Home Depot 2010 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2010 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

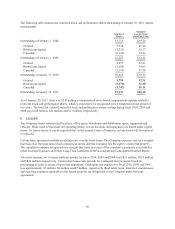

Segment Information

The Company operates within a single reportable segment primarily within North America. Net Sales for the

Company outside of the U.S. were $7.5 billion, $7.0 billion and $7.4 billion for fiscal 2010, 2009 and 2008,

respectively. Long-lived assets outside of the U.S. totaled $3.2 billion and $3.0 billion as of January 30, 2011 and

January 31, 2010, respectively.

Reclassifications

Certain amounts in prior fiscal years have been reclassified to conform with the presentation adopted in the

current fiscal year.

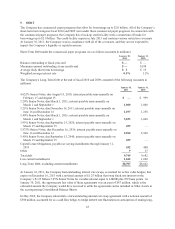

2. RATIONALIZATION CHARGES

In fiscal 2008, the Company reduced its square footage growth plans to improve free cash flow, provide stronger

returns for the Company and invest in its existing stores to continue improving the customer experience. As a

result of this store rationalization plan, the Company determined that it would no longer pursue the opening of

approximately 50 U.S. stores that had been in its new store pipeline. The Company expects to dispose of or

sublet any remaining pipeline locations over varying periods. The Company also closed 15 underperforming

U.S. stores in the second quarter of fiscal 2008, and the Company expects to dispose of or sublet any remaining

locations over varying periods.

Also in fiscal 2008, the Company announced that it would exit its EXPO, THD Design Center, Yardbirds and

HD Bath businesses (the “Exited Businesses”) in order to focus on its core The Home Depot stores. The

Company closed the Exited Businesses in the first quarter of fiscal 2009 and expects to dispose of or sublet any

remaining locations over varying periods. These steps impacted approximately 5,000 associates in those

locations, their support functions and their distribution centers.

Finally, in January 2009 the Company also restructured its support functions to better align the Company’s cost

structure. These actions impacted approximately 2,000 associates.

The Company did not incur any material charges related to these actions (collectively, the “Rationalization

Charges”) in fiscal 2010 and recognized $146 million and $951 million in total pretax charges for fiscal 2009 and

2008, respectively. The Company does not expect any further material charges related to these actions.

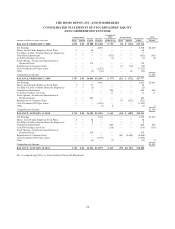

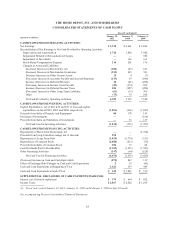

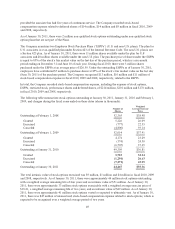

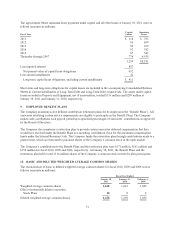

Activity related to Rationalization Charges for fiscal 2010, 2009 and 2008 was as follows (amounts in millions):

Asset

Impairments Lease Obligation

Costs, net Severance Other Total

Fiscal 2008 Charges $580 $252 $ 78 $ 41 $951

Cash Uses — 39 6 18 63

Non-cash Activity 542 — — 3 545

Accrued Balance at February 1, 2009 38 213 72 20 343

Fiscal 2009 Charges — 84 8 54 146

Cash Uses — 106 80 71 257

Non-cash Activity 15 — — 3 18

Accrued Balance at January 31, 2010 23 191 — — 214

Cash Uses —42——42

Non-cash Activity 19 (9) — — 10

Accrued Balance at January 30, 2011 $ 4 $158 $ — $ — $162

41