locations and equipment are leased under capital

leases. As leases expire, it can be expected that, in the normal course of business, certain leases will be renewed

or replaced.

Certain lease agreements include escalating rents over the lease terms. The Company expenses rent on a straight-

line basis over the lease term which commences on the date the Company has the right to control the property.

The cumulative expense recognized on a straight-line basis in excess of the cumulative payments is included in

Other Accrued Expenses and Other Long-Term Liabilities in the accompanying Consolidated Balance Sheets.

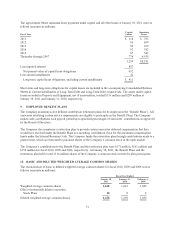

Total rent expense, net of minor sublease income for fiscal 2010, 2009 and 2008 was $821 million, $823 million

and $846 million, respectively. Certain store leases also provide for contingent rent payments based on

percentages of sales in excess of specified minimums. Contingent rent expense for fiscal 2010, 2009 and 2008

was approximately $3 million, $4 million and $5 million, respectively. Real estate taxes, insurance, maintenance

and operating expenses applicable to the leased property are obligations of the Company under the lease

agreements.

50