Home Depot 2003 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2003 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Home Depot, Inc. | 35

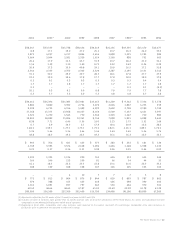

Notes to Consolidated Financial Statements

The Home Depot, Inc. and Subsidiaries

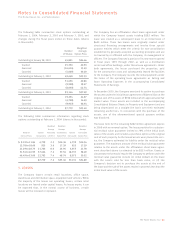

Stock plans include shares granted under the Company’s ESPPs

and stock incentive plans, as well as shares issued for deferred

compensation stock plans. Options to purchase 67.9 million,

52.9 million and 10.9 million shares of common stock at February 1,

2004, February 2, 2003 and February 3, 2002, respectively, were

excluded from the computation of Diluted Earnings per Share

because their effect would have been anti-dilutive.

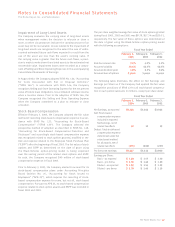

8. COMMITMENTS AND CONTINGENCIES

At February 1, 2004, the Company was contingently liable for

approximately $1.3 billion under outstanding letters of credit

issued for certain business transactions, including insurance

programs, purchases of import merchandise inventories and con-

struction contracts. The Company’s letters of credit are primarily

performance-based and are not based on changes in variable

components, a liability or an equity security of the other party.

The Company is involved in litigation arising from the normal

course of business. In management’s opinion, this litigation is not

expected to materially impact the Company’s consolidated results

of operations or financial condition.

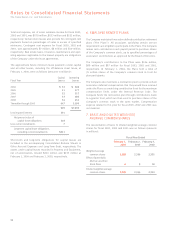

9. ACQUISITIONS AND DISPOSITIONS

The following acquisitions completed by the Company were all

accounted for under the purchase method of accounting. Pro

forma results of operations for fiscal 2003, 2002 and 2001 would

not be materially different as a result of these acquisitions and

therefore are not presented.

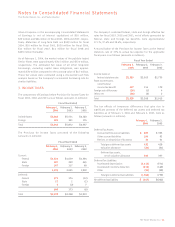

In January 2004, the Company acquired substantially all of the

assets of Creative Touch Interiors, Inc., a flooring supply company

servicing the new homebuilder industry.

In December 2003, the Company acquired all of the common

stock of Economy Maintenance Supply Company (“EMS”) and all

of the common stock of RMA Home Services, Inc. (“RMA”). EMS is

a wholesale supplier of maintenance, repair and operations

products. RMA is a replacement windows and siding installed

services business. In October 2003, the Company acquired

substantially all of the assets of Installed Products U.S.A., a

roofing and fencing installed services business.

In October 2002, the Company acquired substantially all of the

assets of FloorWorks, Inc. and Arvada Hardwood Floor Company

and all of the common stock of Floors, Inc., three flooring

installation companies primarily servicing the new homebuilder

industry. In June 2002, the Company acquired the assets of

Maderería Del Norte, S.A. de C.V., a four-store chain of home

improvement stores in Juarez, Mexico.

In fiscal 2001, the Company acquired the assets of Your

“other” Warehouse and Soluciones Para Las Casas de Mexico,

S. de R.L. de C.V.

The total aggregate purchase price for acquisitions in fiscal 2003,

2002 and 2001 was $248 million, $202 million and $193 million,

respectively. Accordingly, the Company recorded Cost in Excess of

the Fair Value of Net Assets Acquired related to these acquisitions

of $231 million, $109 million and $110 million for fiscal 2003,

2002 and 2001, respectively, on the accompanying Consolidated

Balance Sheets.

In February 2002, the Company sold all of the assets of The Home

Depot Argentina S.R.L. In connection with the sale, the Company

received proceeds comprised of cash and notes. An impairment

charge of $45 million was recorded in Selling and Store Operating

Expenses in the accompanying Consolidated Statements of

Earnings in fiscal 2001 to write down the net assets of The Home

Depot Argentina S.R.L. to fair value. In October 2001, the

Company sold all of the assets of The Home Depot Chile S.A.,

resulting in a gain of $31 million included in Selling and

Store Operating Expenses in the accompanying Consolidated

Statements of Earnings.