Home Depot 2003 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2003 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and Store Operating Expenses. In fiscal 2002 and 2001, advertising

co-op allowances exceeded gross advertising expense by

$30 million and $31 million, respectively. These excess amounts

were recorded as a reduction of Cost of Merchandise Sold in the

accompanying Consolidated Statements of Earnings. In fiscal

2003, net advertising expense was $58 million, which was recorded

in Selling and Store Operating Expenses.

The following table illustrates the full-year effect on Cost of

Merchandise Sold, Gross Profit, Selling and Store Operating

Expenses, Operating Income and Diluted Earnings per Share as

if advertising co-op allowances had always been treated as a

reduction of Cost of Merchandise Sold in accordance with

EITF 02-16 (amounts in millions, except per share data):

Fiscal Year Ended

February 1, February 2, February 3,

2004 2003 2002

Cost of

Merchandise Sold

As Reported $44,236 $40,139 $37,406

Pro Forma 43,295 39,284 36,611

Gross Profit

As Reported 20,580 18,108 16,147

Pro Forma 21,521 18,963 16,942

Selling and Store

Operating Expenses

As Reported 12,502 11,180 10,163

Pro Forma 13,443 12,061 10,969

Operating Income

As Reported 6,846 5,830 4,932

Pro Forma 6,846 5,804 4,921

Diluted Earnings

per Share

As Reported $ 1.88 $ 1.56 $ 1.29

Pro Forma $ 1.88 $ 1.56 $ 1.29

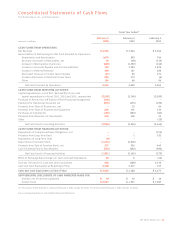

LIQUIDITY AND CAPITAL RESOURCES

Cash flow generated from operations provides us with a significant

source of liquidity. For fiscal 2003, Net Cash Provided by

Operations increased to $6.5 billion from $4.8 billion in fiscal

2002. This increase was primarily driven by stronger Net Earnings,

the timing of tax payments and an improvement in our cash

conversion cycle, or the number of days it takes to convert working

capital into cash.

Net Cash Used in Investing Activities increased to $4.0 billion in

fiscal 2003 from $2.9 billion in fiscal 2002. Capital Expenditures

increased to $3.5 billion in fiscal 2003 from $2.7 billion in fiscal

2002. This increase was due to a higher investment in store

modernization, technology and other initiatives. We opened

175 new stores in fiscal 2003 compared to 203 new stores in

fiscal 2002. Additionally, in December 2003, we exercised an

option to purchase certain assets under a lease agreement at

an original cost of $598 million. After the purchase of these

assets, we now own 86% of our stores. We believe our real estate

ownership strategy is a competitive advantage.

We plan to open 175 new stores in fiscal 2004, including

14 stores in Canada and nine in Mexico, and expect total Capital

Expenditures to be approximately $3.7 billion, allocated as

follows: 57% for new stores, 22% for store modernization, 8% for

technology and 13% for other initiatives.

Net Cash Used in Financing Activities in fiscal 2003 was $1.9 billion

compared with $2.2 billion in fiscal 2002. During fiscal 2002 and

2003, the Board of Directors authorized total repurchases of our

common stock of $4billion pursuant to a Share Repurchase

Program. During fiscal 2003, we repurchased approximately

47 million shares of our common stock for $1.6 billion and during

fiscal 2002 we repurchased 69 million shares of our common

stock for $2.0 billion. As of February 1, 2004, approximately

$400 million remained under our previously authorized Share

Repurchase Program. In addition, in February 2004, our Board of

Directors authorized an increase of $1billion in our authorized

Share Repurchase Program, bringing the total remaining authori-

zation to $1.4 billion. During fiscal 2003, we also increased

dividends paid by 21% to $595 million from $492 million in

fiscal 2002.

We have a commercial paper program that allows borrowings for

up to a maximum of $1billion. As of February 1, 2004, there were

no borrowings outstanding under the program. In connection with

the program, we have a back-up credit facility with a consortium

of banks for up to $800 million. The credit facility, which expires

in September 2004, contains various restrictive covenants, none

of which are expected to impact our liquidity or capital resources.

We intend to renew this credit facility.

We use capital and operating leases, as well as an off-balance

sheet lease created under a structured financing arrangement, to

finance a portion of our real estate, including our stores, distri-

bution centers and store support centers. The net present value

of capital lease obligations is reflected in our Consolidated

Balance Sheets in Long-Term Debt. The off-balance sheet lease

was created to purchase land and fund the construction of certain

stores, office buildings and distribution centers. In accordance

with generally accepted accounting principles, the operating

leases and the off-balance sheet lease were not reflected in our

Consolidated Balance Sheets.

As of the end of fiscal 2003, our total debt-to-equity ratio was

6.1%. If the estimated net present value of future payments under

the operating leases and the off-balance sheet lease were

capitalized, our total debt-to-equity ratio would increase to 27.8%.

Management’s Discussion and Analysis of

Results of Operations and Financial Condition (continued)

The Home Depot, Inc. and Subsidiaries

18