Home Depot 2010 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2010 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

agreement was a liability of $2 million, which is the estimated amount we would have paid to settle the

agreement.

In September 2010, we issued $500 million of 3.95% Senior Notes due September 15, 2020 at a discount of

$1 million and $500 million of 5.40% Senior Notes due September 15, 2040 at a discount of $1 million (together,

the “September 2010 issuance”). The net proceeds of the September 2010 issuance were used to refinance our

4.625% Senior Notes that matured August 15, 2010 in the aggregate principal amount of $1.0 billion.

In fiscal 2009 and 2010, we entered into forward starting interest rate swap agreements with a combined notional

amount of $1.0 billion to hedge interest rate fluctuations in anticipation of the September 2010 issuance, which

were accounted for as cash flow hedges. Upon the September 2010 issuance, we paid $193 million to settle these

forward starting interest rate swap agreements. This amount, net of income taxes, is included in Accumulated

Other Comprehensive Income and is being amortized to Interest Expense over the lives of the Senior Notes

issued in September 2010.

In March 2011, we entered into an interest rate swap, accounted for as a fair value hedge, that expires on March

1, 2016 with a notional amount of $500 million that swaps fixed rate interest on our $500 million 5.40% Senior

Notes due March 1, 2016 for variable interest equal to LIBOR plus 300 basis points.

Off-Balance Sheet Arrangements

In accordance with generally accepted accounting principles, operating leases for a portion of our real estate and

other assets are not reflected in our Consolidated Balance Sheets.

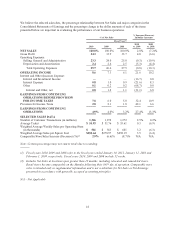

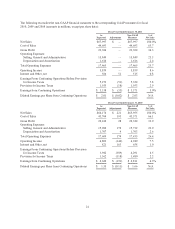

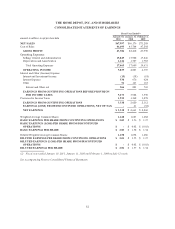

Contractual Obligations

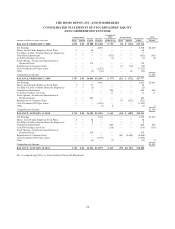

The following table summarizes our significant contractual obligations as of January 30, 2011 (amounts in

millions):

Payments Due by Fiscal Year

Contractual Obligations Total 2011 2012-2013 2014-2015 Thereafter

Total Debt(1) $15,953 $1,452 $2,135 $ 780 $11,586

Capital Lease Obligations(2) 1,259 114 192 179 774

Operating Leases 8,181 783 1,338 1,125 4,935

Purchase Obligations(3) 4,352 1,711 1,741 900 —

Unrecognized Tax Benefits(4) 63 63 — — —

Total $29,808 $4,123 $5,406 $2,984 $17,295

(1) Excludes present value of capital lease obligations of $452 million. Includes $6.7 billion of interest

payments.

(2) Includes $807 million of imputed interest.

(3) Purchase obligations include all legally binding contracts such as firm commitments for inventory

purchases, utility purchases, capital expenditures, software acquisitions and license commitments and

legally binding service contracts. Purchase orders that are not binding agreements are excluded from the

table above.

(4) Excludes $599 million of noncurrent unrecognized tax benefits due to uncertainty regarding the timing of

future cash payments.

Quantitative and Qualitative Disclosures about Market Risk

Our exposure to market risk results primarily from fluctuations in interest rates. Interest rate swap agreements are

used, at times, to manage our fixed/floating rate debt portfolio. At January 30, 2011, after giving consideration to

our interest rate swap agreements, approximately 87% of our debt portfolio was comprised of fixed-rate debt and

13% was floating-rate debt. A 1.0 percentage point change in the interest costs of floating-rate debt would not

have a material impact on our results of operations.

25