Home Depot 2010 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2010 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

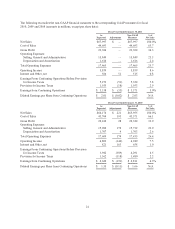

Results of Operations

For an understanding of the significant factors that influenced our performance during the past three fiscal years,

the following discussion should be read in conjunction with the Consolidated Financial Statements and the Notes

to Consolidated Financial Statements presented in this report.

Fiscal 2010 Compared to Fiscal 2009

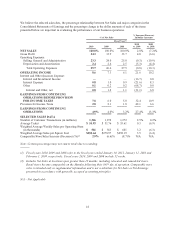

Net Sales

Net Sales for fiscal 2010 increased 2.8% to $68.0 billion from $66.2 billion for fiscal 2009. The increase in Net

Sales for fiscal 2010 reflects the impact of positive comparable store sales. Total comparable store sales

increased 2.9% for fiscal 2010 compared to a decrease of 6.6% for fiscal 2009.

The increase in comparable store sales for fiscal 2010 reflects a number of factors. We experienced positive

comparable store sales in 11 of our 13 departments for fiscal 2010. Comparable store sales for our Lumber,

Tools, Electrical, Indoor Garden, Outdoor Garden and Kitchen/Bath product categories were above the Company

average for fiscal 2010. The increase in comparable store sales also reflects a 2.4% increase in our comparable

store customer transactions and a 0.5% increase in our comparable store average ticket to $51.93.

We believe that our sales performance has been, and could continue to be, negatively impacted by the level of

competition that we encounter in various markets. We estimate our share of the U.S. home improvement market

is approximately 26% using the U.S. Census Bureau’s North American Industry Classification System, or

NAICS, 4441 classification for building material and supplies dealers.

Gross Profit

Gross Profit increased 4.0% to $23.3 billion for fiscal 2010 from $22.4 billion for fiscal 2009. Gross Profit as a

percent of Net Sales was 34.3% for fiscal 2010 compared to 33.9% for fiscal 2009, an increase of 40 basis points.

Our U.S. stores experienced gross profit margin expansion in fiscal 2010 as we realized benefits from better

product assortment management through our portfolio approach and leveraging of our newly developed

merchandising tools. Lower levels of clearance inventory in our stores for fiscal 2010 compared to last year also

contributed to this expansion. Additionally, we realized gross profit margin expansion from our non-U.S.

businesses, primarily Canada, due primarily to a change in the mix of products sold.

Operating Expenses

Selling, General and Administrative expenses (“SG&A”) decreased 0.3% to $15.8 billion for fiscal 2010 from

$15.9 billion for fiscal 2009. As a percent of Net Sales, SG&A was 23.3% for fiscal 2010 compared to 24.0% for

fiscal 2009. Excluding the Rationalization Charges, SG&A as a percent of Net Sales was 23.9% for fiscal 2009.

The decrease in SG&A as a percent of Net Sales for fiscal 2010 reflects expense leverage in the positive

comparable store sales environment and lower payroll and other expenses.

Depreciation and Amortization decreased 5.3% to $1.6 billion for fiscal 2010 from $1.7 billion for fiscal 2009.

Depreciation and Amortization as a percent of Net Sales was 2.4% for fiscal 2010 compared to 2.6% for fiscal

2009. The decrease in Depreciation and Amortization as a percent of Net Sales was primarily due to a smaller

depreciable fixed asset base compared to last year, arising from fully depreciated assets.

Operating Income

Operating Income increased 21.6% to $5.8 billion for fiscal 2010 from $4.8 billion for fiscal 2009. Operating

Income as a percent of Net Sales was 8.6% for fiscal 2010 compared to 7.3% for fiscal 2009. Excluding the

Rationalization Charges from the results of fiscal 2009, Operating Income increased 18.0% for fiscal 2010.

19