Home Depot 2003 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2003 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.IMPACT OF INFLATION, DEFLATION

AND CHANGING PRICES

We have experienced inflation and deflation related to our

purchase of certain commodity products sold in our stores. We do

not believe, however, that changing prices for commodities have

had a material effect on Net Sales or results of operations.

Although we cannot accurately determine the precise overall

effect of inflation and deflation on operations, we do not believe

inflation and deflation have had a material effect on Net Sales or

results of operations.

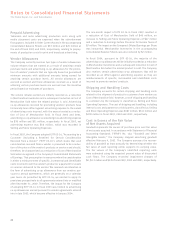

CRITICAL ACCOUNTING POLICIES

Our significant accounting policies are disclosed in Note 1of our

Consolidated Financial Statements. The following discussion

addresses our most critical accounting policies, which are those

that are both important to the portrayal of our financial condition

and results of operations and that require significant judgment or

use of complex estimates.

Revenue Recognition

We recognize revenue, net of estimated returns, at the time the

customer takes possession of the merchandise or receives services.

We estimate the liability for sales returns based on our historical

return levels. The methodology used is consistent with other

retailers. We believe that our estimate for sales returns is an

accurate reflection of future returns. We have never booked a

significant adjustment to our estimated liability for sales returns.

However, if these estimates are significantly below the actual

amounts, our sales could be adversely impacted. When we

receive payment from customers before the customer has taken

possession of the merchandise or the service has been

performed, the amount received is recorded as Deferred Revenue

in the accompanying Consolidated Balance Sheets until the sale

or service is completed.

Merchandise Inventories

Our Merchandise Inventories are stated at the lower of cost

(first-in, first-out) or market, with approximately 93% valued

under the retail inventory method and the remainder under the

cost method. Retailers like The Home Depot, with many different

types of merchandise at low unit cost and a large number of

transactions, frequently use the retail inventory method. Under

the retail inventory method, Merchandise Inventories are stated

at cost which is determined by applying a cost-to-retail ratio to

the ending retail value of inventories. As our inventory retail

value is adjusted regularly to reflect market conditions, our inven-

tory methodology approximates the lower of cost or market.

Accordingly, there were no significant valuation reserves related

to our Merchandise Inventories as of February 1, 2004 and

February 2, 2003.

Independent physical inventory counts are taken on a regular

basis in each store to ensure that amounts reflected in the accom-

panying Consolidated Financial Statements for Merchandise

Inventories are properly stated. During the period between physical

inventory counts, we accrue for estimated losses related to shrink

on a store-by-store basis. Shrink is the difference between the

recorded amount of inventory and the physical inventory. Shrink

(or in the case of excess inventory, “swell”) may occur due to

theft, loss, improper records for the receipt of inventory or deteri-

oration of goods, among other things. We estimate shrink as a

percent of Net Sales using the average shrink results from the

previous two physical inventories. The estimates are evaluated

quarterly and adjusted based on recent shrink results and current

trends in the business.

Self Insurance

We are self-insured for certain losses related to general liability,

product liability, workers’ compensation and medical claims. Our

liability represents an estimate of the ultimate cost of claims

incurred as of the balance sheet date. The estimated liability is

not discounted and is established based upon analysis of historical

data and actuarial estimates, and is reviewed by management

and third-party actuaries on a quarterly basis to ensure that the

liability is appropriate. While we believe these estimates are

reasonable based on the information currently available, if actual

trends, including the severity or frequency of claims, medical cost

inflation, or fluctuations in premiums, differ from our estimates,

our results of operations could be impacted.

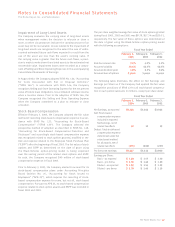

RECENT ACCOUNTING PRONOUNCEMENTS

In December 2003, the Securities and Exchange Commission

(“SEC”) issued Staff Accounting Bulletin No. 104, “Revenue

Recognition” (“SAB 104”). SAB 104 summarizes certain of the

SEC staff’s views on applying generally accepted accounting

principles to revenue recognition in financial statements. The

adoption of SAB 104 did not have any impact on our Consolidated

Financial Statements.

In May 2003, the Financial Accounting Standards Board (“FASB”)

issued Statement of Financial Accounting Standards (“SFAS”)

No. 150, “Accounting for Certain Financial Instruments with

Characteristics of Both Liabilities and Equity” (“SFAS 150”).

SFAS 150 establishes standards for classification and measure-

ment of certain financial instruments with characteristics of

both liabilities and equity. SFAS 150 is effective for financial

instruments entered into or modified after May 31,2003 and

otherwise is effective at the beginning of the first interim period

beginning after June 15, 2003. The adoption of SFAS 150 did not

have any impact on our Consolidated Financial Statements.

In April 2003, the FASB issued SFAS No. 149, “Amendment of

Statement 133 on Derivative Instruments and Hedging Activities”

(“SFAS 149”). SFAS 149 amends and clarifies financial accounting

and reporting of derivatives, including derivative instruments

embedded in other contracts, which are collectively referred to as

derivatives, and for hedging activities under SFAS 133,

“Accounting for Derivative Instruments and Hedging Activities.”

Management’s Discussion and Analysis of

Results of Operations and Financial Condition (continued)

The Home Depot, Inc. and Subsidiaries

20