Home Depot 2010 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2010 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

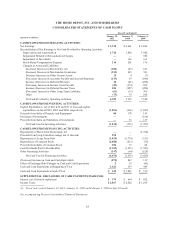

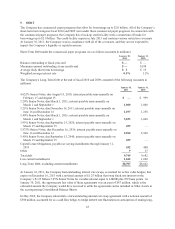

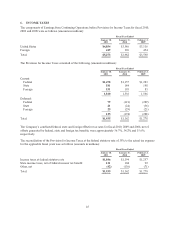

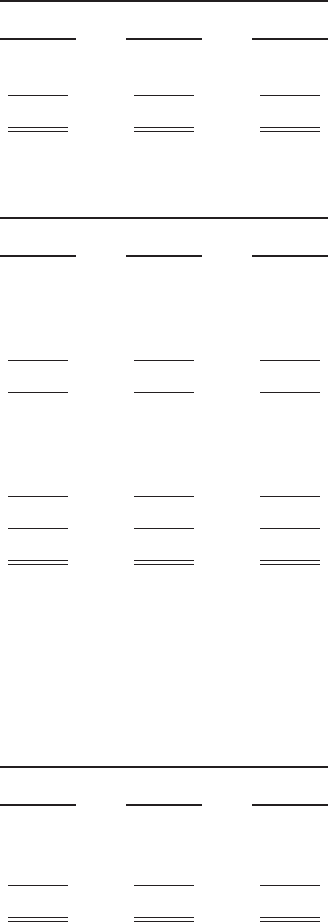

6. INCOME TAXES

The components of Earnings from Continuing Operations before Provision for Income Taxes for fiscal 2010,

2009 and 2008 were as follows (amounts in millions):

Fiscal Year Ended

January 30,

2011 January 31,

2010 February 1,

2009

United States $4,854 $3,586 $3,136

Foreign 419 396 454

Total $5,273 $3,982 $3,590

The Provision for Income Taxes consisted of the following (amounts in millions):

Fiscal Year Ended

January 30,

2011 January 31,

2010 February 1,

2009

Current:

Federal $1,478 $1,157 $1,283

State 181 184 198

Foreign 151 195 85

1,810 1,536 1,566

Deferred:

Federal 79 (121) (209)

State 21 (24) (56)

Foreign 25 (29) (23)

125 (174) (288)

Total $1,935 $1,362 $1,278

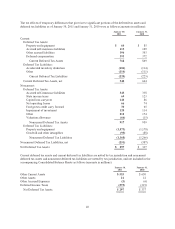

The Company’s combined federal, state and foreign effective tax rates for fiscal 2010, 2009 and 2008, net of

offsets generated by federal, state and foreign tax benefits, were approximately 36.7%, 34.2% and 35.6%,

respectively.

The reconciliation of the Provision for Income Taxes at the federal statutory rate of 35% to the actual tax expense

for the applicable fiscal years was as follows (amounts in millions):

Fiscal Year Ended

January 30,

2011 January 31,

2010 February 1,

2009

Income taxes at federal statutory rate $1,846 $1,394 $1,257

State income taxes, net of federal income tax benefit 131 104 92

Other, net (42) (136) (71)

Total $1,935 $1,362 $1,278

45