Home Depot 2010 Annual Report Download - page 48

Download and view the complete annual report

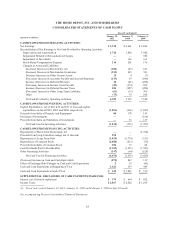

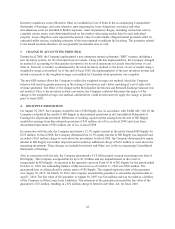

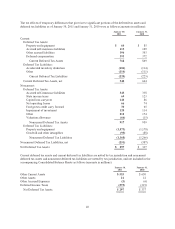

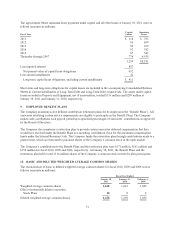

Please find page 48 of the 2010 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Inventory markdown costs reflected in Other are included in Cost of Sales in the accompanying Consolidated

Statements of Earnings, and costs related to asset impairments, lease obligations, severance and other

miscellaneous costs are included in SG&A expenses. Asset impairment charges, including contractual costs to

complete certain assets, were determined based on fair market value using market data for each individual

property. Lease obligation costs represent the present value of contractually obligated rental payments offset by

estimated sublet income, including estimates of the time required to sublease the locations. The payments related

to the leased locations therefore are not generally incremental uses of cash.

3. CHANGE IN ACCOUNTING PRINCIPLE

During fiscal 2008, the Company implemented a new enterprise resource planning (“ERP”) system, including a

new inventory system, for its retail operations in Canada. Along with this implementation, the Company changed

its method of accounting for Merchandise Inventories for its retail operations in Canada from the lower of cost

(first-in, first-out) or market, as determined by the retail inventory method, to the lower of cost or market using a

weighted-average cost method. As of the end of fiscal 2008, the implementation of the new inventory system and

related conversion to the weighted-average cost method for Canadian retail operations was complete.

The new ERP system allows the Company to utilize the weighted-average cost method, which the Company

believes will result in greater precision in the costing of inventories and a better matching of cost of sales with

revenue generated. The effect of the change on the Merchandise Inventories and Retained Earnings balances was

not material. Prior to the inventory system conversion, the Company could not determine the impact of the

change to the weighted-average cost method, and therefore, could not retroactively apply the change to periods

prior to fiscal 2008.

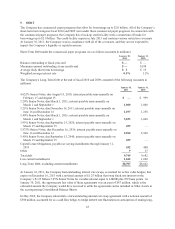

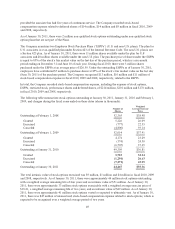

4. HD SUPPLY DISPOSITION

On August 30, 2007, the Company closed the sale of HD Supply, Inc. In accordance with FASB ASC 360-10, the

Company reclassified the results of HD Supply as discontinued operations in its Consolidated Statements of

Earnings for all periods presented. Settlement of working capital matters arising from the sale of HD Supply

resulted in earnings from discontinued operations of $41 million, net of tax, in fiscal 2009 and a loss from

discontinued operations of $52 million, net of tax, in fiscal 2008.

In connection with the sale, the Company purchased a 12.5% equity interest in the newly formed HD Supply for

$325 million. In fiscal 2008, the Company determined its 12.5% equity interest in HD Supply was impaired and

recorded a $163 million charge to write-down the investment. In fiscal 2009, the Company determined its equity

interest in HD Supply was further impaired and recorded an additional charge of $163 million to write-down the

remaining investment. These charges are included in Interest and Other, net, in the accompanying Consolidated

Statements of Earnings.

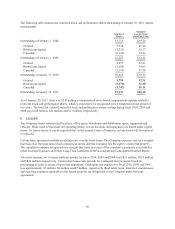

Also in connection with the sale, the Company guaranteed a $1.0 billion senior secured amortizing term loan of

HD Supply. The Company is responsible for up to $1.0 billion and any unpaid interest in the event of

nonpayment by HD Supply. As reported in the quarterly report on Form 10-Q of HD Supply for the period ended

October 31, 2010, the outstanding balance of this term loan as of October 31, 2010 was $940 million. The

guaranteed loan is collateralized by certain assets of HD Supply. The original expiration date of the guarantee

was August 30, 2012. On March 19, 2010, the Company amended the guarantee to extend the expiration date to

April 1, 2014. The fair value of the guarantee at August 30, 2007 was $16 million and was recorded as a liability

of the Company in Other Long-Term Liabilities. The extension of the guarantee increased the fair value of the

guarantee to $67 million, resulting in a $51 million charge to Interest and Other, net, for fiscal 2010.

42